Why the City loves M&S and Sainsbury’s shares

There’s been a flurry of broker upgrades for M&S despite an impressive rally to a seven-year high. City writer Graeme Evans explains why. Plus, there’s good news for this supermarket chain.

17th September 2024 13:54

by Graeme Evans from interactive investor

The £4 argument for Marks & Spencer Group (LSE:MKS) shares grew louder today as another City firm raised its price target amid mounting global interest in the retailer’s FTSE 100 resurgence.

Jefferies, which sees a further 17% upside for shares to 410p, believes a “pro-cyclical UK mindset” has placed the stock on the watchlists of more international investors.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

The bank’s upgrade follows similar moves yesterday by counterparts at RBC and Barclays after they shifted to 400p in order to keep up with a strong run for shares over the summer.

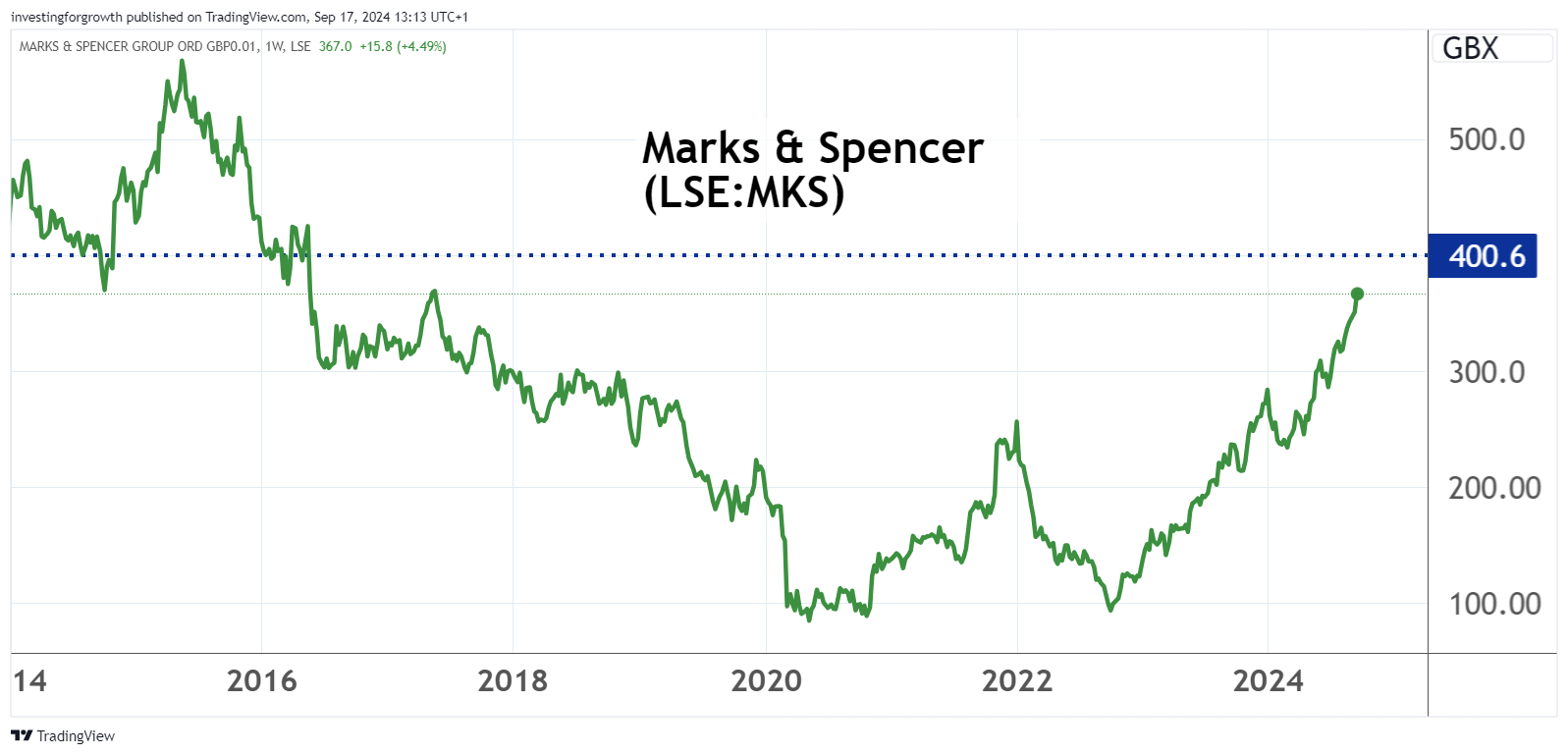

M&S reached midday at 365.3p, representing an increase of 49% since mid-April and a level more than 70% higher than October. The last time they traded at 400p — the same price as Philip Green’s rejected takeover approach in 2004 — was in 2016.

Source: TradingView. Past performance is not a guide to future performance.

Jefferies now values M&S on 14.5 times 2025’s earnings, which is at the upper end of history and up from 12.7 times previously.

The bank sees profits growth of 10% this year and 7% in the next, with interim results due on 6 November set to show another half year of sustained market share growth.

Jefferies’ forecast for a 5% year-on-year rise in half-year adjusted profits to £367 million compares with the City consensus of £358 million and 2022-23’s £205.5 million.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- eyeQ: is this FTSE 100 share’s rally overdone?

It has nudged up its estimates by 2% across all its forecast years, driven by strong volume growth in M&S’s food halls.

The bank’s new estimates include half-year earnings in food of £202 million based on a margin of 4.8%, much more optimistic than City forecasts for £172 million and 4.2% respectively.

It is more cautious on the clothing and home division with an earnings target of £201 million. That’s below the City’s £222 million consensus as Jefferies reflects the increased cost profile seen in the second half of last year.

In a separate note published today, the bank is also more upbeat on Sainsbury (J) (LSE:SBRY)’s after lifting its price target on the Argos owner from 300p to 325p — an upside of 8% on today’s level.

The bank reiterated its full-year estimates amid continued top line progress in the UK grocery division alongside tougher trading conditions in general merchandise.

Jefferies said the potential impact of poor summer weather on Argos has dominated the City focus heading into half-year results on 7 November.

It added: “This likely misses the full picture given the new normal of grocery growth seems to be still-rapid market share gains and an industry recovering volume/mix.”

On Friday, UBS upgraded its price target from 295p to 321p after forecasting a strong first-half grocery performance. It added: “We see Sainsbury’s positioning in the industry as very strong at a time when we see several constrained operators losing market share.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.