Where to invest in Q1 2025? Four experts have their say

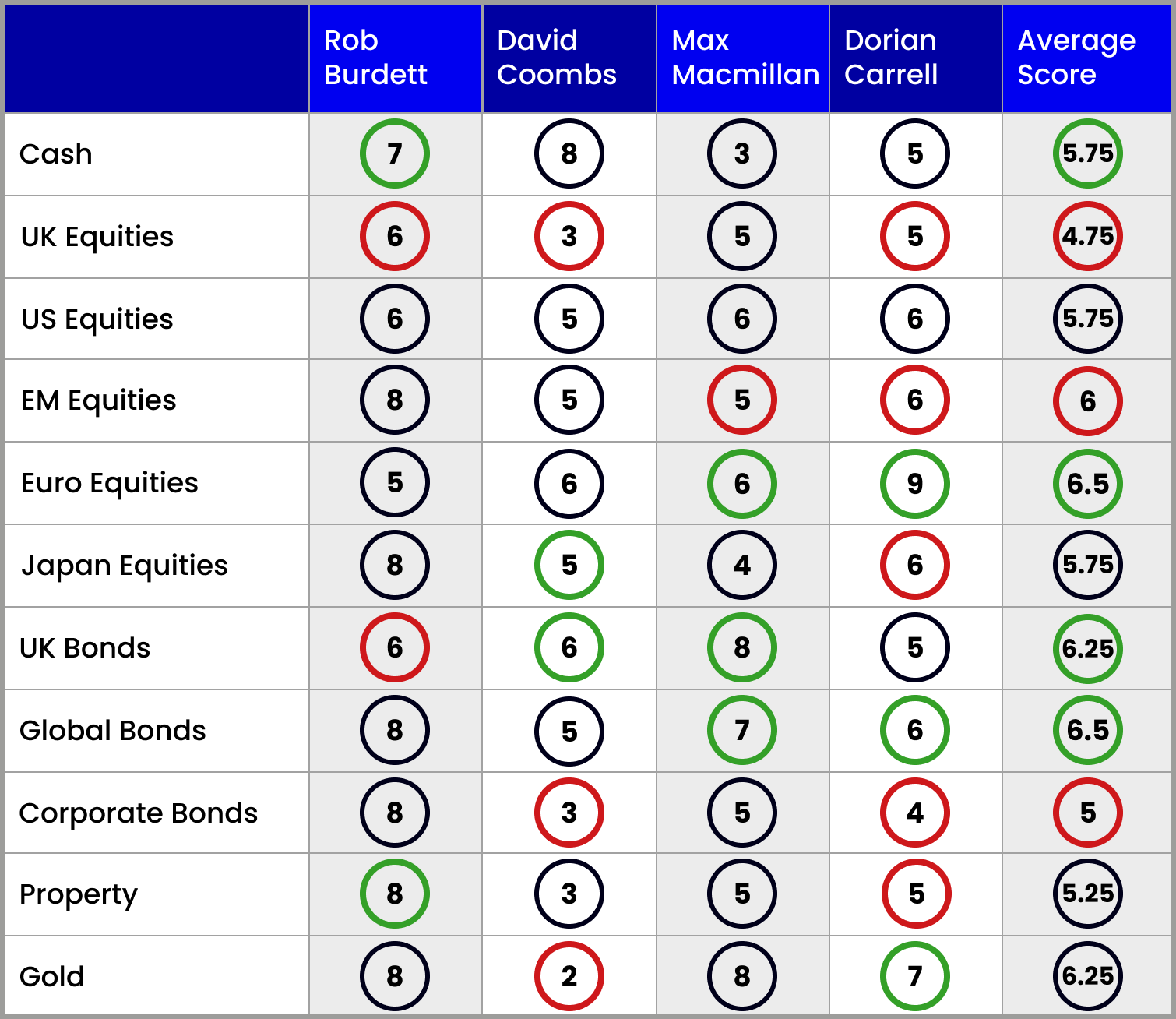

Europe has overtaken emerging markets as the most highly rated equity sector among the four asset allocation experts. Jim Levi shares their latest views across the main asset classes.

24th January 2025 08:57

by Jim Levi from interactive investor

As Donald Trump makes himself comfy in the White House, our panel of asset allocation experts are not expecting miracles from the new regime in Washington DC. But they are hopeful that the levels of uncertainty surrounding financial markets will begin to subside.

It’s often quite hard to find a consensus of opinion among all four members of the panel. This time around though there’s broad agreement on US equities, as well as on European equities, and increasing support for both UK bonds and global bonds.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Caution towards UK equity market

Even on UK equities, they seem to all agree that now is certainly not the time to increase exposure. Rob Burdett at Nedgroup Investments and Dorian Carrell at Schroders have both trimmed their scores and only Burdett is overweight (with a score of five being neutral). Burdett says: “I still think valuations in UK equities are incredibly attractive. But I have lowered my score to reflect the uncertainty created by our new government’s economic policies. It is hard to see how the mood will change in the short term.”

At Rathbones, David Coombs is much more trenchant in his assessment of UK shares - cutting his score from six to three. His verdict on Rachel Reeves: “We have a chancellor who has lost all credibility and the naiveté of the Budget was simply off the scale.”

All this negativity is, however, against a background of the FTSE 100 index rising to all-time highs. But as Max Macmillan at abrdn emphasises: “The performance of the FTSE 100 reflects more the recent weakness of sterling against the dollar rather than any reflection of the state of health of our economy. So many of our leading stocks are insulated from that because they earn a high proportion of their revenues in dollars.”

