Where to invest in Q4 2023? Four experts have their say

Our panellists are bearish on the outlook for most equity markets, and are instead finding more value in bonds. Jim Levi runs through the latest views across the main asset classes.

23rd October 2023 11:15

by Jim Levi from interactive investor

The recent weakness in government bond markets prompted David Coombs to don his buying boots, increasing exposure to a career high.

“I now have more exposure to government bonds than I have ever had before,” he points out. Coombs score for UK bonds shoots up from 5 to 8, while lifting his global bonds score from 6 to 8 as well. The yield on 10-year US Treasury bonds hit a 16-year high earlier this month.

- Invest with ii: Investing in Bonds | Free Regular Investing | Open a SIPP

Coombs points out that he sees this position on government bonds as a hedge against a global recession. He adds: “Recession is an increasing possibility, although I don’t think it is nailed on yet.”

Coombs is a relative latecomer to the bond-buying party among members of our panel of asset allocators. He has avoided a lot of pain by his delay.

Rob Burdett at Columbia Threadneedle and Max Macmillan at abrdn have both suffered by being bond bulls too soon - since the beginning of the year, in fact. Both are still sticking to their overweight positions (with scores above the neutral score of five).

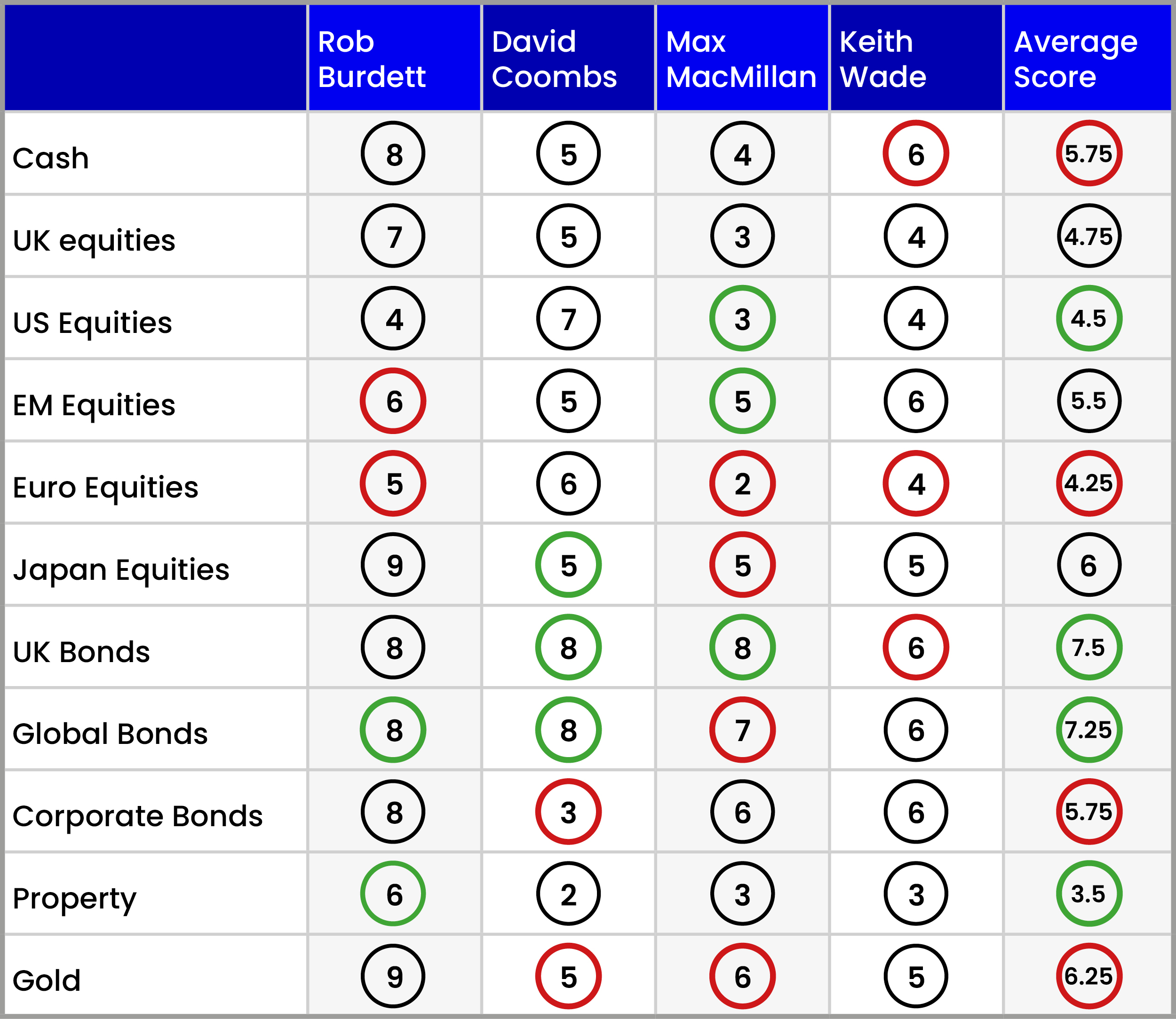

So, there are now three panel members with scores of 8 for UK government bonds. Almost unbelievably boring old gilts are now the most-favoured sector of the financial markets for our four panel members with an average score of 7.5. The average score for global bonds is only a touch below it 7.25.

This is a sure indication of rising levels of anxiety about the direction of equities as central bankers warn interest rates may have to stay higher for longer.

Keith Wade at Schroders is more sceptical about the bond sector than the rest although even he stays overweight. He is preferring short-dated bonds, due to their lower sensitivity to changes in interest rates.

He says: “We don’t like the longer end of the market. We are buying only bonds with five years to redemption or less.”

- Funds and trusts four professionals are buying and selling: Q4 2023

- When is it time to sell a fund, investment trust or share?

