Where to invest in Q2 2022? Four experts have their say

21st April 2022 09:57

by Jim Levi from interactive investor

The pros have turned bearish on equities, and upped their exposure to gold and bonds.

Our panel of asset allocators are on the defensive, and who can blame them? With inflation roaring to a 30-year high and war in Ukraine threatening to get even nastier, the level of uncertainty around financial markets is sky high.

And we still have Covid to contend with. The continued pandemic adds fuel to the inflationary fire with supply chain problems notably in China where major cities are in severe lockdown. Closer to home, two of our four panel members were Covid positive at the time of writing and a third was expecting to catch the virus because his wife was already down with it.

Gold and bonds become more popular

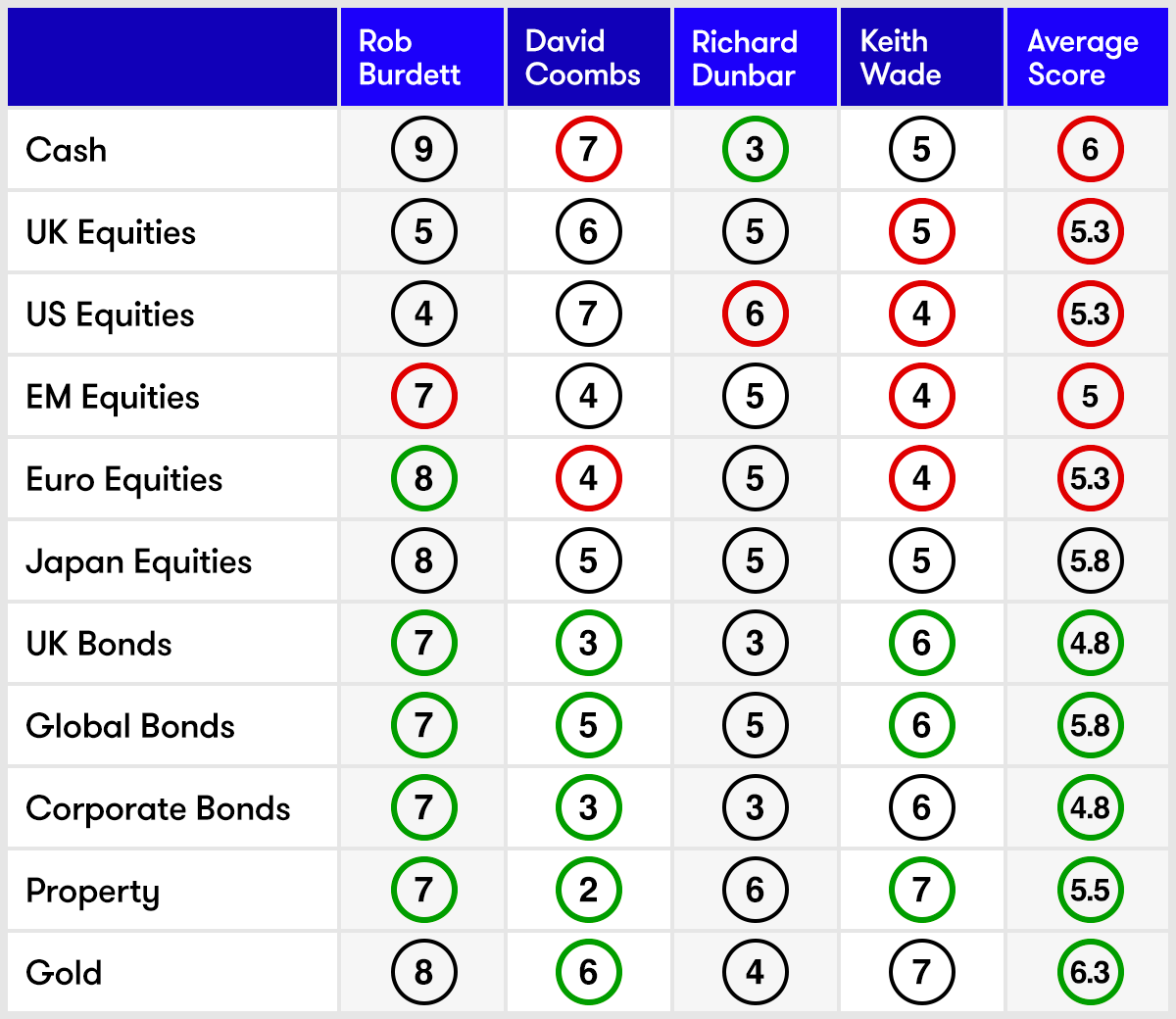

The panel’s broad stance for the weeks ahead is clear. Average scores in all equity sectors except Japan are now lower than three months ago while scores for government and corporate bonds have edged higher. Cash scores remain high, while gold is the sector that has the highest average score of 6.3.

“Gold is a fear hedge as well as a hedge against inflation. Fear is going to be around for quite a while,” Rob Burdett of BMO Global Asset Management gloomily remarks.

David Coombs at Rathbones agrees: “Investors cannot afford to ignore what is going on in Ukraine if only because the two protagonists are so important in terms of energy supply and other key commodities.”

