Where to reinvest your Magnificent Seven profits

It takes a brave investor to turn away from the darlings of global stock markets, but nothing lasts for ever, warns a Kepler analyst.

8th March 2024 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Sometimes it feels safer to run with the herd. Like it or not, you will likely be doing exactly this with your investment portfolio. On a global basis, it has been such a feature of equity markets that the biggest have got significantly bigger, increasingly driving overall performance, and at the same time becoming a greater and greater proportion of market-cap-weighted indices. In fact, this has mainly been a feature in US equity markets, the effect of which has spilled over into global indices, because of the sheer size of the US’s biggest companies which means they make up a huge part of global benchmarks.

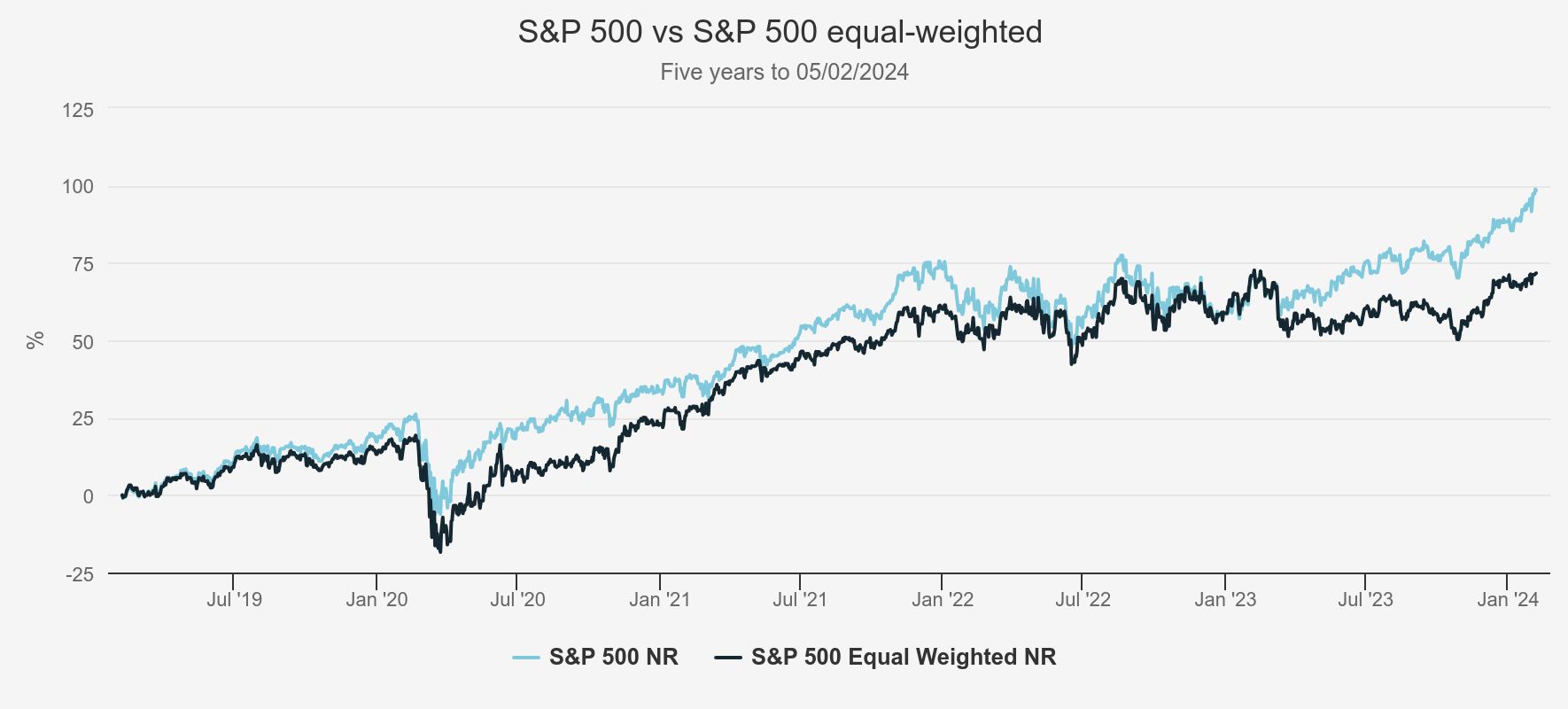

According to statistics from JPMorgan, within the S&P 500, the market-cap share of the largest ten stocks relative to the broader market—is at the 86th percentile relative to history and stands at 29.4%. As we show below, this has led to a significantly divergent performance of the weighted vs the unweighted version of the index. According to JPMorgan the “Magnificent Seven” (of which more below) delivered returns of 101% over 2023, whilst the equal-weight index delivered a return of 2.5%. In other words, if you were a stock picker or aimed to have a vaguely diversified portfolio, it was an impossible year in which to deliver outperformance.

Whilst this isn’t necessarily of concern to investors, it will be of concern to active fund managers, who need these sorts of market phenomena like a hole in the head. With pressures on fees and the rise of cheap passives, looking at the graph below it is hard to argue that investing in an S&P 500 tracker hasn’t been the right thing to do.