Wade fears economies have to slow down or even go into a recession to get inflation under control. “There are concerns about the longer end of the bond markets because of the pressure on governments to issue more debt as the economy slows. They are already running big deficits and they will have to issue more debt as the economy slows.”

Both Wade and Macmillan fear interest rates may have to go even higher and are not convinced by the idea that interest rates may have reached a sort of plateau where they will remain for a number of months before heading downwards.

Macmillan has little doubt a global recession is on its way anyway. He says: “I cannot believe we can go from a period of extremely low interest rates to one of much higher rates without some kind of reckoning.

“We simply have not seen the full consequences of this rise in interest rates on markets and on the global economy.”

So, his strongly overweight position in government bonds is offset by his bearish outlook on US, UK and European equities.

Burdett has a tendency to score more highly than other panel members and is overweight every sector except US and European equities. He has the panel’s highest score for cash at 8.

He explains: “The returns on offer for cash deposits are not yet better than UK inflation, but we are hoping they soon will be. We are now offered a 5% return on cash while we wait for a possible correction in equities.”

His general stance remains to be “underweight equities and overweight everything else”. Like Wade he keeps a score of 4 for the US.

Only Coombs remains upbeat on Wall Street with a score of 7. “I recognise US equities are not cheap but my score reflects a longer-term view. It is simply a safer place to invest because the US economy is much more resilient in difficult times than Europe, for example.”

Even the bearish Macmillan acknowledges this point. He has edged up his US score from 2 to 3. “That reflects our belief that some of the larger US corporations will cope better during a recessionary climate,” he says.

- Fund Battle: Vanguard global ETF versus BlackRock global ETF

- How Andrew Pitts’ 20 trust tips are faring amid discount pain

All eyes are on the so-called Magnificent Seven technology giants - Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Alphabet Inc Class A (NASDAQ:GOOGL) (Google), Meta Platforms Inc Class A (NASDAQ:META) (Facebook), Microsoft Corp (NASDAQ:MSFT), NVIDIA Corp (NASDAQ:NVDA) and Tesla Inc (NASDAQ:TSLA) - which have come to dominate the US market. But Coombs feels there may soon be a switch of emphasis away from technology to more cyclical stocks, which are more economically sensitive.

