Why I'm selling shares in my 'forever holding'

23rd February 2018 11:42

by Richard Beddard from interactive investor

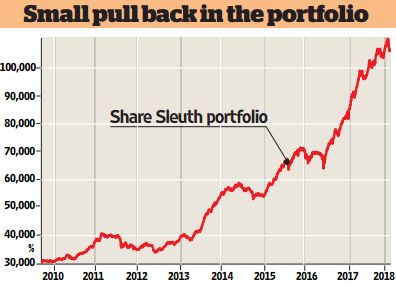

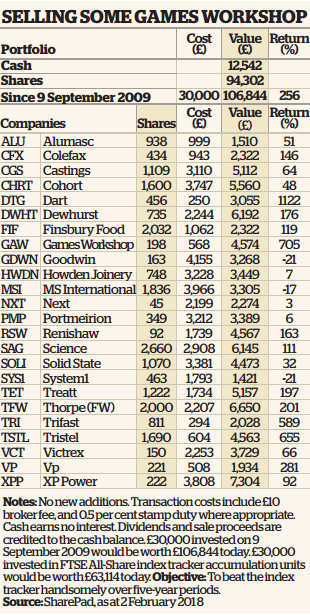

To maintain a diverse portfolio, I generally won't let a holding increase in value to more than 10% of the total value of the hypothetical Share Sleuth portfolio. I get nervous way before that, though, if I have doubts about the business or the valuation implied by its share price. I think is a very good business, but I'm not at all sure about its share price.

To keep things simple in articles, I compare a single year's profit figure with the market value of a company to gauge whether it's cheap or expensive. This is a universal method that most investors understand. But it's not the way I really think about valuation. I base my judgements on return on capital. I look back over the years to see how profitable a firm has been in the past and decide how profitable it will be in future. Most often, I will average return on capital over sufficient years to be confident I have caught the performance of the company through thick and thin.

Return is just another word for profit, so if you know how much capital a firm is employing, it's easy to work out how much profit it would be making if the current year were typical, by multiplying capital employed by the average return on capital. I use an average because profits vary a lot, and I don't think a single year's profit is a reliable way to measure the value of a firm. Averaging works better for companies that aren't changing much.

Games Workshop owns a hobby, Warhammer, that involves collecting, modelling and playing fantasy war games. It controls virtually every aspect of the hobby: the design and manufacture of models and game systems, many of the stores that sell them, and the books and magazines that promote them. So long as it keeps hobbyists happy, it has a captive market. That's why I think it's a good business.

As you might expect, return on capital has been healthy. It averaged about 15% in the first six years of this decade. In the year to May 2017, though, profitability doubled to 30%. Then things got even better. In the first half of the year that ends in May 2018, Games Workshop made as much profit as it did in the whole of 2017. With another six months of profit to add, some traders believe the company broker's forecast of 60% profit growth for the full year is an underestimate.

Much has changed at Games Workshop in recent years, and those initiatives seem to have borne fruit pretty much all at the same time. To give you a flavour, it changed the material models are made from to reduce the cost and improve the intricacy of the models. It slimmed down stores to a more economical single staff member format. It relaunched its venerable fantasy game in a new guise, Warhammer Age of Sigmar, and launched a new edition of Warhammer 40,000, a similar game set in the future.

Games Workshop has improved its marketing, established popular websites to promote the hobby and sponsored a major gaming convention. I think it's more efficient, giving customers a better product and promoting it better.

But I wonder whether, now hobbyists have gorged on the new websites and splurged on new models, we can expect things to quieten down a bit. Games Workshop has changed, so the past may be an unreliable guide to the future, but the present may be an unreliable guide too.

If 2017's return on capital is the 'new normal', the enterprise is valued at about 24 times adjusted profit. If the forecast for 2018 is the new normal, it's valued at a more palatable 16 times adjusted profit. But if Games Workshop reverts towards past levels of profitability, its shares are very expensive.

Because it's such a good business, I will hold some shares forever, but I've reduced the portfolio's holding to 4%. The share price was £22.92. Next month I will consider putting the money to work in .

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.