Why I just bought this mid-cap share

Share Sleuth is betting that a company with big-brand ballast can revive its flagging fortunes.

29th January 2020 10:50

by Richard Beddard from interactive investor

Share Sleuth is betting that a company with big-brand ballast can revive its flagging fortunes.

In October last year, I noted that PZ Cussons (LSE:PZC) was at a crunch point. The company owns illustrious consumer brands such as Imperial Leather soap, but revenue and profit had declined significantly over the previous five years. PZ Cussons had halted its acquisitive strategy and started selling its less profitable businesses, some of them acquired only recently.

Investors had lost faith and the shares traded on a multiple of 12 times adjusted profit. Since then the share price has declined a bit further and subsequently recovered. As I write, on the second trading day of the year, PZ Cussons shares cost 206p, valuing the enterprise at the same 12 times multiple as in October.

Firm in flux

One thing has changed in the interim. The company announced in December that Alex Kanellis, the man ultimately responsible for the firm’s failed acquisitive strategy, as well as nearly a decade of earlier growth, will leave PZ Cussons on 31 January. He will follow the firm’s longstanding finance chief, who left in June 2019. The board is searching for a new chief executive, but it is reassuring shareholders that it is committed to the new focused strategy Kanellis initiated and the people-focused culture he championed.

I think this strategy is sound. Thanks to cost-cutting, PZ Cussons still earns a healthy return on capital and has respectable cash flows, but it needs to invest if it is to grow again. Investing in acquisitions lifted the firm’s debt but did not deliver growth; and since most of the free cash PZ Cussons generates funds its dividend, it does not have money to invest without cutting its dividend or borrowing. Selling off poorly performing brands to finance improvements in better-performing brands is an admission of failure, but it may also be a catalyst for growth without sacrificing the dividend. That is the aim of the firm’s new ‘focus, scale and accelerate’ strategy.

This is a time of change, and therefore uncertainty, at PZ Cussons, which explains why its shares are so unpopular. That uncertainty may or may not be giving us an opportunity to buy at an attractive valuation, which is, of course, the standard dilemma facing any contrarian investor. I have rarely felt the tension between the doubtful prospects of a business and the tug of a low valuation so acutely, which is why, in October and November 2019, when it came to making the one trade I allow myself each month, I found other, less uncomfortable trades to make.

My doubts revolve around brands that have for decades been reliable earners for investors. Brand owners are under pressure from two sources: discount retailers who essentially rip off their products and the proliferation of novel alternatives to big brands on the internet. PZ Cussons’ brands are an indication of its past success, but may not underwrite its future.

If the company is to prosper, it must adapt. It is already doing so, but its capacity to adapt will depend on the people who work for it.

Even though two of those people, hitherto the most significant, have no future at the company, I think PZ Cussons’ emphasis on its culture is more than just marketing blather in annual reports and on the company’s website. Judging by the reviews on recruitment websites, it is a good place to work. A new chief executive could build on its culture and improve high-profile brands such as Imperial Leather, Original Source and St Tropez, a fake tan product.

I have added 1,870 shares to the portfolio at a price of 205p (the broker’s price). The total cost was £3,878, including charges of £10 in broker fees and £19 in stamp duty. I put just 2.5% of the portfolio at risk, my minimum trade size, which reflects my remaining uncertainty about the firm and gives me scope to add more shares should I develop more backbone.

Performance on the rise once more

Cussons brings big-brand ballast

| Portfolio | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 5,608 | ||||

| Shares | 149,048 | ||||

| Since 9 September 2009 | 30,000 | 154,656 | 416 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ALU | Alumasc | 938 | 999 | 929 | -7 |

| ANP | Anpario | 937 | 3,168 | 3,186 | 1 |

| AVON | Avon Rubber | 192 | 2,510 | 3,994 | 59 |

| BMY | Bloomsbury | 1,256 | 3,274 | 3,755 | 15 |

| CGS | Castings | 1,109 | 3,110 | 4,702 | 51 |

| CHH | Churchill China | 341 | 3,751 | 6,206 | 65 |

| CHRT | Cohort | 1,600 | 3,747 | 11,552 | 208 |

| DTG | Dart | 456 | 250 | 7,857 | 3,043 |

| DWHT | Dewhurst | 735 | 2,244 | 7,350 | 228 |

| GAW | Games Workshop | 198 | 568 | 12,009 | 2,015 |

| GDWN | Goodwin | 266 | 6,646 | 8,219 | 24 |

| HWDN | Howden Joinery | 748 | 3,228 | 5,012 | 55 |

| JDG | Judges Scientific | 159 | 3,825 | 8,936 | 134 |

| NXT | Next | 45 | 2,199 | 3,131 | 42 |

| PMP | Portmeirion | 349 | 3,212 | 2,862 | -11 |

| PZC | PZ Cussons* | 1,870 | 3,878 | 3,880 | 0 |

| QTX | Quartix | 1,085 | 2,798 | 3,949 | 41 |

| RM. | RM | 1,275 | 3,038 | 3,545 | 17 |

| RSW | Renishaw | 92 | 1,739 | 3,597 | 107 |

| SOLI | Solid State | 1,546 | 4,523 | 10,358 | 129 |

| TET | Treatt | 1,222 | 1,734 | 5,682 | 228 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 7,140 | 224 |

| TRI | Trifast | 2,261 | 3,357 | 4,092 | 22 |

| TSTL | Tristel | 750 | 268 | 2,888 | 976 |

| VCT | Victrex | 150 | 2,253 | 3,810 | 69 |

| XPP | XP Power | 339 | 6,287 | 10,407 | 66 |

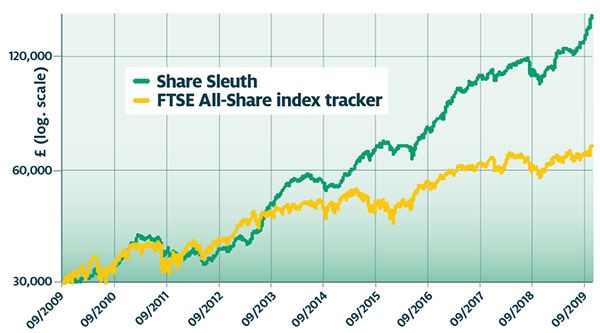

Notes: *New addition. Transaction costs include £10 broker fee and 0.5% stamp duty where appropriate. Cash earns no interest. Dividends and sale proceeds are credited to the cash balance. £30,000 invested on 9 September 2009 would be worth £154,656 today. £30,000 invested in FTSE All-Share index tracker accumulation units would be worth £69,749 today. Objective: To beat the index tracker handsomely over five-year periods. Source: SharePad, as at 3 January 2019

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.