When to buy more of these great tech funds

This pair of funds has made the Saltydog analyst a big profit in just a few weeks, and he may buy more.

4th February 2019 13:18

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This pair of funds has made the Saltydog analyst a big profit in just a few weeks, and he may buy more.

The rebound continues

Last week, we saw several stock markets closing at levels that we haven't seen since last November. In the UK, the FTSE 100 index ended the week above 7,000, and in the US the Dow Jones went back over 25,000.

Our sector analysis has been reflecting this upturn. Last week, I pointed out that the best performing sector over the previous four weeks had been technology and telecommunications, and that we had made a small investment into a couple of funds.

The funds in this sector tend to invest in the large information businesses which have matured over the last 20-plus years – Apple, Microsoft, Amazon, etc. The sector went up by 25% in 2016 and 24% in 2017. It also had a good start to 2018, but in September started to flounder. By the end of the year it had seen most of the gains of the previous 12 months eroded.

There were a number of factors which contributed to this. Due to the increase in valuations over the last few years, the price/earnings (PE) ratios of some of these companies had grown to levels that many thought were unsustainable. It also looked as though there would be more regulatory pressure put onto these businesses to increase the amount of tax that they had to pay, and to improve their social responsibility.

At the same time there was a general slowdown in the global economy as the central banks reduced or stopped their quantitative easing programmes, and there were signs of interest rates starting to rise. America and China had started a trade war and the UK and Europe were struggling to agree a Brexit deal.

Although many of these situations are still unresolved, investors seem to have started to get used to them. Last week, the Federal Reserve indicated that interest rates in the US probably wouldn't go up as quickly as had been anticipated which gave further support to equity markets.

The technology funds that we went into on the 24 January have started well and benefitted from this general recovery. If they continue to make gains then we will consider adding to them.

