Where to invest in Q1 2023? Four experts have their say

20th January 2023 09:24

by Jim Levi from interactive investor

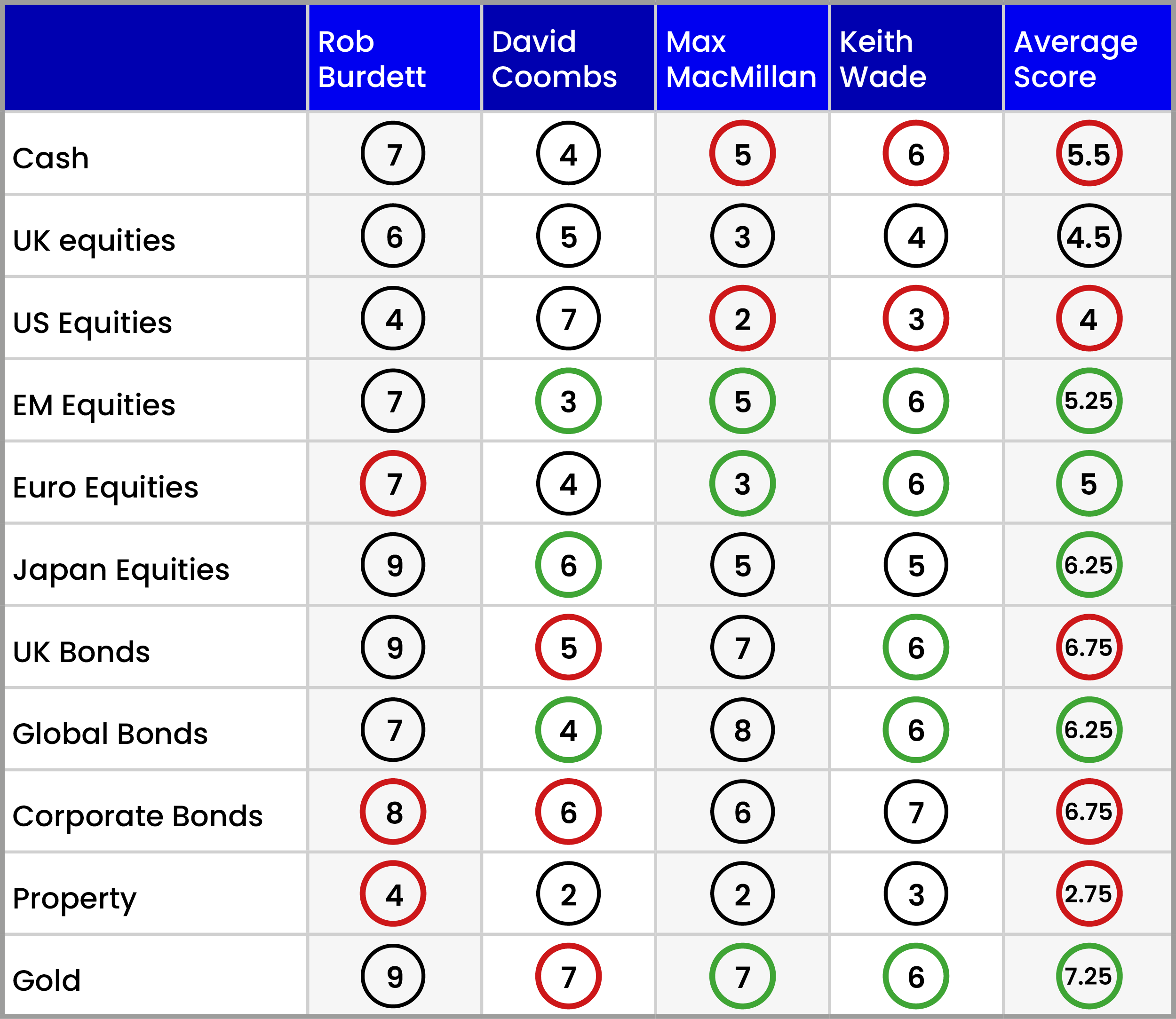

Our panellists are cautious on prospects for equity markets for the months ahead, instead favouring gold and cash. Here they explain why to Jim Levi.

Equities markets have hit the recovery road since mid-October when we last consulted our panel of asset allocators. Encouraged by signs of falling inflation the gains in equity indices have ranged from about 11% on Wall Street to nearly 20% in Europe and about 15% in the UK.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

But do our professional panel trust this bounce-back? Max MacMillan at abrdn definitely does not. Neither does Keith Wade at Schroders. MacMillan goes so far as to cut his score for US equities to 2, while Wade is almost as gloomy with a score of 3.

Reasons to be cautious

Such low scores seem to scream to private investors to be very careful. After all, when Wall Street sneezes the rest of the world is supposed to catch cold.

“We think the pain is not yet over for equity markets,” McMillan says.

He adds: “We are expecting a recession in developed economies with rising unemployment. We think the effect on corporate earnings has only just begun. Markets have priced in something more benign than what we have in mind.”

Wade agrees: “Markets are only looking at the improvement in inflation and have not accepted that there is going to be a recession in the UK, the US, and Europe. We predict a fall in earnings of S&P 500 companies of about 14% this year. This prospect is not reflected in US equities at all.”

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

- Andrew Pitts’ trust tips: UK and Europe strategies stage strong revival

Only David Coombs at Rathbones is overweight US, with a score of seven, above the neutral score of five. Indeed, it is the only equity sector where he feels comfortable to be overweight. “The US is where I can find a wide choice of quality companies,” he insists.

Even so Coombs does admit the risk of recession. “We are in the hands of Jerome Powell at the Federal Reserve. He may decide rising unemployment is the only way to stamp on the neck of inflation.”

