Why Tesco just hiked its dividend by over 58%

Supermarket sales are booming, but it’s not all one-way traffic. Our head of markets explains.

8th April 2020 09:35

by Richard Hunter from interactive investor

Supermarket sales are booming, but it’s not all one-way traffic. Our head of markets explains.

Tesco (LSE:TSCO) is at an interesting juncture, not least because of the ramifications of the current pandemic, which add to the already complicated strategic push the company was undertaking.

Tesco’s financial year, as covered in these results, ended on 29 February, and does not therefore reflect the month of March when supermarkets generally were at full throttle. Even so, while the company has not gone as far as providing full guidance, it has given some clues on its most recent trading.

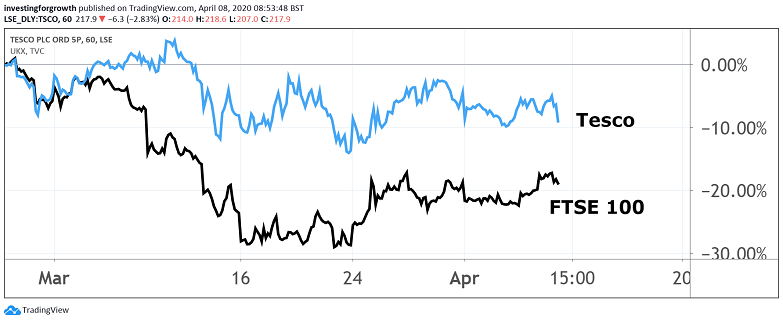

Source: TradingView Past performance is not a guide to future performance

From a profit perspective, the current surge is not likely to be one-way traffic. There will, of course, be a boost to sales (an uplift of 30% was seen during the initial panic buying phase) which, alongside the current business rates relief and prudent operations management, will bolster the numbers on an exceptional basis.

On the other hand, staff costs will also spike (Tesco has employed 45,000 people in the last two weeks alone), there are costs associated with the necessary store restrictions and distribution in general will also be an additional drag.

Indeed, Tesco has estimated an uplift in retail cost lines of anywhere between £650 million and £925 million.

From an ESG (environmental, social, and governance) perspective, the company has made any number of social, community and financial contributions which could see it favourably regarded once the coronavirus dust has settled.

The results themselves are marginally disappointing in some areas, with the costly transformation being undertaken in Central Europe proving to be a drag in terms of both sales and profits.

The discount supermarkets continue to be a thorn in the side of the more established players, while the potential competition from the likes of Amazon or indeed a newly-revitalised Asda adding to the mix.

These factors have combined to crimp overall profitability, with pre-tax profit sliding 19%, significantly behind a consensus which had been a figure in double-digit positive territory.

Revenues, however, were ahead of expectations at a group level, bolstered by a strong UK performance, where operating profits jumped by 17%.

Meanwhile, the Booker acquisition looks to have been an increasingly shrewd strategic move, with a 5% increase in sales being meaningful, since Booker now accounts for around 11% of group revenues.

The previously announced tie-up with Carrefour should provide synergies and the sale of the Asian unit, once agreed by the necessary authorities, should provide a £5 billion boost as a special dividend, a near £2 billion pension deficit reduction and a further streamlining of the business as a whole.

The company’s balance sheet also remains robust, and a reduction of net debt by over £1 billion is welcome news. Tesco’s cash generative ability remains prodigious, with ample free cash flow underpinning the decision to hike the dividend for the period.

Quite apart from being notable by its inclusion in a current environment where dividend deferrals are becoming almost standard – and the amount of the dividend rise being well ahead of expectations - the projected yield of around 4% will give starved income-seekers an option.

Tesco has proposed a final dividend of 6.5p per share, which, combined with the interim dividend, takes the total payout for the financial year to 9.15p, up 58.6% year-on-year. The dividend will be paid on 3 July, assuming it is agreed at the AGM in June.

In all, Tesco remains the preferred play in the sector, although it has been far from immune from the recent market meltdown. Its share price has fallen 12% over the last three months as investors in general have shunned equities in favour of more traditional haven assets.

However, over the last year, the share price decline of 5% compares favourably with a drop of 23% for the wider FTSE 100 index, even though there remains much strategic work for the company to complete. The market consensus for Tesco is undeterred in light of future prospects, with the general view of the shares as a “buy” likely to stay intact.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.