WEIGHTED VS UNWEIGHTED

Source: Morningstar. Past performance is not a reliable indicator of future results

Investing in a market-weighted US or Global ETF during 2023 would have resulted in the outperformance of active managers at a low cost. On the other hand, indices are not “intelligent” capital allocators as such, but they are allocating capital for you—not based on anything other than what other people are investing in. This is reassuring in some way. No one likes being out on a limb, particularly when the downside of doing so is acute. Imagine a swimmer noticing the previously bustling shoreline full of other swimmers who are now all standing on the beach. Is it possible to imagine them being able to continue to enjoy their swim? Of course not. Humans are (generally) programmed to ask—what have I missed? Why am I here on my own? What awful predator has everyone else seen, but I haven’t? Irrespective of the very remote likelihood of being shark food, 99.9% of swimmers will get out of the water—sharpish!

Investors in an ETF of either the MSCI World or the S&P500 will find that, after many years of startling returns, a material part of these holdings is now represented by the seven stocks we show in the table below. More and more people are now standing on the same patch of beach!

£1,000 INVESTED TODAY IN AN ETF

| STOCK | ISHARES MSCI WORLD ETF (£) | ISHARES S&P 500 ETF (£) |

| Microsoft | 45.60 | 71.10 |

| Apple | 44.90 | 62.20 |

| Nvidia | 30.60 | 45.40 |

| Amazon | 25.60 | 37.10 |

| Meta | 16.90 | 25.10 |

| Alphabet (Class A and C) | 25.40 | 36.80 |

| Tesla | 8.60 | 12.40 |

| £ Total | 197.60 | 290.10 |

Source: iShares, as at 23/02/2024. Past performance is not a reliable indicator of future results

