Why Boohoo and Games Workshop are unstoppable

Among the best-performing stocks of the past few years, here’s what’s given this pair an extra boost.

14th January 2020 12:36

by Graeme Evans from interactive investor

Among the best-performing stocks of the past few years, here’s what’s given this pair an extra boost.

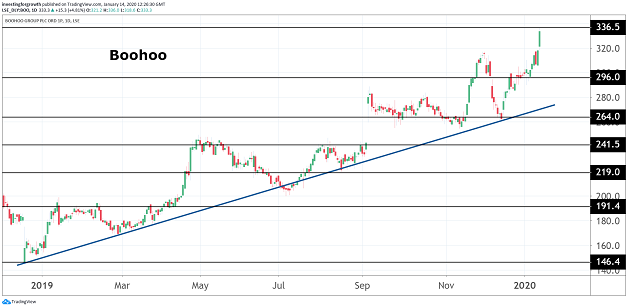

Boohoo (LSE:BOO) overtook Marks & Spencer (LSE:MKS) in value today as the fashion retailer and fellow high-flyer Games Workshop (LSE:GAW) confirmed why they are top momentum picks at the start of 2020.

Their latest forecast-beating updates reassured investors that there's more to come for shares, despite the pair rocketing in value during 2019 to fresh record highs.

Boohoo was up another 5% to 334.5p today as better-than-expected Christmas trading figures prompted brokers at Liberum and N+1 Singer to up their target prices to 370p and 375p respectively.

Games Workshop, meanwhile, was hiked to 7,000p from 5,000p by Peel Hunt after the fantasy war games retailer accompanied strong half-year results with a record dividend. The shares rose another 5% to 6,700p to extend a spectacular run of form dating back to 2016.

The pair are among a number of momentum stocks in the FTSE All Share currently trading at all-time highs. The others include AVEVA (LSE:AVV), Bellway (LSE:BWY), JD Sports Fashion (LSE:JD.), Meggitt (LSE:MGGT) and Ultra Electronics (LSE:ULE), while Aggreko (LSE:AGK), British American Tobacco (LSE:BATS) and United Utilities (LSE:UU.) are at one-year highs.

- 35 best growth stock ideas for 2020

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

For Boohoo, the momentum means the AIM-listed fast fashion chain is now worth more than established retailer M&S at around £3.8 billion. Matthew McEachran at N+1 Singer thinks there's scope for this figure to eventually reach £8 billion, based on the company's ability to triple underlying earnings across its brands over four to five years.

He noted that revenues growth of 44% for the September to December trading period was five-percentage points better than the market had expected, with sales for the Boohoo brand up 42%, PrettyLittleThing up 32% and NastyGal 102% stronger.

McEachran's positive view is also based on the expected economies of scale and the benefits from the automation of the company's Burnley and Sheffield warehouses. Boohoo now expects an underlying margin above 10% for the year to the end of February, with sales growth of between 40% and 42% stronger than its last guidance for 33% to 38%.

Source: TradingView Past performance is not a guide to future performance

Shore Capital retail analyst Greg Lawless said it had been “another excellent quarter” for the company, with its marketing campaigns continuing to resonate with younger customers.

Highlighting its potential to become an online version of Zara owner Inditex, Lawless said the Boohoo investment case was built around its ability to leverage the operating platform across its six brands, which now include Karen Millen and Coast.

Lawless added:

“The group remains very well managed in our view and there is a significant global opportunity outside the UK.”

The shares currently trade with an enterprise value to earnings multiple of 25x.

Games Workshop has also richly rewarded shareholders in recent years, with today's interim results another reminder of that progress after half-year profits hit a record £58.6 million — higher than the company's previous guidance for not less than £55 million. The interim dividend of 45p also reflected the Nottingham-based firm's continued strong cash generation.

Source: TradingView Past performance is not a guide to future performance

There have been many reasons for the company's dramatic share price spurt of recent years, which has taken its market capitalisation above £2 billion. These include the simplification and reboot of the original Warhammer game as Warhammer Age of Sigma and the adoption of cheaper to operate one-man stores.

Return on capital has increased in recent years from good to spectacular at 110%, with higher volumes meaning the factory and stores are operating more efficiently. The company has also been successful in engaging its customer base through social media, online and videos.

- 10 stocks from one of 2019’s top strategies

- You can also invest in UK equities via ii’s Super 60 recommended funds. Click here to find out more

- Like AIM and small-company shares? Check out ii’s Super 60 recommended funds

Peel Hunt said there was plenty still to look forward to, with ongoing product innovation and plans for a new TV series based on the Eisenhorn series of novels.

The broker's new price target equates to 30 times 2020 earnings, compared with 27.6x currently:

“There is a lot of encouragement given the strong sales progress and the step-up in the monetisation of the intellectual property.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.