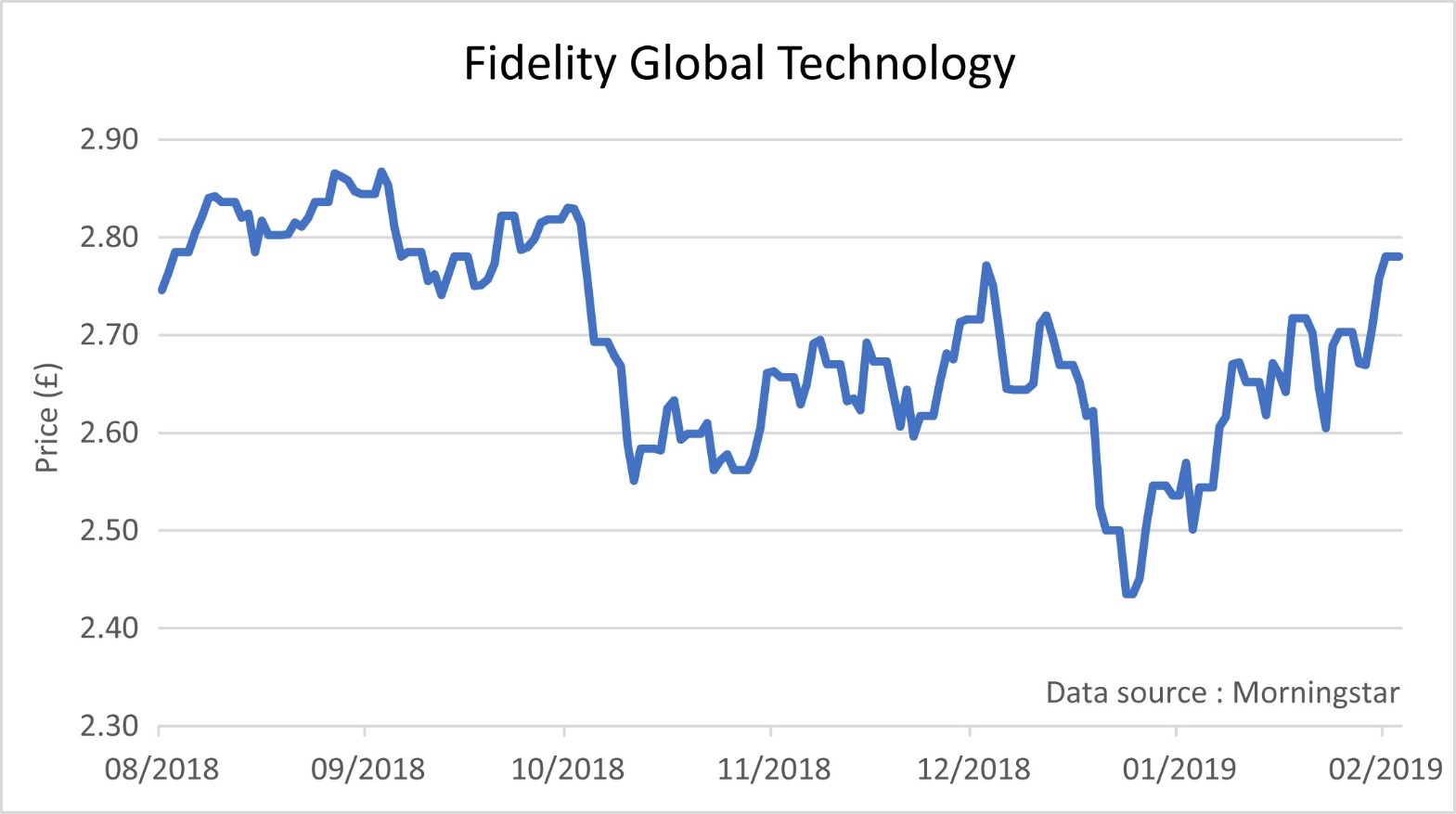

The Fidelity Global Technology fund is up 3.4% in less than two weeks. It peaked last September and then fell during October, November and December. Since Christmas it has recovered strongly.

Past performance is not a guide to future performance

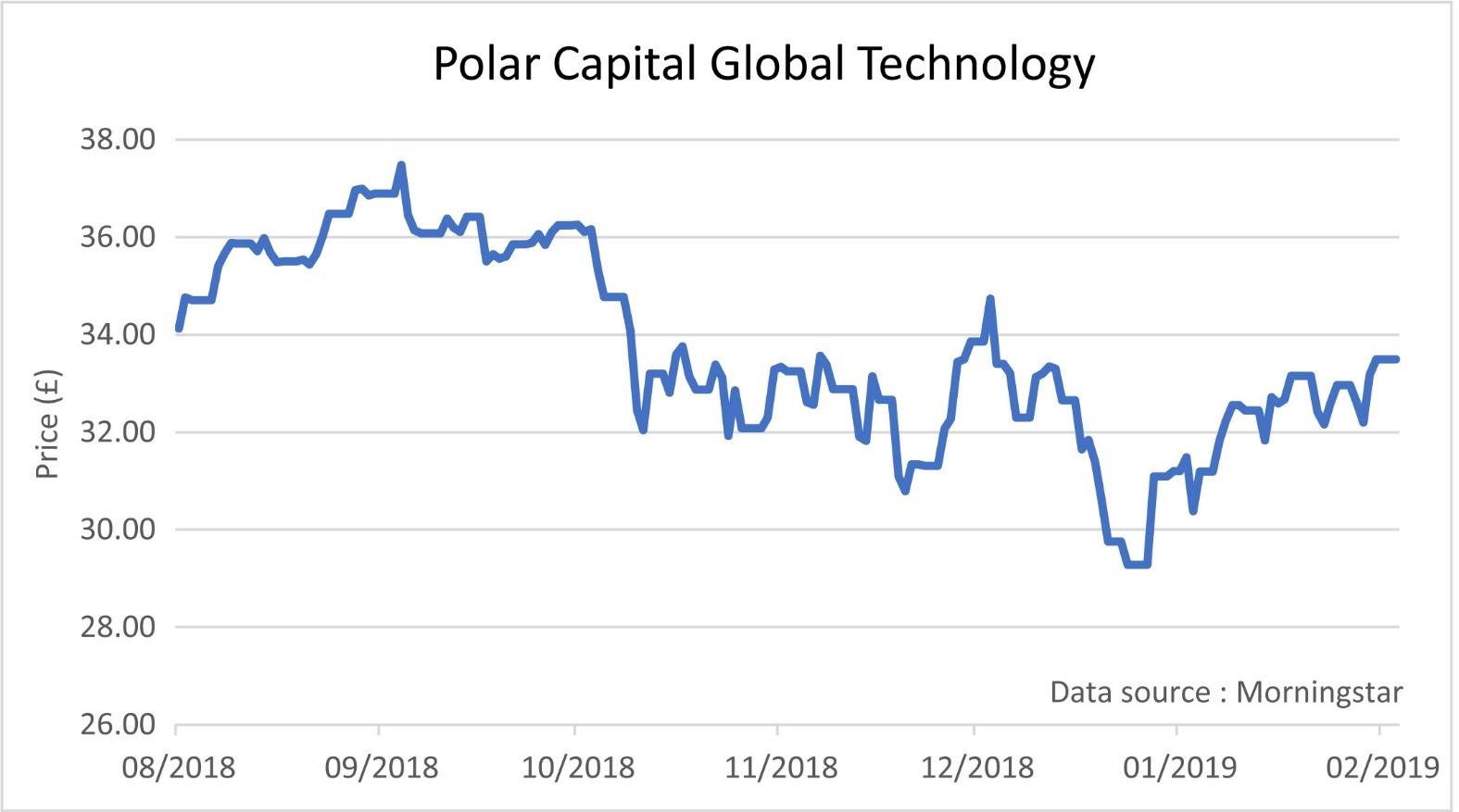

The Polar Capital Global Technology fund hasn't done quite as well, but it is still up 2.8% since we bought it.

Past performance is not a guide to future performance

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.