- Funds and trusts four professionals are buying and selling: Q2 2022

- Recessions are becoming more likely – here’s how to invest

- Find out what is now being tipped to be the best investment of 2022

We are nearly a third of the way through 2022, so our panellists are already wondering what 2023 will bring. At Schroders, forecasts for inflation are being ratcheted up while global growth forecasts are being cut back to such a degree that worries about stagflation are now turning into fears of an outright recession. That changing financial weather forecast will keep our panel members on tenterhooks.

Schroders chief economist Keith Wade explains: “Recently bonds have not been a very good hedge against weakness in equities as worries about inflation has led to rising bond yields and falling bond prices. So we have been using commodities as a hedge and that has worked quite well.”

Now, however, Schroders is rotating out of energy-based commodities into gold and bonds on signs that inflation might now be near a peak. If he is right then market fears about rising interest rates may have been overdone.

“We believe the impact of the rising cost of living and rising taxes on consumer spending will do some of the work of central banks,” says Wade. “I think markets are getting carried away about what central banks really need to do and are expecting too much tightening.”

As ever striking the right balance is key

Richard Dunbar at abrdn sees three possible scenarios for the next few months. “It is easy to paint a picture of stagflation which would not be good for equities and it is easy to paint a picture of a recovery in gilts on the prospect of a recession,” he says. “Equally things could trip along quite nicely if central banks are able to thread the needle between the two.”

Dunbar is hedging his bets. He is now only overweight in US equities and in property while keeping neutral (a score of five) on all other equity sectors and also on global bonds. “At the moment a balanced portfolio seems the right strategy,” he says. “We could be heading for stagflation or recession, but US Federal Reserve could thread the needle on interest rates, and we could even get a resolution of the conflict in Ukraine.”

According to Coombs the recent resilience of equity markets reflects big outflows from weak global bond markets as inflation has flared on the surge in energy and other commodity prices. “The bond market is so volatile it is trying to work out where it wants to be, but I am buying into bond markets at these levels. I think 10-year (US government bond) yield of 2.75% looks attractive; though I am not making any big bold moves because there is far too much uncertainty.”

Burdett, meanwhile, has the most overweight positions in bond markets of any of the panel raising his scores across the board to 7. “I think we are at the peak in inflation, and I believe we are overdue for a rally in bond prices.”

Property has also become more popular among our panellists, particularly as an inflation hedge. Both Wade and Burdett have pushed their scores from 6 to 7. Wade says property has similar defensive attractions to UK equities. “It has proved a good late cycle investment providing some protection against inflation through rent reviews. Though the property market still grapples with problems in retail and offices as more people work from home and shop online, there are opportunities in warehousing and logistics.”

European equities: bargain or cheap for a good reason?

The recent resilience in equity markets - the MSCI World Index was down less than 2% in the first three months of this year - has been less apparent in Europe. With a war on its doorstep this should be no surprise. The German Dax Index was down nearly 25% in the first two months of this year. Will European shares get still cheaper, or will they continue to recover?

There is certainly a case for being bearish. This is well made by Wade. He says: “Something like a quarter of all Europe’s energy needs are coming from Russia and there is still a big risk that Europe will get very badly dislocated by the war in Ukraine.” Th latest inflation figure for the Netherlands at a scary 9.7% underlines the point. This is all enough to send Wade’s score for European equities down from 7 to 4.

Burdett takes a different view. He raises his score from 7 to 8. “We think the sector is a little bit oversold, so we are looking for recovery. We are not adding to our portfolios yet, but we will probably do so in the coming quarter.”

UK and US scores also downgraded

In contrast to Europe, UK Equities have been one of the best-performing regions so far this year. The composition of the FTSE 100 Index, which strongly features oil, energy and natural resources stocks, has proved a benefit so far this year. But three of the four panel remain cautiously neutral in their scores - indicating they think we may have come to the end of the outperformance against other markets. Wade has trimmed his score from 6 to 5.

Moving across the pond, it is highly unusual to find two panel members now underweight in US equities. Wall Street so dominates the world’s financial markets that it is as good a measure as any of twitchy mood. Burdett went underweight at 4 at the beginning of the year and remains so, while Wade now joins him on the same score. Even Dunbar, who normally moves cautiously, has trimmed his US score from 7 to 6.

But Coombs thinks the big names in US equities are a good place to be in uncertain times and so far he has been proved right He keeps his score at 7. “When the market was at its recent low point in early March I was adding to the Microsoft’s and Alphabet’s of this world. That was where I felt most comfortable.”

- Why this fund manager is finding value in top tech shares

- Investors dump funds: here’s what they are selling

- Inflation-friendly trusts in demand: what is proving popular?

Japan is the ‘cheapest it has ever been’

Burdett continues to carry the torch for Japanese equities, which he describes as “the cheapest [they have] ever been.” A lot of investors do not agree. He is holding his score at 8 in the hope that “one day it will perform”.

In contrast, he has trimmed his score for emerging markets mainly on the outlook for China. However, he remains overweight pointing out that some Latin American markets have performed well on the back of the commodities boom. He adds: “Some emerging markets have emerged already and are in better financial shape than we are.”

Note: The scorecard is a snapshot of views for the second quarter of 2022. How the panellists’ views have changed since the first quarter of 2022: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.