Where to invest in Q2 2023? Four experts have their say

21st April 2023 09:52

by Jim Levi from interactive investor

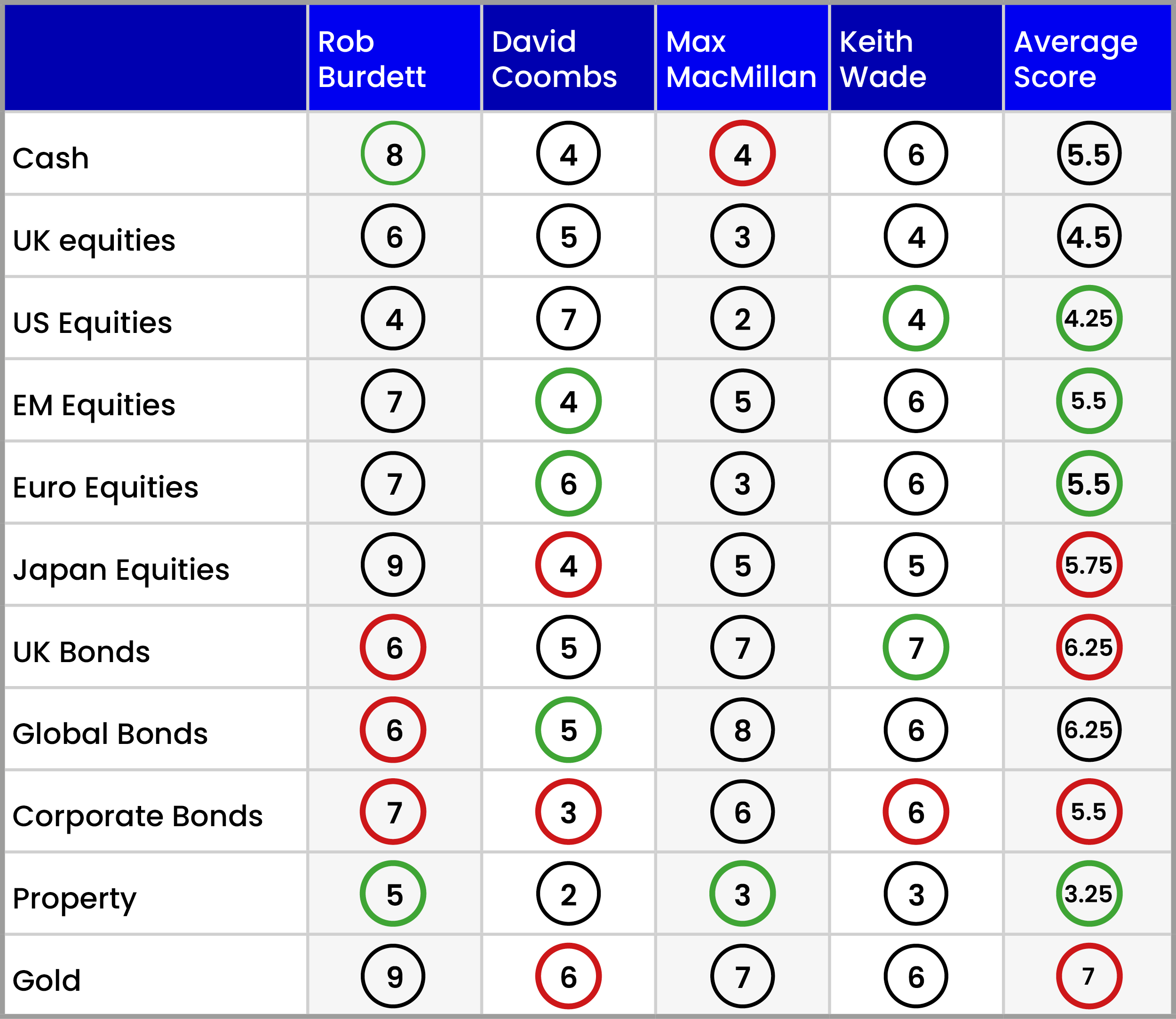

Our panellists have become slightly more optimistic on the prospects for equities, but it is gold that remains the most favoured asset. Jim Levi reports.

All four of our asset allocators are keen that there should be an element of gold in any diversified investment portfolio. It is not hard to see why. Since our last review in January, we have added banking crashes (Silicon Valley Bank, Credit Suisse (SIX:CSGN), etc) to the list of other worries troubling investors.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

The price of gold has risen almost $200 an ounce since early March and now regularly tops the $2,000 mark - largely prompted by that banking crisis. Banking troubles may not be over, as Rob Burdett at Columbia Threadneedle Investments warns: “We all remember the queues outside Northern Rock branches back in 2007. But in the digital age you can now go to your computer and in seconds take your money out. It can be very quick and very violent.”

David Coombs at Rathbones scored a 7 on gold back in January. “That was a good call. If interest rates peak, gold should continue to do well, but it makes sense for me to take some profits and edge the score down a notch to 6.”

The rest of the panel are sticking with their overweight scores with Burdett on 9. As Schroders’ Keith Wade points out: “Being already overweight in government bonds implies that I believe bond yields are attractive and could come down. If interest rates start to fall back that should continue to support the gold price.”

