Why Colefax will be sticking in this portfolio

27th October 2017 15:33

by Richard Beddard from interactive investor

On the back of my bathroom door hangs a pair of shorts. I last wore them about four years ago when I was fighting fit and as lean as a tower in Pisa.

To me, they're a benchmark. I'm going to run until I can wriggle my way back into them. I may even cut down on Kit Kats and chocolate Brazils.

is that pair of shorts. It will stay in the portfolio, like they will stay hanging in the bathroom, until I can find 20 or more companies that can do better forever.

Though 10% a year-plus buy-backs doesn't sound that great, it's a surprisingly tough benchmark to beat over decades. It's even more difficult to find shares in such companies at anything less than nosebleed prices.

Talking of nosebleed prices, Colefax's share price of 540p values the enterprise at 24 times adjusted profit. It sounds expensive but it's probably because profit is temporarily depressed.

As long as the pound doesn't surge, profitability should improve as the onerous hedges expire during the forthcoming year and now a semblance of confidence has returned in the US. At its AGM last month, Colefax confirmed that business in the US, the UK and Europe is growing modestly again.

At the current share price I wouldn't be buying the shares, but as Colefax is one of the top 30 or so companies I follow, they'll probably be sticking around in the portfolio a while longer.

Richard, why do you keep Colefax in your Share Sleuth portfolio? I mean it's not an outstanding performer is it.

Hmm. You noticed the decline in profit then? In the year to April 2017, revenue rose 5% but profit fell by over a quarter. Return on capital was just 7%. That's not really satisfactory.

It's still profit. What's wrong with 7% return on capital?

Well, think about it. You're going into business selling luxury fabrics, posh patterns people in country mansions and luxury London apartments want to drape their walls and furniture in. You're going to rent showrooms in expensive locations, employ designers to update your timeless designs. You're going to spend millions of pounds on sample books, stock warehouses with fabric and paper you've sourced from factories around Europe and India. You're going to employ decorators to work on large redecoration projects.

That's quite a bit of effort, and quite a bit of risk. Rents and salaries must be paid whether or not a collection wins customers over, and whether or not they fancy decorating this year. What return would you require?

Financiers say a firm should earn more than its cost of capital, but then fall out over what the cost of capital is. Meanwhile, loads of firms battle on earning thin returns.

I take the view a company is only thriving if it routinely earns more than an 8% return on capital, after tax, because that's a lot better than putting money in the bank.

So how posh is Colefax? How much would it cost me to decorate my bedroom?

Hmmm. Good question. First off, Colefax makes most of its money from fabric, for curtains and upholstery, and a little from wallpaper, furnishings and decorating. It's difficult to buy the fabric direct as Colefax only supplies interior designers, but you'd be talking £150 a metre for silk plus, of course, the interior designer's fee.

Let's say you buy the wallpaper online though. Your bedroom is what, about 4m by 4m. You'd need about 10 rolls costing anywhere between £60 and £130 a roll. So £600 to £1,300 assuming you do it yourself, excluding all the gubbins.

Gubbins?

Paste, brushes, a nice man in white overalls. It's been a while since I hung wallpaper. If you really want to push the roll out go with Manuel Canovas. It's the £1,300 brand.

What went wrong in 2017 then?

Fewer people bought Colefax's wallpaper and fabric.

Colefax owns five brands, Colefax and Fowler, Manuel Canovas, Jane Churchill, and Larsen are European brands also sold in North America, where its signature brand is Cowtan and Tout.

They are all aimed at the luxury end of the market, and an unpredictable election campaign in the US unsettled bankers and other wealthy customers worried about the potential impact of a Clinton presidency on the stockmarket. A hike in stamp duty also extinguished the high-end property market in London. With far fewer mansions changing hands, the imperative to redecorate just wasn't there. It still isn't in London.

The effect could have been much less damaging for Colefax, though, had it not hedged its dollar revenues, because Brexit also provided a natural elixir. The decline in the value of the pound after the vote meant Colefax's substantial dollar revenue should have been worth much more. The US brings in 60% of fabric sales (including wallpaper).

I thought hedges were supposed to protect companies from losses, not prevent them from making gains!

Your mistake. Colefax effectively fixed all its dollar revenues at $1.50. If the pound had gone up, and Colefax's dollar revenue been worth less in pounds, the company would have been protected because the value of the hedge would have increased.