Burdett is meantime the sole panellist to show any enthusiasm for UK equities. He raised his score to 7 back in July and is keeping it at that level. Burdett points out that on some measures the UK was the best performer among major equity markets during the past three months but the rise was a barely discernible 2.7% and only beat the US performance by less than a percentage point. Like Coombs, who holds his score at 5, he thinks the UK market remains cheap but needs some good news on the inflation front to make further progress.

“I have no particular enthusiasm for the UK,” Coombs declares. He adds: “HS2 seems to symbolise Britain’s ‘can’t do’ spirit. The background is one of political uncertainty, low investment and low productivity.”

Macmillan scores only 3 for the UK. “UK equities tend to be quite cyclical and the prospect of a recession means UK shares may not have an easy time in the coming months.”

As with US equities, Coombs is the only member of our quartet to keep an overweight position in European equities, although he is not sure he should have done.

“I admit I probably should have had Europe as a 4 given the recent performance. But I will stick at 6 because there is a wide choice available of stocks in cyclical industries where buying opportunities may soon occur.”

Wade, Burdett and Macmillan take the opposite view and all three are edging their scores lower. “We are not in a great backdrop for equities as we wait for rising interest rates to make their impact on economies,” says Wade.

There are mixed messages from the panel on emerging markets. Rob Burdett lowers his score from 7 to 6.

Macmillan is more hopeful he edges up his score from 4 to 5. He explains: “Emerging markets are dominated by China and everyone knows already about China’s problems. This explains why valuations there are very cheap.

“We are neutral because the strength of the dollar offsets the faster growth prospects of the sector.”

Japan proved to be the best-performing major equity market in the first half of this year. But it has been more or less flatlining since mid-June. Only Burdett remains a super-bull with his score of 9, but none of the rest of the panel is underweight now Coombs has lifted his score from 4 to 5. Japan has the highest score among equity sectors.

Burdett continues to wax lyrical. He says: “Japan has all the ingredients you want in an equity market at the moment. By making sure government debt is mostly held domestically, the central bank has much more flexibility on interest rates [and] while inflation is creeping up, it remains relatively low and is in any case quite welcome after long years of deflation.”

- Fund Spotlight: a value play for the unloved UK market

- Are these the only two funds DIY investors need to own?

Coombs is once again the odd man out on corporate bonds - lowering his score from 4 to 3 reflecting his big switch into government bonds. Wade stays overweight because the investment grade corporate bond market contains plenty of big corporations with strong cash positions.

But he warns: “A lot of the signals on the sector are very negative at the moment. In the US, something like 20% of the market will need to be re-financed next year and the market will demand higher returns.”

Not content with being the super-bull on Japan, Burdett keeps his score for gold at 9, while other panel members have more modest expectations.

He says: “Gold is challenged by the returns available on cash and bonds. But I will keep my score high as a safety value if the crisis in the Middle East gets worse.”

Burdett is even upbeat on the property sector raising his score from 5 to 6.

He says: “The property sector is already in recession and has already paid a heavy price. So, I am raising my score because I suspect the worst may be over.”

Other panel members think there is plenty more pain to come as the high street continues to suffer and companies scale back their plans for office space. Property, with an average score of only 3.5, is still the panel’s least-favoured investment sector.

Note: The scorecard is a snapshot of views for the fourth quarter of 2023. How the panellists’ views have changed since the second quarter of 2023: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent. Max MacMillian has replaced Richard Dunbar as a panellist.

Panellist profiles

Rob Burdett is head of multi-manager solutions at Columbia Threadneedle Investments.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.