Why these are three outstanding funds

Saltydog Investor screens the fund universe to find those that stand out from the crowd in terms of consistently delivering.

13th August 2024 09:18

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Those of you familiar with Saltydog Investor will know that every three months we produce our “6x6” report.

This is where we do a deep dive into the numbers in search of funds that have gone up by 5%, or more, in each of the last six six-month periods. It is a tough challenge, but we do occasionally find a few funds that make the grade.

- Invest with ii: Buy Global Funds | Top Investment Funds | What is a Managed ISA?

We have just finished our analysis that covers the three years from the beginning of August 2021 through until the end of last month. None of the UK-domiciled funds managed to beat the 5% target in all six periods, but we did find five funds that achieved it five out of six times.

There are two funds from the Japan sector, two funds from the Global Equity Income sector and one fund from the North America sector.

| Saltydog Investor 6x6 Report - August 2024 | Aug 21 | Feb 22 | Aug 22 | Feb 23 | Aug 23 | Feb 24 | 1 year | 2 year | 3 year |

| to | to | to | to | to | to | return | return | return | |

| Jan 22 | July 22 | Jan 23 | July 23 | Jan 24 | July 24 | ||||

| Funds that have risen by 5% or more in 5 out of 6 periods | |||||||||

| WS Morant Wright Nippon Yield | 6.0% | 1.7% | 6.6% | 9.7% | 10.1% | 14.7% | 26% | 48% | 59% |

| Man GLG Japan CoreAlpha | 7.5% | 4.5% | 10.5% | 6.1% | 7.8% | 8.6% | 17% | 37% | 54% |

| Invesco Global Equity Income | 6.0% | 1.5% | 6.9% | 7.7% | 7.3% | 8.9% | 17% | 35% | 45% |

| FTF ClearBridge US Equity Income | 9.8% | 5.9% | -0.9% | 5.7% | 6.0% | 6.9% | 13% | 19% | 38% |

| WS Guinness Global Equity Income | 5.2% | 6.0% | -0.1% | 6.6% | 5.7% | 8.8% | 15% | 22% | 37% |

Data source: Morningstar. Past performance is not a guide to future performance.

Out of these five funds, only the top three have also avoided having a loss in any of the six-month periods.

Two of these, WS Morant Wright Nippon Yield and Man GLG Japan CoreAlpha, are from the Japan sector.

This year, the Japanese Nikkei 225 stock market index set a new all-time high, beating the previous record that was set over 30 years ago. It has been a long time coming.

Their current economic policy builds on the foundations laid by former prime minister Shinzo Abe. In 2012, he introduced a set of economic policies known as “Abenomics”, aimed at combating deflation and stimulating economic growth. These policies were based on “three arrows”: aggressive monetary easing, fiscal stimulus, and structural reforms to promote long-term growth.

- Funds and trusts tipped to prosper from falling interest rates

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Fumio Kishida took over as prime minister in October 2021, and has sought to implement his own economic vision, which he refers to as a “new form of capitalism”. It has largely maintained the monetary easing policies of the Bank of Japan, and he has introduced additional fiscal measures to support the economy. The main difference is a change in emphasis when it comes to structural reform.Abe focused on labour market changes, regulatory reform, and corporate governance. Kishida has put greater weight on redistributive policies aimed at reducing income inequality and promoting wage growth.

As a large and well-developed economy, you may think that the funds investing in Japan would all produce similar results, which do not vary that much from the benchmark. That does not appear to be the case.

Here is a similar table showing the bottom three funds from the Japan sector.

| Saltydog Investor 6x6 Report - August 2024 | Aug 21 | Feb 22 | Aug 22 | Feb 23 | Aug 23 | Feb 24 | 1 year | 2 year | 3 year |

| to | to | to | to | to | to | return | return | return | |

| Jan 22 | July 22 | Jan 23 | July 23 | Jan 24 | July 24 | ||||

| Bottom of the Japan sector | |||||||||

| FSSA Japan Focus | -10.5% | -9.2% | 3.1% | -8.8% | -0.4% | -1.1% | -2% | -7% | -25% |

| Baillie Gifford Japan Small Companies | -23.2% | -3.4% | 3.5% | -10.5% | -7.1% | -7.1% | -14% | -20% | -41% |

| FTF Martin Currie Japan Equity | -24.2% | -4.8% | 0.2% | -11.8% | -6.7% | -2.2% | -9% | -19% | -42% |

Data source: Morningstar. Past performance is not a guide to future performance.

They all recorded losses in five out of the six six-month periods,

At Saltydog Investor, we tend to focus on identifying which sectors are showing the most positive momentum. However, this comparison highlights how important it is to then find the best-performing funds.

It also shows just how remarkable the WS Morant Wright Nippon Yield and Man GLG Core Alpha funds have been over the last three years.

The third fund to avoid a loss in any of the six-month periods, while gaining over 5% in the remaining five, was Invesco Global Equity Income.