As you know, the pound sank as low as $1.20 after the Brexit vote. Colefax's dollar revenues were worth more in pounds, and the value of the hedge declined by £2 million. Had Colefax not hedged it would have made £2 million more profit, enough to mean it wouldn't have fallen much at all.

In retrospect, the hedge looks slightly crazy, it provided a measure of stability, and made it easier for the company to budget. Mostly though, it's a case of swings and roundabouts. Some years hedging profits the company, in other years it doesn't. Perhaps the greatest risk is the risk of embarrassment if a company is more or less hedged than rivals. I think Colefax was embarrassed in 2017.

It's lost its appetite for hedging: some of the hedges remain in force at the onerous $1.50 price, so the company is about 50% hedged this year. After that, I imagine there will be much head scratching about policy.

It's important, though, Colefax adopts a consistent policy, otherwise it will be gambling on foreign exchange movements.

Not the first time profitability has dropped to questionable levels is it?

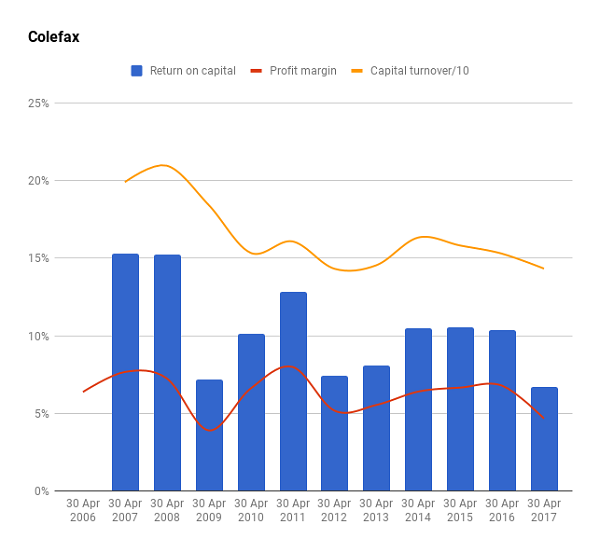

Nope, and this is praying on my mind a bit. Take a look at my favourite chart:

Three times in the past 11 years, return on capital has sunk as low as 7%, and one other time it fell to 8%. Even if we include two go-go years before the financial crisis, average return on capital is 10%. A 10% average after tax return on capital is not bad if it can be sustained or improved in future, but there will be companies doing better.

Sounds iffy. I still don't understand why you still hold?

Because I haven't yet found those companies.

In many ways Colefax is run conservatively. It's efficient, it produces relatively few patterns, for example, which means it carries less stock. Unlike some rivals, Colefax has resisted the temptation to license patterns for use on other products, reckoning its customers don't want to see their curtains on coffee pots, for example.

It's also reluctant to acquire other businesses, preferring to use surplus cash to buy back stock, which increases the returns to shareholders. Although cash flow can vary considerably from year to year and 2017 was particularly poor, over the last 11 years cash profits have almost matched accounting profits, which gives me confidence.

The returns aren't spectacular, but it's a regular gravy-train, which serves management very well. The executives pay themselves high salaries, but at least the company doesn't inflate them further with opaque incentive schemes. Since David Green, the chairman and chief executive, owns 30% of the shares, he's got a powerful enough incentive to ensure the gravy keeps flowing to shareholders and directors.

Can I tell you a story about my shorts?

Oh go on, tell me a story about your shorts.

On the back of my bathroom door hangs a pair of shorts. I last wore them about four years ago when I was fighting fit and as lean as a tower in Pisa.

To me, they're a benchmark. I'm going to run until I can wriggle my way back into them. I may even cut down on Kit Kats and chocolate Brazils.

Colefax is that pair of shorts. It will stay in the portfolio, like they will stay hanging in the bathroom, until I can find 20 or more companies that can do better forever.

Though 10% a year-plus buy-backs doesn't sound that great, it's a surprisingly tough benchmark to beat over decades. It's even more difficult to find shares in such companies at anything less than nosebleed prices.

Talking of nosebleed prices, Colefax's share price of 540p values the enterprise at 24 times adjusted profit. It sounds expensive but it's probably because profit is temporarily depressed.

As long as the pound doesn't surge, profitability should improve as the onerous hedges expire during the forthcoming year and now a semblance of confidence has returned in the US. At its AGM last month, Colefax confirmed that business in the US, the UK and Europe is growing modestly again.

At the current share price I wouldn't be buying the shares, but as Colefax is one of the top 30 or so companies I follow, they'll probably be sticking around in the portfolio a while longer.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.