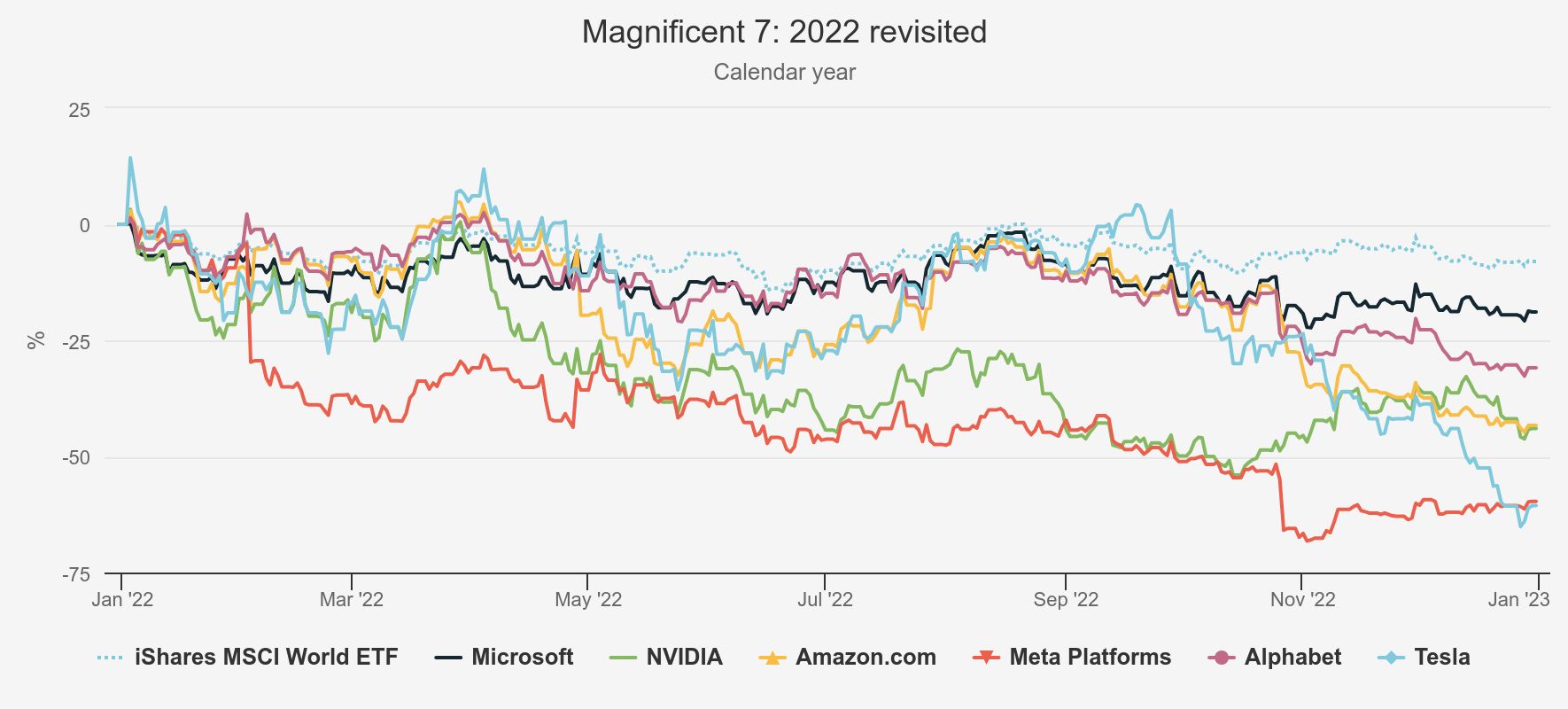

It takes a brave investor to peel away from these darlings of global stock markets and get back in the water. However, in our view, it makes absolute sense from a risk management perspective, to rebalance, take profits, and reallocate elsewhere. 2022 provides a good illustration (see below) of what can happen when the tide goes out. All of these companies underperformed world indices by a considerable margin, and it is hard to argue that the same could not happen again should sentiment turn.

2022: NOT SO MAGNIFICENT

Source: Morningstar. Past performance is not a reliable indicator of future results

Find me shelter!

Swimming against the tide is hard when you are investing. It takes tenacity, self-confidence and a willingness to be wrong until you are (eventually) proved right. As such, turning away from the Magnificent Seven will take a certain level of fortitude. But we all know that nothing lasts forever.

Aside from mitigating stock-specific risks, which as we show are increasingly prevalent in indices, adding less correlated returns to a portfolio adds to risk-adjusted returns. That said, given the financialisation of everything, the level of connectedness amongst investors globally, and the globalisation of capital flows, it is likely that if the Magnificent Seven hit turbulence, then stocks everywhere will feel the effect from a sentiment perspective. However, after the initial shock, we think fundamentals will eventually re-assert themselves, and so in our view, it makes sense to look within equity markets for other areas of growth which potentially offer very different drivers to those of the biggest listed companies in the world. We therefore examine various complementary growth opportunities, which might make sensible avenues to explore for re-investing those magnificent profits into.

