Why new sustainable fund labels will get off to a slow start

In its latest monthly column, Morningstar says that new labels for sustainable funds, which can be used from today, are proving to be tougher than expected to implement.

31st July 2024 09:01

by Morningstar from ii contributor

Towards the end of last year (28 November 2023), the UK’s Financial Conduct Authority (FCA) unveiled its long-awaited Sustainability Disclosure Requirements (SDR) and investment labels’ regime for investment products.

The SDR policy statement included a substantial package of measures aimed at improving the trust in, and transparency of, sustainable investment products and minimising greenwashing.

Discover: Sustainable Investing Ideas | What is a Managed ISA? | Open a Managed ISA

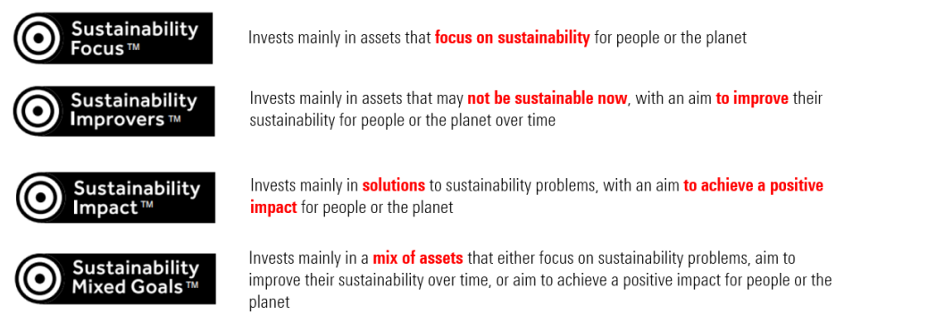

These measures included four consumer-focused sustainability labels that asset managers will be allowed to use from 31 July 2024. The labels are “Sustainability Focus”,“Sustainability Improvers”,“Sustainability Impact”, and “Sustainability Mixed Goals”.

A brief description of each label is provided in the graphic below.

Source: SDR Policy Statement. FCA, November 2023

To use a label, funds need to meet a number of general requirements as well as label-specific criteria on an ongoing basis. This list is extensive and quite onerous and as an example at least 70% of a fund’s assets must be invested in accordance with its sustainability objective, with reference to a robust, evidence-based standard that is an absolute measure of environmental and/or social sustainability.

The remaining assets should not conflict with the sustainability objective, and any that could be considered as doing so should have their purpose in the portfolio explained.

While this new framework for using environmental, social and governance (ESG) labels was initially hailed as a major step towards fighting greenwashing, Morningstar Sustainalytics believes that it is likely to see a slow start when adoption comes into force from today.

- What you need to know about the new anti-greenwashing rule

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Morningstar’s view is that managers look set to take a “wait-and-see approach, as requirements to qualify for a label are tougher than expected and demand lower than anticipated”.

The ii ACE 40 list features a number of multi-asset funds managed by Royal London and we have contacted them to understand their stance. They have confirmed that they are currently working through the package of measures and expectations of SDR, and how they apply to their business and product offering and expect to disclose more on this topic in the coming weeks, but at the time of writing have not concluded their findings.

Similarly, we approached iShares to understand the asset manager’s view in regard to passive funds, as they too have a number of funds featured in the ACE 40. The iShare ETFs that feature in the ACE 40 are Irish-domiciled funds and are therefore out of scope of the FCA’s SDR. They do, however, fall under the scope of the European Securities Markets Authority (ESMA), which in May published revised guidelines for ESG funds.

While these revised guidelines could be seen as an effort to harmonise the approach of the two regulators, in the short term they might increase confusion and will inevitably not result in perfect harmonisation. As a small example, while the FCA have stipulated that a minimum of 70% of fund assets must be invested in sustainable investments, this figure increases to 80% for funds that fall within scope of ESMA’s regulations.

Ruli Viljoen is head of manager selection at Morningstar.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.