Why Citi says it’s time for small-cap stocks to sparkle

Many of the market’s ‘high-quality’ smaller and mid-cap stocks have spent the year being mostly overlooked, and are now trading at a 30% discount to the key US stock market index. Here’s why now could be the time to go bigger on smaller stocks.

27th October 2023 14:04

by Carl Hazeley from Finimize

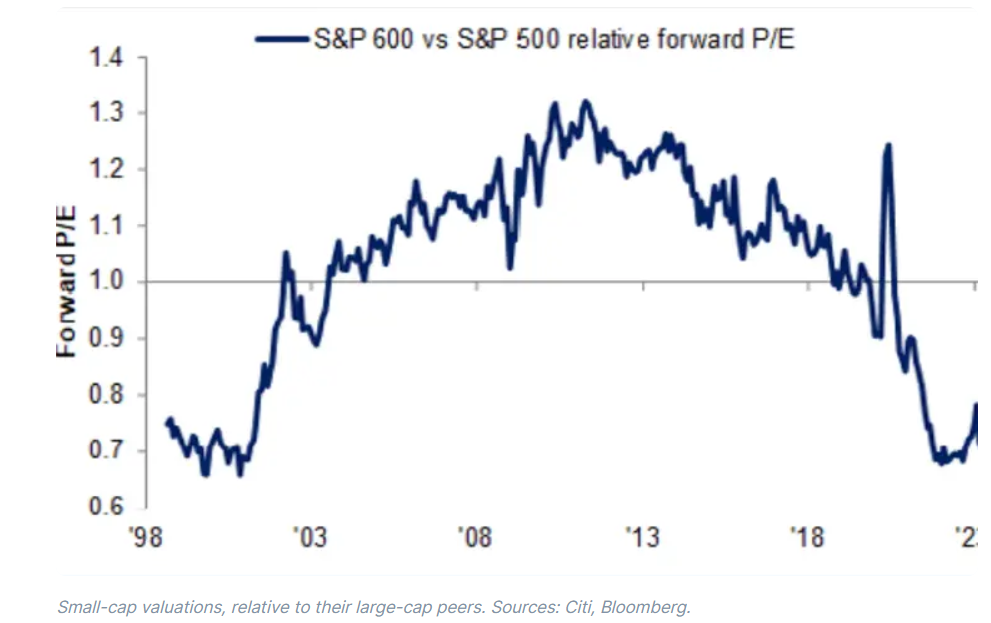

“High-quality” small and midcap stocks are currently trading at a 30% discount to the S&P 500, creating an attractive opportunity to buy into smaller stocks for the long term.

Dispersion is around the 75th percentile for small and midcap companies, whereas it’s still below the 50th percentile for large-cap stocks – and that suggests that active management could outperform passive strategies.

Look for active managers with a reliable track record, especially during tricky market conditions and whose funds are the right size to take advantage of opportunities.

The S&P 500 is up a chunky 14% this year, with the vast majority of its gains driven by just a handful of already massive and wildly buzzy stocks. And that means many of the market’s “high-quality” smaller and midcap stocks have spent the year being mostly overlooked. Well, Citi Wealth has had its eye on these little gems, which are now trading at a 30% discount to the key US stock market index. Here’s why Citi’s wealth management unit says now could be the time to go bigger on smaller stocks...

What’s the allure of small stocks?

You don’t tend to hear as much about smaller firms. They generate less excitement compared to the market’s giants and get less attention from investors. They’re usually also less “liquid” – meaning that fewer shares trade per day – and because of that, their prices can be prone to more dramatic moves. But all of these things can lead to a systematic valuation discount, which, if unfair, may be a signal of future outperformance to follow.

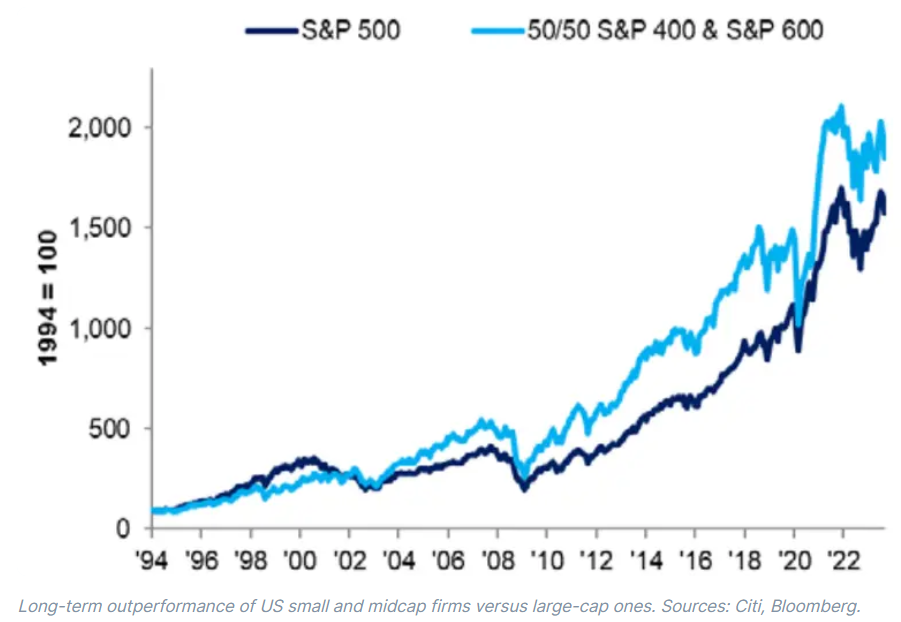

Small and midcap stocks have outperformed in most decades over the past 100 years. And that’s been especially true of profitable small and mid-sized firms, which have outperformed their bigger counterparts since 1994.

