Why I’d buy shares in three of the world’s biggest banks

19th July 2023 09:54

by Rodney Hobson from interactive investor

American banks are the starting gun for US earnings season, and this year overseas investing expert Rodney Hobson has upgraded his view on one of them. Read his investment rationale here.

Large American banks have had a pretty good second quarter, getting the US half-year reporting season off to a great start, with dividend increases promised for the third quarter. One should never underestimate the propensity of the banking sector to snatch defeat from the jaws of victory, but life is looking remarkably good despite the lingering effects of the pandemic and soaring inflation.

Price/earnings (PE) ratios are still generally low, mostly in single figures, and yields are quite attractive if less than spectacular.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

After the collapse earlier this year of Silicon Valley Bank and First Republic Bank, it was reassuring to hear the US Federal Reserve say all 23 major US banks passed its annual stress test that assesses how they would fare in a major financial crisis. They are well positioned to continue to lend to households and businesses even during a severe recession, the Fed concluded. Not that there is any serious sign yet of a downturn in the US economy.

As in the UK, banks across the Atlantic continue to benefit from charging higher interest rates on loans and credit cards while avoiding passing on similar increases to depositors. There is so far little evidence that borrowers will default on their more expensive loans. Consumers seem to be leaving more debt on their credit cards but, for the moment at least, that will mean greater interest revenue for banks.

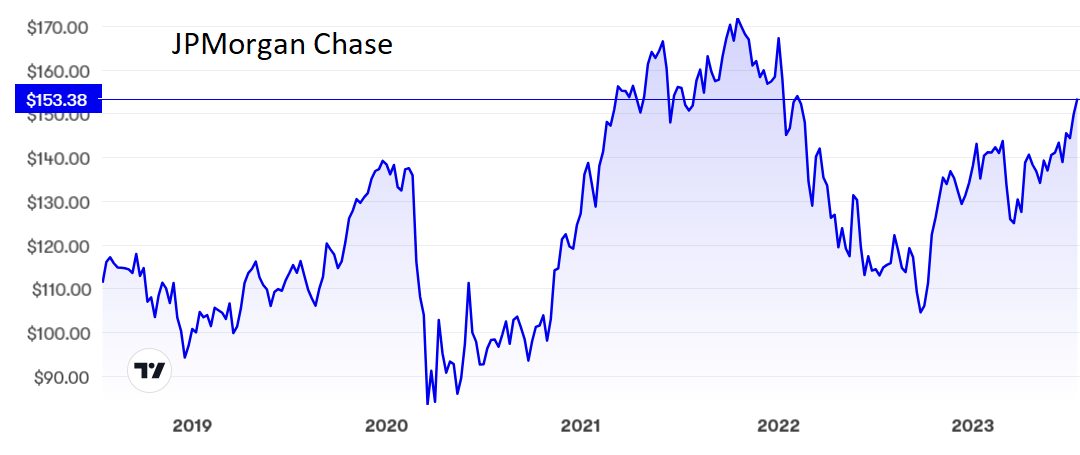

Once again, JPMorgan Chase & Co (NYSE:JPM) set a blistering pace with profits for the quarter up 67% year on year to $14.5 billion on revenue 34% ahead at $41.3 billion. That’s thanks mainly to a 44% widening of the gap between total interest payments received and those paid out. The one disappointment was that the quarterly dividend was unchanged at $1.

- ii view: JP Morgan profits fly as it beds down First Republic bank

- DIY Investor Diary: how I apply Warren Buffett tips to fund investing

JPM’s shares have naturally moved higher to stand at a 17-month high above $150, but even so the PE ratio is undemanding at just under 10 and the yield of 2.6% is not bad for a company of this quality.

Source: interactive investor. Past performance is not a guide to future performance.

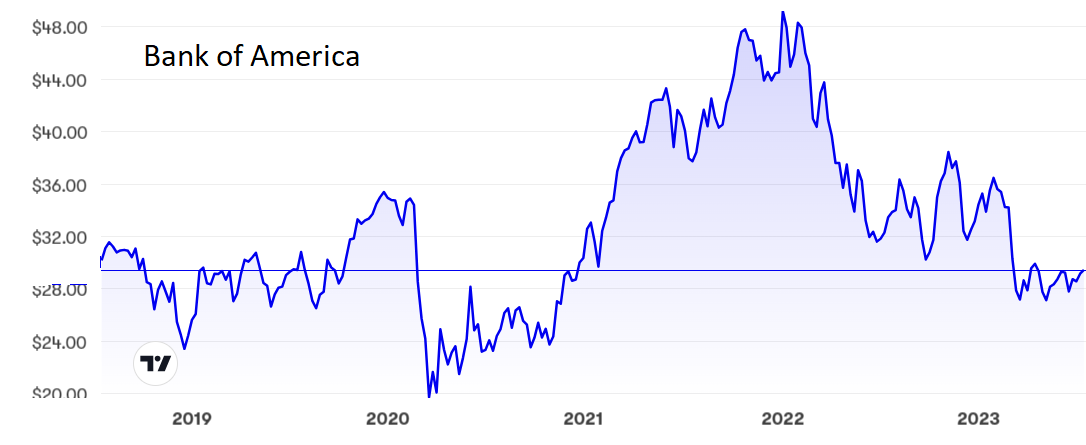

Bank of America Corp (NYSE:BAC) results were a little more subdued, but still showed revenue up 11% to $25.2 billion and net income 19% higher at $7.4 billion in what the bank hailed as one of its strongest quarters. Higher interest rates showed through in a 15% rise in revenue for the consumer bank unit.

