Why investors should not be alarmed by 25% UK dividend slump

27th April 2022 10:13

by Kyle Caldwell from interactive investor

The fall doesn’t reflect the true picture. We run through the two key reasons why UK dividends declined in the first three months of 2022.

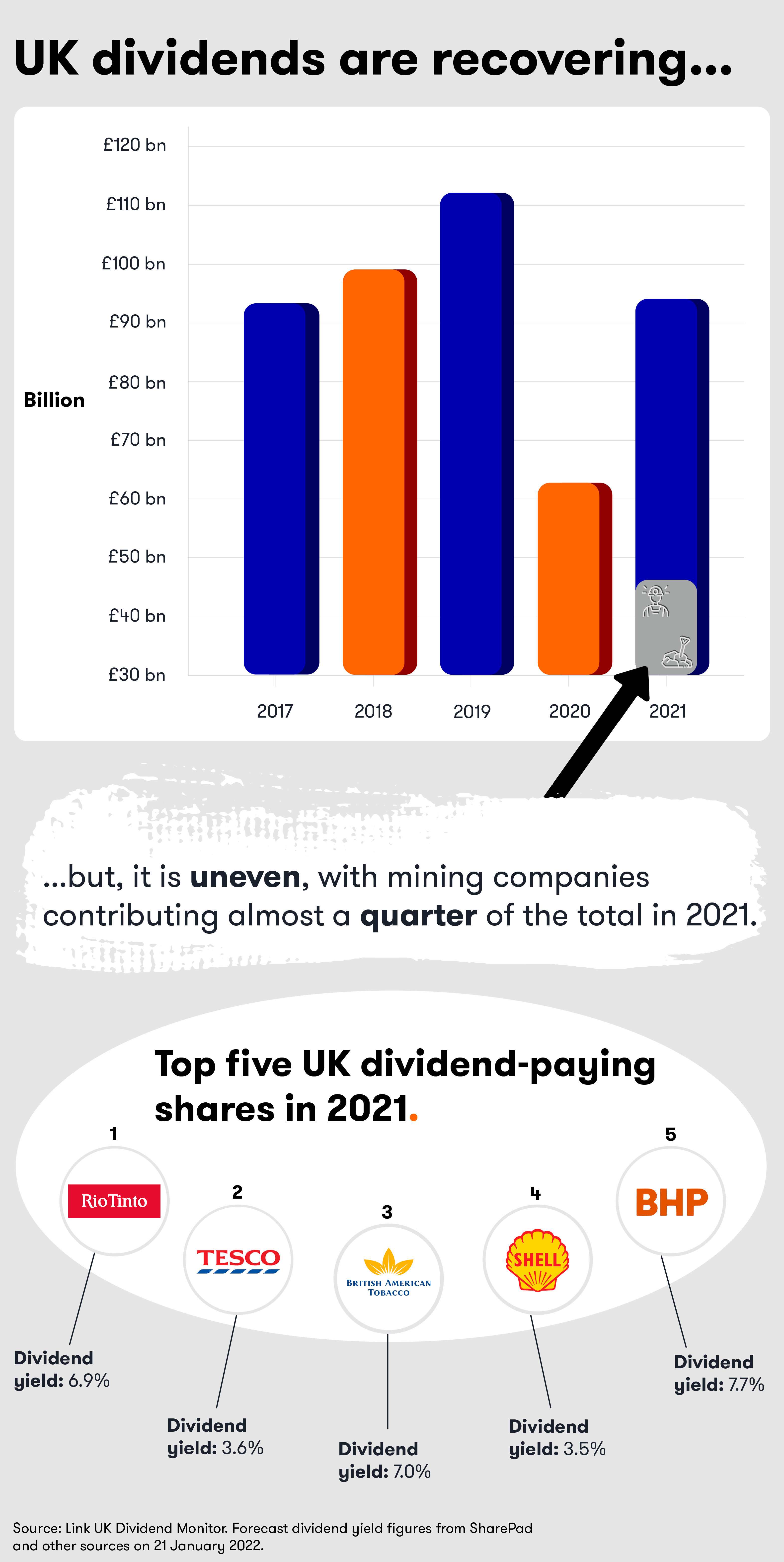

Overall income payouts among UK companies fell sharply in the first quarter of 2022 due to a fall in special dividends and the departure of BHP. UK dividends came in at £14.2 billion, which is 24.9% down year-on-year.

The mining giant was the fifth biggest dividend payer in the UK market in 2021. It delisted from the FTSE 100 at the end of January after shareholders approved plans to simplify the firm’s structure under a main listing in Sydney.

However, once these two factors are stripped out UK dividends had a strong start to 2022. Figures from Link Group’s dividend monitor show the adjusted underlying divided growth jumped 12.2% to £13.3 billion.

- Where to invest in Q2 2020? Four experts have their say

- Recessions are becoming more likely – here’s how to invest

- Find out what is now being tipped to be the best investment of 2022

Oil companies drove growth in the first quarter, raising payouts by 29%. Firms in the sector have become more cash rich, benefitting from the soaring oil price following Russia’s invasion of Ukraine.

The banking sector was highlighted by Link as raising income payouts at “a slightly faster pace than we expected”, while the firm noted that healthcare payouts rose “thanks to a long-awaited increase from an enlarged AstraZeneca (LSE:AZN)”.

Across the board – when stripping out exchange-rate and calendar effects - every sector saw higher dividends in the first quarter.

The soaring oil price and the continuation of the mining dividend boom has led Link to upgrade its dividend forecast for 2022.

The report notes: “The ongoing mining boom has driven four fifths of the £4.5bn upgrade in our 2022 forecast. We now expect headline dividends to reach £92.2bn this year, a fall of 0.8% year-on-year reflecting lower one-off specials and BHP’s departure from London.

“Underlying payouts of £85.8 billion will be 11.1% higher than 2021. Adjusting for the BHP departure gives an underlying increase of 15.2%.”

Mining company dividends fluctuate depending on the performance of the iron ore price. Therefore, the sector is not a reliable dividend payer.

In January, Link Group said mining companies “can neither sustain this pace of increase nor likely repeat special dividends of this size”. It also said it expected special dividends to fall from their record peak.

However, it has now changed its view on the back of the sector benefiting from soaring commodity prices, which it notes were given a further boost from sanctions imposed on Russia.

In its latest report Link Group said: “In January we commented that the mining sector cannot sustain its breakneck pace of dividend increases nor the size of its special dividends for long. This remains true as a medium-term expectation but is not yet fully coming to pass.

“The pace of mining dividend growth in the second quarter will slow by half but (adjusted for BHP’s departure) it will still be around 40% - rapid by any stretch. Special dividends will continue to be a feature this year too and will be larger among those miners that remain on the London Stock Exchange than they were in 2021.”

- Growth fund vs income fund, which is best for me?

- UK bank bargains beckon as rate rises set to boost results

- Best active funds leave passives standing over 20 years

David Smith, fund manager of Henderson High Income Trust (LSE:HHI), struck a more cautious tone.

He commented:“While the outlook for underlying dividends for the remainder of the year is robust, helped by large dividend payments from oil & gas (albeit still significantly below historic levels) and mining companies, supported by the high commodity price environment, there are headwinds on the horizon.

“Slowing global economic growth could see commodities come under pressure and therefore mining dividends, surging inflation may temper the dividend growth of those companies most exposed to the consumer while some companies are likely to find it harder to continue to offset their own cost pressures with price rises or efficiency savings.

“Having said that, the UK is still an attractive market for income with a dividend yield of 3.7%, significantly above the yield available on bonds or cash.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.