Where to invest in Q3 2021? Four experts have their say

UK equities have overtaken Japan as the region professional investors are backing to outperform.

19th July 2021 14:18

by Jim Levi from interactive investor

UK equities have overtaken Japan as the region professional investors are backing to outperform.

In commodity markets, timber (North Americans call it lumber) has been a focus of much attention lately among fund managers. Not surprising. It has doubled and then halved in the space of the last couple of months. The timber price’s volatile behaviour seems to have been almost enough on its own to convince financial markets to accept the central bankers’ argument that the threat of inflation from post-pandemic bottlenecks might prove “transitory”.

The result has been a rally in prices at the longer end of US and UK government bond markets as those inflation fears have receded. They have not entirely gone away, though.

As Aberdeen Standard’s Richard Dunbar points out: “The soaring price of timber choked off demand but stimulated increased supply, so the price fell. Surprise, surprise. But it is still 80% higher than pre-pandemic levels.”

Indeed, commodities generally have been the best-performing asset class for investors so far this year with the oil price up nearly 50% and industrial metals averaging a 20% rise.

- Inflation is the big risk, but here’s what else is worrying investors

- Funds and trusts four professionals are buying and selling: Q3 2021

- Fund managers losing faith in the global economic recovery

Post-pandemic bottlenecks

Those bottlenecks should not surprise us, Dunbar argues. “We are going from a global economy that slammed on the brakes because of Covid-19 and has now put its foot hard down on the accelerator.”

Schroders’ Keith Wade agrees: “The bottlenecks are a symptom of the low level of stocks and inventories everywhere. They will have to be replenished and that could lead to another bounce in global activity this autumn.”

Meanwhile, gold has underperformed as those inflation fears receded while many players in the gold market were tempted into cryptocurrencies. “The best indicator we have for gold is the real (inflation adjusted) yield and that remains quite low,” Wade points out.

Equities however are not far off record highs. “There have been record inflows of funds into equity markets, partly reflecting the rise in savings levels - prompted by the pandemic,” says Rob Burdett of BMO Global Asset Management. “With these markets at or near record levels and a lot has got to go right for some of these valuations to be justified.”

David Coombs at Rathbones agrees: “I am not saying equities are cheap or a steal but the pandemic has made people more cautious. They are saving more and those savings are tending towards equities. A lot of people think equities are the only game in town.”

Burdett thinks the level of inflows of new funds should have sent prices even higher. “That suggests a lot of churn in the markets and plenty of people taking profits,” he says.