After underperforming last year and for much of this year, small and midcaps are now historically cheap relative to their bigger peers. And that, Citi says, has created an attractive entry point to buy and hold for the long term.

And, sure, valuations alone aren’t especially good at predicting what’s going to happen over the short term (remember, it’s notoriously difficult to “time the market”), but Citi expects that inflation will moderate and lead to interest rate cuts next year. And that’s why it says it’s worth buying into small and midcaps now.

So what’s the opportunity here?

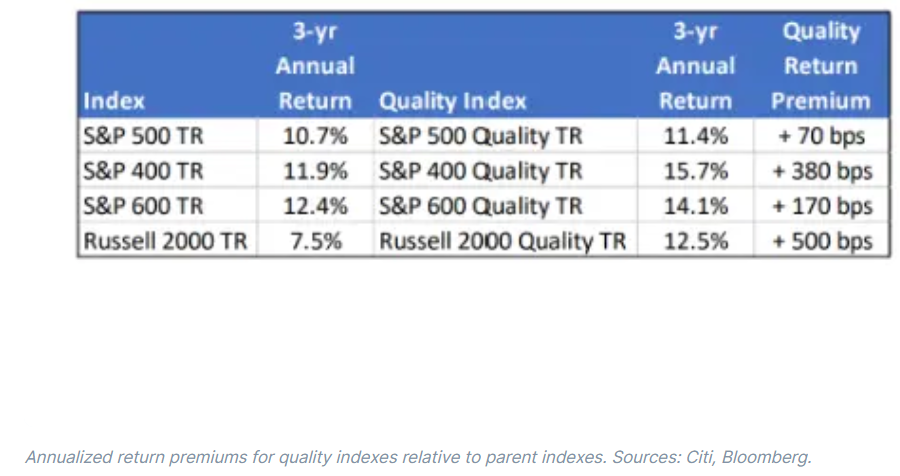

With current small-cap valuations offering up some attractive entry points, Citi says you’d do well to focus on high-quality firms that have underperformed so far.

That means zeroing in on those that rank highly relative to their peers on financial metrics, including return on equity (a measure of how profitable companies are), earnings quality (how reliably their reported profits flow through to the company cash balance), and financial leverage (the amount of debt they have compared to their assets or profits).

Data from the past three years shows that quality-focused small and mid-cap exchange-traded funds (ETFs) have outperformed the rest of the pack.

But to get the most out of a quality-focused small and midcap portfolio allocation, you might want to consider an active approach to the investment. See, active management tends to work best in areas of the market where dispersion is high, allowing investors to choose outperformers and avoid – or even bet against – underperformers. In the US, the dispersion has been persistently higher among small and midcap companies than it’s been for bigger players.

Right now, in fact, uncertainty about the future of the economy has pushed dispersion to around the 75th percentile of monthly values for small and midcap companies. For large-cap stocks, meanwhile, it’s still below the 50th percentile. And that signals an opportunity for an active approach to generating returns over and above a passive, ETF-based strategy.

Mind you, Citi’s not suggesting you take on the work of actively managing your midcap portfolio yourself. You could instead entrust your cash to an active manager – like a hedge fund if you’re an accredited investor – who can do deep dives on the industry trends for a given company and on its various risks, funding needs, and cash flows. Those pros will also analyze a firm’s barriers to entry, competitive positioning, management quality, and more to make informed investment decisions.

They’ll know, for example, that a small or midcap company’s leverage is worth paying close attention to because its ability to pay the interest on its debts could become an issue if rates stay higher for longer, especially because a high proportion of smaller companies are unprofitable.

By buying high-quality individual stocks and betting against – or “shorting” – low-quality small and midcap stocks, hedge funds or other active fund managers can set their investors up to profit and limit their downside risk during volatile times by essentially “winning by not losing”. The major risk worth being aware of here is that shorting stocks opens investors up to theoretically infinite losses which can be triggered or magnified by a short or gamma squeeze, famously à la GameStop.

So, what should you look for in an active manager?

If you’re looking for an active manager to pursue this kind of opportunity, seek out the ones who have a record of successful stock picking. And keep in mind that with funds, size matters: it should be hefty enough to support the research necessary for effective selection but small enough to be able to profit without having too huge an impact on the market.

You should also evaluate the manager’s record in delivering returns relative to the amount of risk taken, and performance during times of market volatility and stress.

Keep in mind that active managers can underperform stock markets during periods of unrestrained optimism. But finding a high-quality active manager who can deliver in decidedly unoptimistic times may reward patient investors in the long run.

Carl Hazeley is VP Content and chief analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.