This fund is from the Global Equity Income sector, which means that it can invest anywhere around the world. However, it cannot invest in just one country and has to be “diversified by geographic region”. The Invesco Global Equity fund has around 50% invested in the US, 20% in the UK, 25% in the rest of Europe, and the balance (which is not very much) in Asia and Australasia.

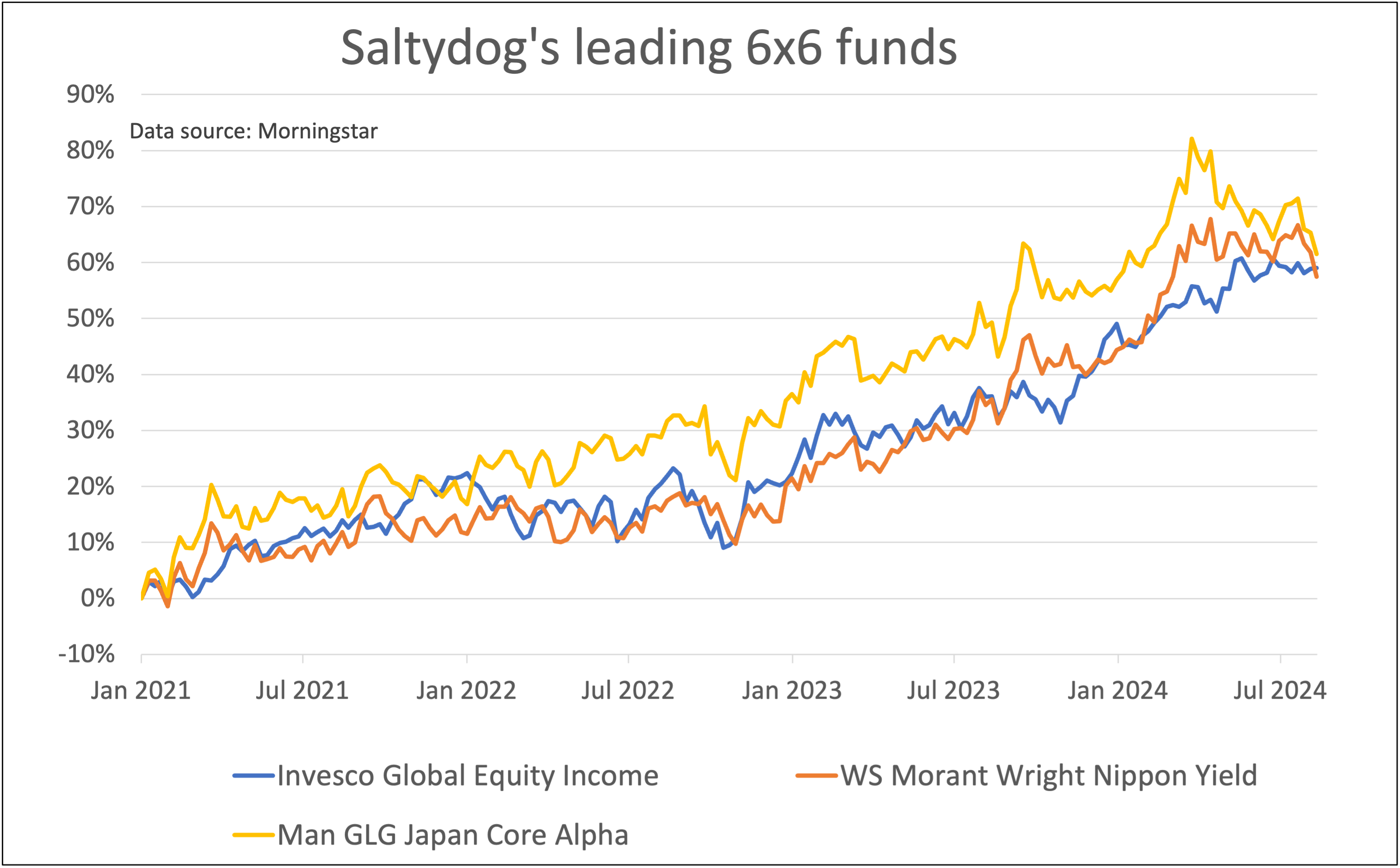

Here is a graph showing how the three leading funds have performed since the beginning of 2021.

Past performance is not a guide to future performance.

Although they have done well over the six-month periods that we were looking at earlier, you can see they have all had their fair share of ups and downs in between. In the last couple of weeks, the Japanese funds have had a particularly difficult time.

The Bank of Japan rather unexpectedly lifted its primary interest rate at the end of July, only its second increase in 17 years. The Nikkei 225 fell by 2.5% the day after the announcement, and then went into free-fall. It dropped by 5.8% the next day, which was a Friday, and the following Monday lost a further 12.4%. It rallied on the Tuesday, gaining 10.2%, before levelling off. It has still lost more than 15% since the high that it recorded earlier in the year.

It will be interesting to see if the Japanese funds can rally, and go on to produce another gain of over 5% in the six months starting from the beginning of this month. They have not had a great start, but have got plenty of time to recover.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.