It was not alone, though, in reporting a further surge in provisions for credit losses, although it should be noted that banks now tend to overprovide for bad debts and write back some of the provisions in later quarters.

BoA shares are way down since the start of last year but seem to have bottomed out around $30, where the PE is only 8.8 and the yield 3%, with a quarterly dividend up from 22 cents to 24 cents.

Source: interactive investor. Past performance is not a guide to future performance.

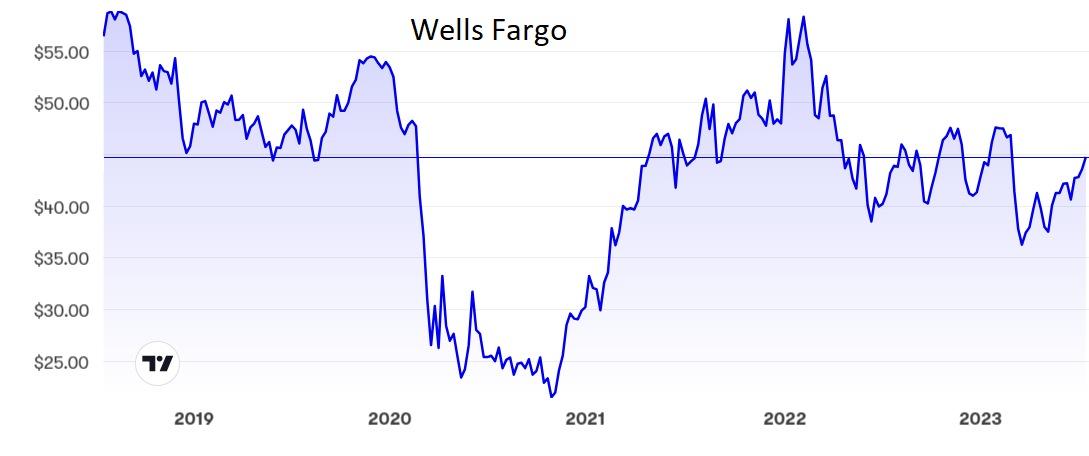

Wells Fargo & Co (NYSE:WFC) has looked the least appetising of the major US banks in the recent past, but the latest result were the best for some time, with profits leaping 57% to $4.9 billion on revenue up 20% to $20.5 billion. Again, there were greater provisions for possible bad debts on credit cards and for property loans, but the bank said there had not been significant such losses so far.

The shares have edged up recently from $36 to $45, pushing the PE up to 11.2 with a yield of 2.7%. The dividend is going up from 30 cents to 35 cents.

Source: interactive investor. Past performance is not a guide to future performance.

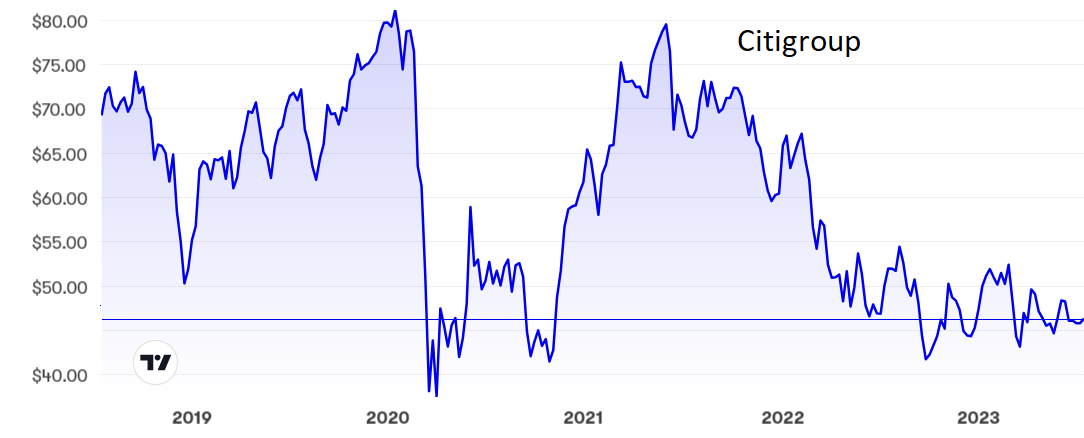

The big exception was Citigroup Inc (NYSE:C), where profits fell 36% to $2.9 billion on revenue down only 1% at $19.4 billion. Citi is more dependent on trading and investment banking, which remain weak.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I said three months ago that the $29 share price then did not reflect the full value of Bank of America. The recommendation to buy up to $36 still stands. I moved Wells Fargo up from sell to hold in April and the continued improvement means the shares are now worth buying. JPMorgan has edged up since I said buy below $145 but the shares have further to go so are still a buy.

Citigroup’s poorer showing is reflected in a share price slump from $80 to $47, where the PE is down to 7.3. Although the yield is the best in the sector at 4.4% the shares rate no more than a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.