Europe

We have often advocated European companies as being an interesting, yet often underappreciated area of the market that offers exposure to global leaders, that just happen to be headquartered in Europe. A recent article in the FT drew attention to the continued strong performance of 11 European companies known as the ‘Granola’ stocks. In contrast to the Magnificent Seven, which are currently the seven largest companies in the MSCI World indices, the Granola stocks were identified by a Goldman Sachs analyst in 2020 as representing a collection of companies which all had strong balance sheets, low volatility earnings growth, and good dividend yields. This collection of companies did well in the ten years up to February 2020, when they were first identified. The 11 Granola companies (or more accurately Grannnolass…) consist of GSK (LSE:GSK), Roche Holding AG (SIX:ROG), ASML Holding NV (EURONEXT:ASML), Nestle SA (SIX:NESN), Novartis AG Registered Shares (SIX:NOVN), Novo Nordisk A/S ADR (NYSE:NVO), L'Oreal SA (EURONEXT:OR), LVMH (EURONEXT:MC), AstraZeneca (LSE:AZN), SAP SE (XETRA:SAP), and Sanofi SA (EURONEXT:SAN). Strong performance in aggregate continued during the coronavirus sell-off and subsequently. We note that these do not represent the largest companies in the European Index, which as of 31/12/2023 also included several energy companies, banks, insurance, miners, and consumer staples.

According to the FT article, the 11 Granolas have generated around 50% of the European stock market’s gains over the last 12 months (to mid-February 2023), and their combined market capitalisation has reached nearly 25% of the Stoxx Europe 600, which is nearly equivalent to the Magnificent Seven weighing in at 29% of the S&P500. Whilst the article claimed that Granola’s dominance was echoing that of the Magnificent Seven in terms of the impact of concentration on portfolios, we are not quite so sure. The difference comes in the size of these companies, and therefore their relevance to a non-European focussed investor.

We have analysed the Magnificent Seven and the Granola stocks share of the Morningstar Global Markets Index (which is equivalent to MSCI World). As of 31/12/2023, the Granolas represented just 3% of the Global Index. So, these 11 companies combined, in a variety of different sectors, represent less than either Apple or Microsoft’s weighting in the global index. This may be concentration, but it is a pretty dilute concentrate! As the Granola’s illustrate, many of Europe’s leading businesses have no US or other significant global competitors of note. They clearly offer an opportunity to access strong growth, but with very different drivers and risks than the Magnificent Seven expose investors to.

Of the seven large-cap AIC Europe trusts, all but one hold Novo Nordisk as the largest or second-largest holding in the portfolio, the exception being Baillie Gifford European Growth Ord (LSE:BGEU), which has only one of the Granola stocks in its top ten holdings and looks very different to the rest. BlackRock Greater Europe Ord (LSE:BRGE) has been an impressively strong performer over the long term, with its concentrated portfolio focused on high-growth opportunities across Europe. Manager Stefan Gries leads a team focused on stock picking. The portfolio is exposed to a number of long-term secular growth trends and typically has low turnover and long holding periods, all of which have contributed to an outstanding long-term track record. BRGE has been awarded one of our 2024 Growth Ratings.

Thematic

Staying in equity markets, but looking for non-crowded growth opportunities, one might look at thematic funds. High-growth technology opportunities of a very different flavour to those of the Magnificent Seven can be found within the likes of Impax Environmental Markets Ord (LSE:IEM). IEM targets companies in a range of six different environmental sectors, such as efficiency & waste management, water, sustainable food, and energy. The trust has a distinct bias towards mid and small caps, which offers investors a very different exposure to that found in most global equity portfolios. That said, the small-cap growth focus has cost it dearly relative to the wider global indices over 2023. We think it noteworthy that the managers of BlackRock Energy and Resources Inc (LSE:BERI)have noted the underperformance of the “energy transition” universe of companies that they follow and have been adding exposure to this area. BERI offers another very different exposure to world markets, with a strong thematic flavour, but with an element of in-built balance. Strong performance is reflected in BERI having won a Kepler Growth Rating for 2024. The growthier opportunities in the energy transition part of the portfolio complement the “value” characteristics that traditional energy and mining stocks offer. As a result, relative to world equity markets, it offers a potentially interesting place to find shelter from any mega-cap technology storms that may break over the horizon.