Inflation will fall, but rates expected to remain high

Wade says US inflation will halve this year. “After averaging 8% in 2022, we predict it will be down to 4.1% this year and 2.2% next,” he says. But to achieve that he believes Powell will keep interest rates high until the final weeks of this year.

Columbia Threadneedle’s Rob Burdett remains overweight in all equity sectors except the US. “These battles to bring down inflation can take a while to sort out,” he says.

Burdett adds: “Past experience suggests we are in for a period greater volatility in equities. Volatility creates opportunity and I think this year will be a good year for active fund managers.”

Many fund managers of course bear the livid scars of last year’s pummelling of technology high-flyers such as Tesla (NASDAQ:TSLA) and Meta Platforms (NASDAQ:META).

“The last 20 years has been about globalisation and the next 20 years is going to be about de-globalisation,” Burdett predicts.

With the US Nasdaq Composite index down roughly one-third in the past year Coombs is left wondering whether many of these high-flyers will ever climb back to their old peaks. “Maybe Apple (NASDAQ:AAPL) can, but I am not sure about Tesla”, he says.

Going for gold

This volatility coupled with the uncertainties over Ukraine and China’s Covid crisis has pushed the gold price towards peak levels. Burdett scores a 9 for gold. “The performance partly reflects a period of weakness in the dollar, but the simple fear factor is strong,” Burdett admits.

Coombs asks: “Will a cornered Vladimir Putin do something drastic and will nasty new variants of Covid emerge from China?”

That such questions are even being asked perhaps explains why gold has become the panel’s most favoured market sector.

Bullish on bonds

The corporate bond market is keenly supported as well after rising on average by about 10% since mid-October. All the panel are overweight the sector, although both Burdett and Coombs are taking some profits.

In both UK Bonds and Global Bonds, Coombs is now the only panel member who is not overweight the sectors. In UK bonds, Coombs saw the Truss/Kwarteng mini-budget fiasco as a buying opportunity and is now taking profits - lowering his score from 7 to 5.

- Watch Sam Benstead's video: My high-yield bond market tip for 2023

- Bond Watch: how will fixed income perform in 2023?

“Recession is a time when government bonds prove their worth as diversifiers,” he says.

Wade has decided to lower his cash score from 8 to 6 and re-allocate the funds into both UK bonds and global bonds as well as into emerging market equities and European equities.

MacMillan’s bearish view on UK, US and European equities is balanced by unchanged high scores in bonds.

The Truss government fiasco also turned out to be a wonderful buying opportunity for investors in UK equities. As Rishi Sunak and Jeremy Hunt subsequently led us into calmer waters, the pound made a dramatic recovery with both gilts and equities following in sterling’s slipstream.

Staying away from the UK

Since our last review in mid-October, the Footsie (the FTSE 100 index of leading shares) has gained more than a thousand points and now threatens to break through to an all-time high.

Such a display of buoyancy seems astonishingly inappropriate given the gloomy domestic backdrop of an NHS in crisis, widespread industrial unrest, and rampant inflation.

Certainly our panel do not seem to trust this recovery. Only Burdett is overweight UK equities with a score of 6.

“UK stocks are still very unloved by international investors and are still quite cheap,” he argues.

- Funds and trusts four professionals are buying and selling: Q1 2023

- 11 ways to invest your ISA like Warren Buffett

Coombs agrees but insists the performance reflects the dominance of multinationals and defensive stocks in areas such as utilities, consumer staples, food retail and healthcare.

He points out: “The outlook for the domestic economy looks dreadful and although I score a 5, I would only score a 2 for stocks outside the FTSE 100.”

Wade warns that Rishi Sunak will have to wait until next year to fulfil his promise to halve inflation. His forecast is that inflation in the UK will rise slightly from 9.2% to 9.3% this year, but will more than halve to 4.1% in 2024.

European equities were the outstanding performer since our last review as oil and gas prices tumbled sharply and fears receded over the region’s dependence on imported energy. Burdett is the one who got the sector timing right in the short term, so he is able to take profits and lowers his score from 8 to 7.

MacMillan fears recession in the region but has edged up his score from 2 to 3, while Coombs also believes Europe faces “a messy economic outlook”. He sticks with a score of 4 for the region. Wade, however, has become an enthusiast doubling his score from 3 to 6.

Will China recover in 2023?

China is the dominant influence in emerging markets equities and the U-turn on zero-Covid opens up the possibility of resumed economic growth, not just in China but in the region and globally. These optimistic signs are reflected in the recovery of the Hang Seng Index in Hong Kong, which has bounced back nearly 20% in the past three months.

MacMillan has edged up his emerging market score from 3 to 5, while Wade has boosted his score from 4 to 6. Wade says: “The new Covid policy is going to cause a lot of pain, but the Chinese will probably get through it, while the weaker dollar will also be a helpful factor for emerging equities generally.”

Coombs is not so confident about China: “It is difficult to call,” he says. “You could make shedloadsof money, but it could be absolutely awful.” Grudgingly he raises his score from 2 to 3.

Japanese shares have yet to echo the recovery in Europe and the US. But they remain our panel’s favourite equity sector. Valuations remain attractive, and as yet the Japanese have not had an inflation problem. Coombs raises his score from 5 to 6. MacMillan, though, admits his exposure is prompted more by the strength of the local currency than by the equity market.

Contrarian investors may be tempted by the absence of much support for the property sector where the average score is now a lowly 2.75. The Investment Association (IA) index of Britain’s direct property market shows a 7.1% drop in the final quarter of 2022.

“I would not want to be rushing into property right now,” says Coombs, but he admits: “I might buy a couple of house builders' shares. They look really cheap.”

Panellist profiles

Rob Burdett is head of multi-manager solutions at Columbia Threadneedle Investments.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.