He insists that the FTSE 250 index is a much more accurate gauge of the UK economy’s state of health. And this index has made no progress at all since Labour won the election.

“What is really needed,” says Coombs, “is a change of tack in the government’s economic policies, but it is hard to see the catalyst that will prompt such a change.”

Carrell agrees: “Fiscal policy is not very growth-related, and I see the situation getting worse before it gets better.”

Wariness of Magnificent Seven risk

Across the pond, US stock markets powered to all-time peaks in celebration of the scale of Trump’s election victory. Three of the four panel members see no reason at this stage to alter their overweight positions in the sector. Schroders’ Carrell says: “My big concern is how China and Europe might react to Trump’s action on tariffs. So I feel that in US equities there is the least uncertainty.”

Even Coombs, whose US equities’ score remains neutral at five, admits: “I would score a seven for US equities outside the highly rated Magnificent Seven stocks: Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), Alphabet Inc Class A (NASDAQ:GOOGL) (Google), Meta Platforms Inc Class A (NASDAQ:META), NVIDIA Corp (NASDAQ:NVDA) and Tesla Inc (NASDAQ:TSLA).”

- Where the pros are investing beyond the Magnificent Seven

- ii Top 50 Fund Index: most-bought funds, trusts and ETFs in Q4 2024

The bull market on Wall Street has been going on for a long time with the S&P 500 index up around 80% over the past five years. This leaves everyone wondering when the party will end. Not quite yet according to our panel.

Germany powering European market higher

Again there is broad agreement on the outlook for European equities where it is notable that the German stock market has been massively outperforming other European equities. Germany’s DAX index has just hit an all-time high with a near 30% gain in the past year - comparable to the recent performance of equities on Wall Street.

As in the FTSE 100, companies in the DAX index generate a higher share of their revenues in dollars than they do domestically and might therefore avoid some of the impact of Trump tariffs on their businesses.

The star of the German market lately has been the computer software giant SAP SE (XETRA:SAP) - now the country’s largest company by stock market value and up around 70% in the past year.

Three panel members are overweight in European equities with only Burdett remaining at five, while Carrell goes from six to nine. With an average score of 6.5, European equities are now the most highly rated equity sector on the scorecard.

- Funds and trusts four pros are buying and selling: Q1 2025

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Burdett admits: “I have thought long and hard about raising my score for the sector, but in the end decided to stick with a five.”

In contrast, UK equities are now the least favoured with an average score of 4.75.

Threat of tariffs harms China

Switching from West to East, three months ago there was some enthusiasm for emerging markets as China introduced measures to boost the flagging economy. But the impact of those measures fizzled out as Trump’s threat of tariffs increased, while the strength of the dollar hit the sector.

Markets in China, India, Brazil and other Asian markets have failed to perform in the past three months.

Macmillan and Carrell have both trimmed back their scores, although Burdett believes the sector is poised for a comeback.

Macmillan says: “China’s economy seems to be in quite a deep structural hole.”

Burdett also maintains his enthusiasm for Japanese equities, which had a quiet final quarter of 2024. But Japan is the only equity sector where Macmillan remains underweight, while Carrell lowers his score from seven to six.

Bullish on bonds

Trump’s victory has created a climate where the prospect is for a recession to be avoided, for growth prospects to improve but for inflationary pressures to increase and for interest rates to remain higher for longer.

Recent weakness in the government bond markets - UK bond yields have lately been at their highest level since 2008 - has left the panel inclined to raise their exposure both to UK bonds (gilts) and to global bonds.

No panel members is now underweight global bonds following Carrell’s decision to lift his global bonds score from four to six.

- Ask ii: ‘are bonds really low risk? My portfolio keeps dropping!’

- Building a ‘gilt ladder’ – everything you need to know

- Top 10 gilts: all the data you need

Macmillan has pushed up his gilts’ score from six to eight and his global bonds’ score from five to seven. He prefers to be in government bonds rather than cash, where he still scores a lowly three. “You don’t want to be in cash when you think financial assets are going to perform,” he says.

That is not a view shared by Burdett or Coombs who both keep their cash scores high. The modest yield premium available on investment-grade corporate bonds, and fears that Trump’s aggressive policies on immigration, tariffs and tax cuts might lead eventually to a global recession, have prompted Coombs to lower his score for corporate bonds from five to three. “I’d rather been in cash or gilts right now,” he says. Carrell lowers his score to four, but Burdett maintains his score at eight. No consensus there then.

Property and gold divides the panel

No consensus either over the sudden turbulence in the commercial property market now the mood on interest rates has changed. But the recent sharp correction in REITs (Real Estate Investment Trusts) has been overdone, according to Burdett. So he keeps his score for the sector at eight.

Carrell, however, has gone from an overweight seven to a neutral five, alongside Macmillan, while Coombs continues to steer clear of the sector.

Finally, the safe-haven asset that is gold. Its price has lost momentum in recent weeks but three of the panel members maintain high scores with Carrell going from six to seven. According to Burdett, more central bankers are buying gold as there is a trend to rely less heavily on the dollar as a reserve currency. But Coombs is unimpressed. “We have sold most of our gold,” he says as he lowers his score from three to two.

Note: the scorecard is a snapshot of views for the first quarter of 2025. How the panellists’ views have changed since the fourth quarter of 2024: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is head of multi-manager with Nedgroup Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.