Where to invest in Q2 2021? Four experts have their say

Our panellists have become cautious on every equity region – expect one. Here they explain why.

22nd April 2021 17:56

by Jim Levi from interactive investor

Our panellists have become cautious on every equity region – expect one. Here they explain why.

Our panel of asset allocators are getting more cautious. Not surprising considering the buoyant showing by global equities over the past year.

If you measure the performance since the dark days of March, it is even more dramatic. In the past year (to 19 April), the S&P 500 and the Dow Jones are up around 75%, while the Nasdaq has doubled. Japanese and German indices are around 70% higher, and in emerging markets the leading stocks measured by the Nifty 50 index have nearly doubled.

Even the UK’s slumbering FTSE 100 index has jumped by one-third, while indices such as the FTSE 250 that better reflect our domestic companies are 60% higher. Indices measuring AIM stocks have doubled. As Aberdeen Standard’s Richard Dunbar puts it: “It has been a terrible year of pandemic and economic activity, but it has certainly not been a terrible year for the stock market.”

- Funds and trusts four professionals are buying and selling: Q2 2021

- Key takeaways from the fund winners and losers in first quarter

- In the year of recovery, here’s how our five Model Portfolios fared

- Scottish Mortgage dips its toes into cryptocurrency

Clearly there is a feeling this upward momentum cannot last. Various red flags have been fluttering indicating that there may be trouble ahead. What form might that trouble take? The rise in yields in the government bond markets - the benchmark US 10 Treasury bond yield has crept up from 1.1% to 1.7% this year - are a symptom of rising inflation fears.

Then there has been the collapse of the hedge fund Archegos and shadow finance outfit Greensill to prompt the question: who’s next? Underlying it all is the realistic recognition that the pandemic has not gone away. Vaccine roll-outs are impressive but variants keep threatening our hopes.

“I think we are in for a very wobbly three months,” says David Coombs at Rathbones. “Markets are very volatile and there is a lot of froth around and a lot of debt in the system after 12 years of virtually free money.” Rob Burdett at BMO agrees: “Odd things such as Archegos and Greensill do tend to happen in a market hiatus and investment sentiment surveys show everyone seems a bit over-excited. But we still have a wide range of valuations and the best fund managers are doing really well.”

Cash weightings increased

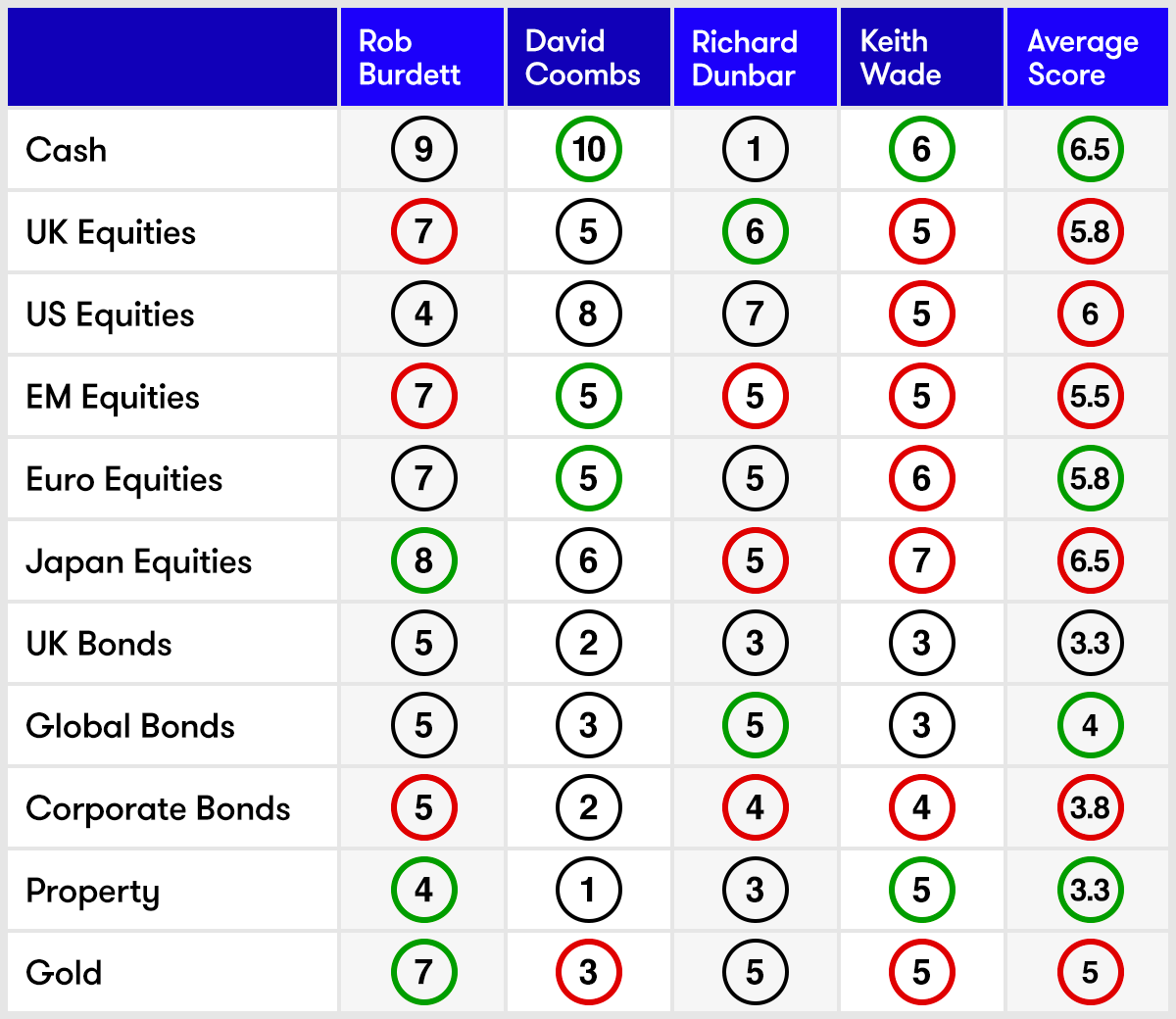

Coombs’ current strategy is simple but dramatic. He has sold his gold holding and moved into cash. “Cash is my favourite investment at the moment,” he claims. He is not alone here. Burdett keeps his cash score at 9, while Keith Wade at Schroders edges his score up from 5 to 6.

