Why retail sector shares rule the roost in 2019

8th January 2019 14:22

by Graeme Evans from interactive investor

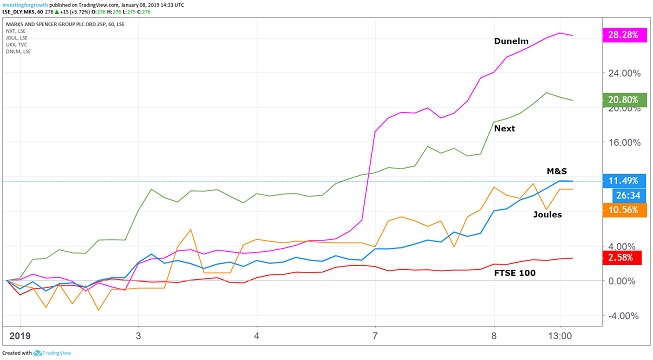

The first flurry of retail sector results has put a rocket under share prices, but what does the future hold for M&S and the rest? Graeme Evans studies the forecasts.

Having just fallen to their lowest point in 10 years, will the afternoon of December 27 prove to be a turning point for Marks & Spencer shares and the retailer's long-suffering army of small investors?

The stock has subsequently risen 13% from that Christmas week low of 240p, helped by tentative signs that festive trading by UK retailers might not have been quite as desperate as everyone feared.

These are still early days of course, but it's reassuring that we've now had well-received updates from Next, Dunelm, Joules and Greene King. There's also been an absence of unscheduled trading statements, although AIM stock Footasylum was punished today for another downgrade that kept its sickly shares at a record low.

We should know much more by Thursday, given that heavyweights Sainsbury, Debenhams, Tesco, Ted Baker and M&S are among those due to report over the next two days. The figures are unlikely to be pretty, particularly after the retail industry’s widely-documented trading difficulties in November.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

However, it's likely that a last-minute surge in sales will have averted the profits carnage feared when internet shopping giant ASOS stunned markets on December 17 with a downgrade to its forecasts. The ASOS warning prompted some analysts to slash their price targets for the AIM company by 65%.

Marks & Spencer was caught in the subsequent sell-off as short-sellers strengthened their hold on the blue-chip retailer. About 11.5% of the stock is currently out on loan.

Source: TradingView Past performance is not a guide to future performance

Whether the hedge funds end up with a bloody nose will require significantly more progress from the turnaround being undertaken by M&S chairman Archie Norman. He told the retailer's shareholders last summer that the business was on a "burning platform" and had no God-given right to exist.

Modernising the clothing range, focusing on good quality but affordable 'must-haves', and selling more of what people want is key to Norman's plans. So too is making M&S a "faster, more commercial and more digital business".

In the current climate, however, house broker Shore Capital expects like-for-like Christmas sales declines of between 2.5% and 3% in both the M&S general merchandise and food businesses.

It's likely that investors will want to see much more evidence that the restructuring is having the desired effect, despite a forward price/earnings ratio of 10x and attractive prospective dividend yield of 7%.

M&S reports on Thursday, the same day as employee-owned John Lewis Partnership. The department store chain said today that the first week of its post-Christmas clearance saw sales rise 11.2% on a year earlier, following on from rises of more than 4% for the previous two weeks.

Among other retailers reporting figures today, lifestyle brand Joules said retail sales rose 11.7% in the seven-week period to Sunday. The chain appears to have adapted well to "changing customer shopping behaviours", with e-commerce representing almost half the total sales in the period.

Shares rose 5% to 258p, up from a near-two year low of 203p seen at the start of December.

There was no respite for Footasylum, however, as margins at the athleisure brand fell victim to significant discounting and promotional activity. Total revenues were up 14% to 102.3 million in the 18 weeks to December 29, but this was insufficient to prevent another downgrade to 2019 earnings forecasts.

Executive chairman Barry Bown said:

"The short-term outlook is undeniably challenging, and we continue to maintain our focus on cash, working capital and inventory management, as well as reducing costs across our operations."

Having been valued at £171 million with a price of 164p a share when it floated in October 2017, the stock is now worth £30 million at 27p a share.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.