Wade stresses the geopolitical situation - from Ukraine to Chinese threats to Taiwan - “is not getting any better and gold is the safe haven in times of trouble. Any attempt by China to take Taiwan would be a massive blow to the global trading system, which is not in great shape anyway.”

Max MacMillan is happy to keep his gold score at 7. “If central banks do get spooked by turbulence in financial markets and then start to lose credibility over reaching their inflation targets, that would be the sort of environment where gold will perform.”

Property remains most out of favour

If our panel are singing in unison on gold they are not quite so universally bearish about the property sector, although it remains the most out of favour.

“Commercial property is a dreadful place to be at the moment,” declares Coombs. He adds: “I am scoring a 2 at the moment but that is quite generous. Perhaps 10% of all commercial property will need expensive upgrading if it is to meet net-zero targets. It might be cheaper to knock them down and start again. I cannot see property being a decent investment for quite some time.”

Burdett offers a more hopeful perspective. He raises his score from 4 to 5. “I am being very selective but I can now buy relatively lowly geared property companies offering yields of 5% or 6% on discounts of perhaps 20% to valuations.”

- Funds and trusts four professionals are buying and selling: Q2 2023

- How Andrew Pitts’ 20 trust tips fared in first quarter of 2023

But are those valuations up to date? Wade argues: “It takes a while for valuers to catch up with what is happening to prices.” He feels the problems in the banking sector and the risk of recession in the UK could keep the pressure on the property sector. He leaves his score at 3.

MacMillan supports Burdett to some degree - raising his score from 2 to 3. “I think a lot of the pain has already occurred in the UK particularly in the REITS,” he says. Two panel members, Wade and MacMillan, are still predicting recession later this year for the US with it spilling over to the UK and Europe as well. “We think this is a year for safe-haven assets,” says MacMillan. “Although we cannot see any data indicating recession yet, we are sticking to our prediction.” It means MacMillan still likes gold and still likes UK bonds (gilts) and global bonds. “And we don’t mind high-yield corporate bonds because they have a lot of interest rate sensitivity.”

Will the US enter a recession?

But MacMillan’s scores on equities - all unchanged from last time - show he is still cautious on stock markets.

Wade is still expecting at least a shallow recession in the US and probably in the UK later this year. “I cannot see how inflation gets back under control unless there is some kind of increase in unemployment,” he insists. However, unlike MacMillan, Wade has tweaked up his US score from 3 to 4.

He admits: “We are a bit more optimistic than we were three months ago. We have upgraded our forecast for global growth with oil and natural gas prices turning out to be lower than we expected.”

Wade adds that he thought the US would be in recession by now. However, he notes that “companies have been able to pass higher labour costs and energy costs through to consumers”. In turn he points out that this has led to higher profits but also to more inflation.

Burdett has been underweight US equities for over a year, but remains overweight in all other equity sectors. On the question of a recession, he argues that growth measures for the economy are not adjusted to allow for high levels of inflation. “It means you end up not having a technical recession, but it will feel like a recession.”

Apart from the US, Burdett uniquely remains overweight in all other equity sectors. “The key issue in an era of high inflation and elevated interest rates is to find companies that are well financed, able to raise prices, able to manage the labour force and able to invest in capital to become more efficient as labour becomes more expensive,” he stresses.

UK unloved, but Europe upgraded

Apart from Burdett, the rest of the panel shows no great enthusiasm for UK equities. European equities find more favour. Coombs raises his score from 4 to 6. He says: “European markets tend to do quite well when growth accelerates in Asia. Only MacMillan remains underweight at 3. He acknowledges that the fall in energy prices and the better prospects for exports to the Far East should benefit the sector. “But eventually rising interest rates there will weigh on Europe’s performance,” he claims.

- Scottish Mortgage: should you hold, fold or be bold?

- Listen to our podcast: banking turmoil: why we’re in a mini crisis and not another global crash

Emerging markets also finds support with Coombs cautiously raising his score from 3 to 4 as he hopes for the benefits from the re-opening of the Chinese economy. In October his score was only 2. Meanwhile, Burdett and Wade uphold their existing overweight positions.

“We certainly think emerging markets are a better proposition than developed markets,” argues MacMillan. Underweight on the US, Europe and the UK, he manages a neutral score of 5 for emerging markets as well as for Japan.

Japan continues to sow division among the panel members. At one extreme is the ever-enthusiastic Burdett. “We talk to fund managers, who have not travelled to Japan for three years because of the pandemic, coming back from recent visits really excited about how cheap the market now is,” he says.

Coombs, who recently bought Sony (NYSE:SONY) shares, believes Japan is now “slightly less attractive than Europe at this stage”. So he is cutting his score from 6 to 4.

Our panellists’ overweight bonds

Moving on to fixed income, apart from Burdett who has taken some profits in the UK gilt market, the panel continues to emphasise the attraction of government bonds on hopes that the recent sharp rise in interest rates is nearing its peak.

Wade says: “I think the Federal Reserve will raise the US interest rates from 5% to 5.25% in May - and that will be the peak.”

MacMillan thinks the banking crisis will mean the commercial banks themselves will take on some of the work of the central banks in tightening credit conditions for their customers.

“We still think the US will go into recession, and if the US goes into recession the rest of the developed world will decline with it.”

Note: The scorecard is a snapshot of views for the second quarter of 2023. How the panellists’ views have changed since the first quarter of 2023: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager solutions at Columbia Threadneedle Investments.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.