Dunbar, however, prefers US Treasury bonds where yields have edged higher. He raises his score for global bonds from 3 to 5 to reflect the move, while keep his cash score at a minimum. Dunbar’s move is the only change in government bond scores across the panel which remain mostly underweight – with scores of less than five.

“Government bonds have not been a happy scene of late but unusually for us we have been buying a bit on weakness,” says Coombs. Across the board, scores for corporate bonds are still being lowered. Yield premiums over government bonds are seen as not being worth the extra risk. Average scores here are down from 4.5 to 3.8.

Equity region scores downgraded, except Europe

Moving from bonds to equities, our panellists have become more cautious, with only European equities seeing its average score rise. Wade has shaved one point off the scores of all the equity sectors except emerging markets, which has been reduced from 7 to 5. “We are still just favouring equities but we are scaling back some of our bets,” he says.

- Investment trust tips: winners and losers so far in 2021

- Ian Cowie: three health and biotech trusts I wish I’d owned

Only in Japan and Europe is he now overweight – with scores above five. His neutral score of five for the US reflects his belief that markets have already priced in a lot of good news. All this caution contrasts with some very strong economic growth numbers that Wade expects to come through in the second quarter - possibly 10% in both the US and the UK. “But I feel this has already been priced into share markets,” he says. “Meanwhile, higher inflation pressures will lead to a further rise in bond yields - although not a huge rise.”

Wade still cannot see much of a rise in central bank interest rates in the foreseeable future - perhaps not until 2024. “Chancellor Rishi Sunak will want to wind down all the Covid support measures such as furlough schemes and business rates holidays without triggering another recession. So the Bank of England really has no choice but to keep interest rates where they are.”

Coombs is keeping his exposure high in the US with a score of 8. “I still think US equities is the safest place to be. We are not thinking so much of companies in the S&P 500 or the Nasdaq and we have reduced our position in the so-called FANGS. There could be companies in those indices which might undermine performance, but I can still find some amazing value.”

Dunbar has kept his US score at 7. “There is lots of talk among investors about value versus growth and technology versus non-technology and cyclical versus non-cyclical,” he says. “But I believe in not betting the farm on any one point of view.”

Dunbar wants a balanced portfolio and, like Coombs, points to the wide range of opportunities offered by the US markets. Burdett agrees. Although he remains underweight the US, scoring 4, he says: “We still have a wide range of valuations in the US and the best fund managers are doing really well.” He says his underweight score reflects generally stretched valuations.

Japan remains most favoured, but panellists turn cold on emerging markets

Elsewhere, Burdett retains his enthusiasm for Japanese equities - a sector that remains the panel’s most favoured (along with cash) with an average score of 6.5. Burdett has raised his score from 7 to 8. He sees the defensive merits of investing in a safe-haven currency such as the yen while share valuations remain attractive. It remains Wade’s favourite sector, although he has trimmed his score from 8 to 7. “The country’s export-led industrial base benefits from the economic upswing,” he says.

Emerging markets are now the least favoured equity sector with only Burdett giving an overweight score of 7, down from 8. The waning enthusiasm reflects worries over Covid-19 in places such as India and Brazil as well as the recent rise in US bond yields prompting a ripple of interest rate rises in some emerging countries.

Dunbar points out that the global recovery will now begin to reflect a pick-up in demand for services. “The early shape of the recovery benefited emerging countries, but from now on the recovery will be service-driven rather than goods-driven,” he says.

UK equity scores trimmed

Burdett and Wade have both trimmed back their UK scores, but Dunbar raises his from 5 to 6. “There is still more value there than elsewhere and the UK is still underperforming other markets. Meanwhile, the roll-out of vaccines here looks very successful - and there is really nothing at the moment more important than the vaccine roll-out,” says Dunbar.

- Top-performing fund, investment trust and ETF data: April 2021

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Coombs is the sceptic about UK equities. “I struggle to find UK stocks for a global portfolio,” he admits, “although lately we have done quite well out of energy and mining stocks. But if I was an investor from Mars looking down for stocks to buy, how many UK stocks would I choose? Not many.”

European stocks have performed better than most expected recently, and this has prompted Coombs to raise his score from 3 to 5, but Wade is taking some profits down from 7 to 6 reflecting his belief that equity markets generally are “well up to speed with all the good news of the bounce-back in the global economy”.

Again there is an intriguing uptick in interest in the property sector as a defensive move. “I still think property would outperform in any falling equity market,” says Burdett, who edges his score up from 3 to 4. He is supported by Wade who scores a 5. “With low yields on bonds we have quite a challenge to find hedges against the risk of equities turning sour,” says Wade. “Our property experts at Schroders are pessimistic on retail, cautious on offices, but positive on industrial and storage, and that is where our upgrade really comes from.”

Note: the scorecard is a snapshot of views for the second quarter of 2021. How the panellists’ views have changed since the first quarter of 2021: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 10 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at Aberdeen Standard.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.