Equities the most attractive asset class

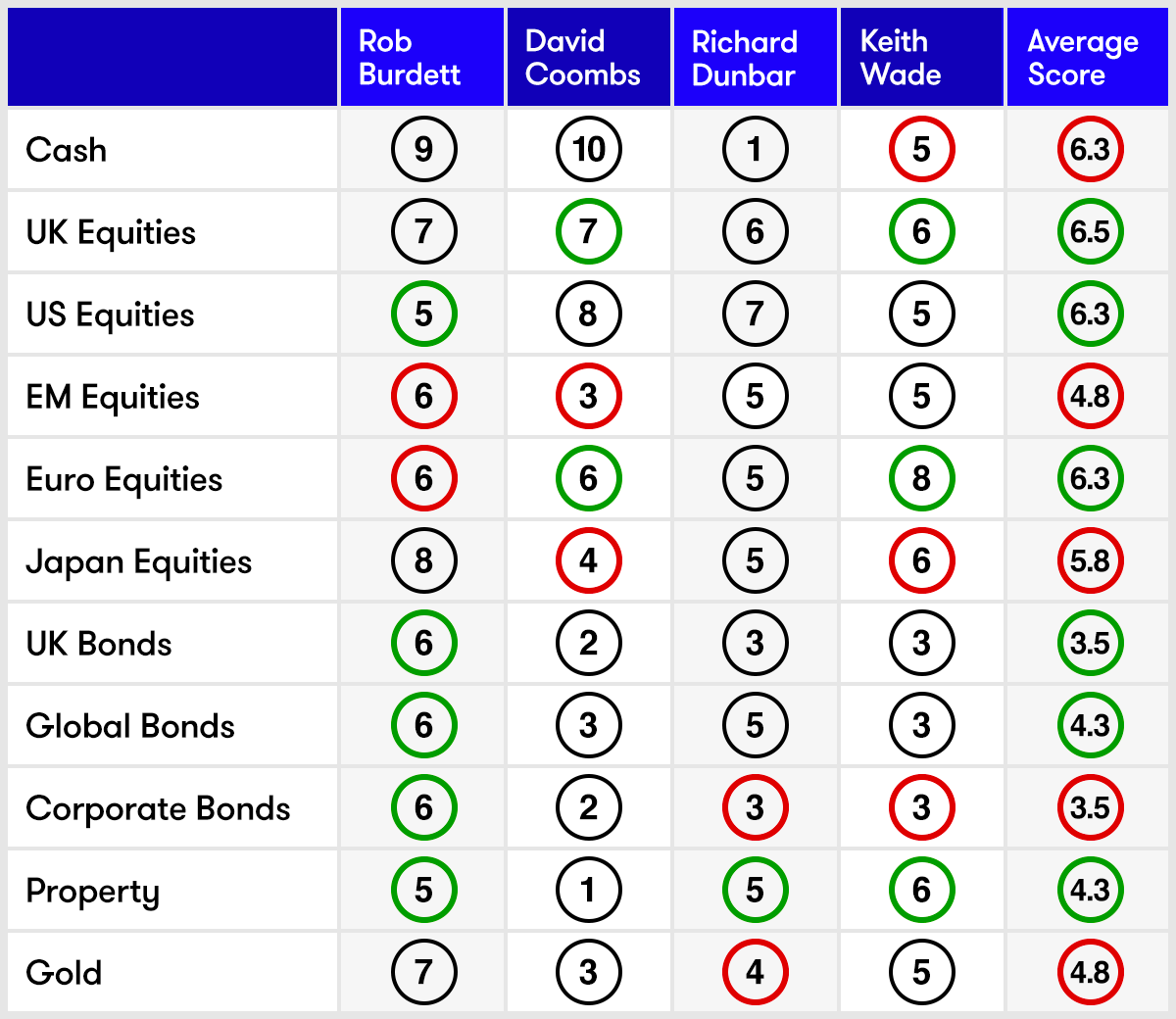

Our panel remain overweight in equities, but there is a more defensive stance. For example, both Coombs and Burdett retain high cash positions while lowering their exposure to more volatile emerging markets. The average panel score in emerging markets is now 4.8, an underweight position (with 5 being neutral).

In US equities, Burdett has finally ended his underweight stance by raising his score from 4 to 5. “It is the region of the world where the economy is behaving most normally,’ he argues. “The Delta variant of the virus has not taken hold there, but the vaccination roll-out is going ahead rapidly.”

Wade takes a more cautious approach holding his score at five but has considered going lower. “We are not really brave enough at this point to go underweight in the US,” he admits.

“You need to be there for exposure to growth and technology companies. But there are signs of the US economy peaking, while the US central bank has taken much bigger steps towards monetary tightening than other leading economies. We are not expecting the US economy to stall or anything like that but market expectations have risen considerably.”

- How the fund and trust winners of 2020 have fared so far this year

- Bargain Hunter: signs of a turnaround and wider discount than rivals

- Funds Fan: winners in first half of 2021, robotics, and case for Japan

Coombs and Dunbar both make the US their favourite equities sector. “Quality and growth is what you get in the US,” Dunbar claims. “Overall, we at Aberdeen Standard have an optimistic view of the global economy despite the uncertainties. A lot of people expect a correction, but we expect an annual return in the medium term of 6% or 7% on equities. We are being paid a sufficient premium over bonds to take the risk in equities.”

The performance of equities worldwide in the last three months at least seems to bear out some of Dunbar’s confidence. Of the major markets, only Japan failed to make progress in the period while the US’ S&P 500 Index rose 8.5%, the UK FTSE 100 was up 5.7% and the Euro Stoxx 50 Index advanced by 5.2%.

Dunbar also points to the boom in merger and acquisition activity to support his case. “The last six months has been one of the best periods ever for bids and deals,” he says. “You would not have thought that would be possible a year ago.”

UK equities firmly in favour

UK equities are very much in favour - the average panel score here is the highest of all sectors. It is supported by recent strong performances of smaller and mid-cap companies. All the panel are now overweight the UK as both Coombs (up from 5 to 7) and Wade (up from 5 to 6) raise their scores.

Dunbar believes his balanced approach to his portfolio has paid off lately and has left all his equity and government bond scores unchanged. “Our emphasis is on cheap UK equities and quality and growth in the US,” he says.

Wade sees the UK benefiting from a general recovery in the European economy, while UK equities could be helped by the current strengthening of the dollar. “Of course we are ahead of the pack on the vaccine,” he adds.

“UK equities have had a pariah status since we voted for Brexit five years ago, but overseas institutions are showing an interest, particularly in smaller British companies because they look so cheap,” Burdett says. “Smaller British companies have been one of the best areas of investment in world markets recently. The past year has seen the FTSE 100 index rise only 13%, whereas the FTSE 250 index of mid-cap companies is up 30% and smaller-cap indices show gains of more than 40%.”

European equities are back in favour having shown just about the best overall performance of any major region this year - even slightly outstripping Wall Street on some measures. Coombs and Wade are now raising their scores, but Burdett having scored a 7 last time has decided to take some profits.

“While the US has taken a much bigger step towards tighter money controls, Europe has not,” says Wade, who now has a score of 8. “Inflationary pressures in Europe would be quite welcome as they continue with their fiscal and monetary support to revive growth.”

Outlook for Japan, bonds and property

Japan was the one major market that failed to perform in the second quarter, but Japanese equities enthusiast Burdett believes it is the wrong time to reduce exposure. He thinks if equities face headwinds this autumn, Japanese shares could do relatively well. But Coombs has now gone underweight (with a score of 4) and Wade has also cut his score.

Only Burdett is raising his score and going overweight in UK bonds. Burdett also goes against the trend in corporate bonds, which are now completely out of favour with the rest of the panel.

- Commercial property post-pandemic: what’s next for the sector?

- Jim O’Neill: where retail investors should look next

Property has become a more intriguing investment sector gradually recovering from the doldrums of last year. Burdett, Wade and Dunbar have all raised their scores. Only Coombs is avoiding the sector “I think as an asset class there is more pain to come,” he says. “I look down the high streets of some of our more prosperous towns and I see lots of vacant shops.”

But Dunbar sees clear signs of recovery. “I think there is value emerging in less popular office and retail areas of the market where transaction activity is beginning to happen. Meanwhile, more popular areas such as retail warehousing are still offering attractive returns.”

Burdett has his focus on specialist REITs investing in areas like the warehousing hubs of the supermarkets or care homes.

Note: the scorecard is a snapshot of views for the third quarter of 2021. How the panellists’ views have changed since the second quarter of 2021: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent. David Coombs is a new panellist, which is why his scores are neutral. Gold scores are also neutral for this update, as gold has replaced commodities going forward.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at Aberdeen Standard.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.