Asia

Global indices, and some might say the global economy, seem inextricably linked to China. However, Asian stock markets have also tended to be correlated to China, given its position as the economic powerhouse of the region. Certainly, this seemed to be the case until 2023. With economic growth moderating, combined with heightened political tensions with the US, it has also performed poorly over the short term. In fact, just as we show in the graph below, as China has stumbled, India has powered ahead.

Ashoka India Equity Investment Ord (LSE:AIE)has been the best-performing trust since it launched in July 2018, and this strong performance continues. It won a Kepler Growth Rating for 2024, the first year that it had a track record long enough to be considered, and continues to issue shares this year, when most trusts appear to buying shares back trying to protect their discounts. AIE has a natural tilt towards small and mid caps, but the team also favour higher-quality businesses and place a great deal of weight on good governance. The team have recently been adding exposure to companies in some more highly regulated areas in which they are typically light. This is in order to ensure their stock-selection successes are not outweighed by the impact of a surge in the more regulated, state-owned sectors, given the current government looks set to win elections this year.

Alongside India, it may also make sense to look at Vietnam, which shares some high-level characteristics, both being at earlier stages of their development than China, and both might arguably have now achieved ‘escape velocity’ from the traditional orbit of Chinese growth. In particular, Vietnam is one of the countries benefitting the most from the decoupling of US/China trade, all while it is continuing its long-term liberalisation of its economy and markets. Vietnam Enterprise Ord (LSE:VEIL)sets out to benefit from these trends, using the deep knowledge and connections of a locally-based management team. VEIL has delivered strong long-term returns in both absolute and relative terms. Returns in Vietnam tend to be volatile, and 2022 was a tough year, but 2023 has seen a decent recovery in the market. The managers tell us they are growing increasingly bullish and have increased their weighting to cyclical, economically sensitive companies in anticipation of strong earnings growth over the next few quarters.

INDIA & CHINA DIVERGE

Source: Morningstar. Past performance is not a reliable indicator of future results

Japan

Japanese stock markets are now surpassing the 1989 peak in nominal terms. That said, Japanese small caps — particularly those focused on growth —have had a torrid time in relative and absolute terms during 2023. One might argue that growth opportunities in Japanese small caps are as far as it is possible to be from the Magnificent Seven but the current narrative around these companies is one of intrigue, offering a potentially differentiated source of growth opportunity buoyed by a number of tailwinds. Perhaps most compelling of all is the optimism around recent corporate governance reforms.

Over the course of 2023, a lot of investor attention was steered towards the more liquid and easily traded large companies that had already demonstrated positive changes. However, the manager of Fidelity Japan Trust Ord (LSE:FJV) argues that these changes are starting to trickle down the market-cap scale presenting a plethora of untapped opportunities. Mid and small caps are a relatively under-covered part of the market, which means being locally based and having access to a dedicated on-the-ground team, provides the manager with valuable insight into company management and the domestic market that others in the sector might be missing. Over the last year, two opportunities with good long-term potential were unearthed—Harmonic Drive Systems and Taiyo Yuden, both of which fall into the electric appliances sector. Both companies are sitting at attractive valuations, versus overseas and large-cap domestic peers and offer a differentiated source of returns.

Following a similar vein, JPMorgan Japan Small Cap G&I Ord (LSE:JSGI) also provides exposure to this part of the market. The manager believes there is huge potential for active management to add alpha in this part of the market, evident by its recent investment in Osaka Soda. It’s a global chemical company positioned in multiple niche product categories, but its biggest future growth driver, in the manager’s eyes, is silica gel, which is used in the same GLP-1 obesity drugs that have driven Novo Nordisk’s recent success. Furthermore, the manager argues that the average valuations of Japanese companies remain attractive compared to most other major markets and the longer-term potential for improved shareholder returns– bodes well for Japanese equities, which in their eyes, position the portfolio well to capital on future growth. Recent pressure on Japanese small caps has led to poor performance over 2023, these types of companies can kick back quickly when these pressures alleviate.

As we highlighted above, the Magnificent Seven have suffered a painful stumble before, and in any event, nothing lasts forever. We have illustrated a number of very different growth opportunities, that over the medium term could complement a portfolio. In our upcoming virtual ‘Themes for your ISA in 2024’ event, three of these managers are presenting.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.