Wheels come off at WH Smith, shares resume fall

Even one of the top mid-caps of recent times is not immune from Covid-19, reports our head of markets.

14th May 2020 10:48

by Richard Hunter from interactive investor

Even one of the top mid-caps of recent times is not immune from Covid-19, reports our head of markets.

Apart from the more obvious tour operators and airlines, there are other connected businesses of the Travel and Tourism sector which are beginning to buckle, such as WH Smith (LSE:SMWH).

These results cover the six months up to the end of February, when the Travel business in particular – responsible for 60% of group revenues – was showing strong growth, with trading profit up 11%.

The acquisitions of US travel retailers InMotion and Marshall Retail Group were beginning to make a meaningful contribution, as the captive audience of the airport traveller which had served WH Smith well in the UK began to replicate in the US. Overall group revenues rose 19%, although there was a decline of 8% in High Street trading profit and the earnings per share metric also dipped.

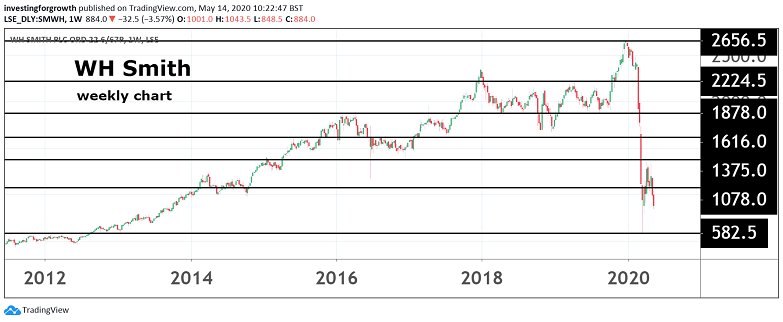

Source: TradingView. Past performance is not a guide to future performance.

Unfortunately, in April the wheels came off as airport travel all but ceased, with a similar picture being seen at the group’s other profitable business area within railway stations. April group revenue plunged 85%, comprising a 91% decline in Travel and a 74% drop from the High Street.

The group was forced to take emergency financial measures, such as a share placing at £10.50 per share, which raised £162 million and immediately looked to contain costs wherever possible, including the delay of capital expenditure, the furloughing of staff and the removal of the dividend.

Given a monthly cash burn of £25-£30 million, these measures should provide some financial succour, as will the business rates relief as announced by the Government. Smiths has declared itself to be a going concern, which covers the next 12 months at least, and access to liquidity reserves of £400 million should be sufficient in the immediate future.

Be first to watch our interviews with fund manager like Nick Train and Keith Ashworth-Lord, plus leading City analysts and our own experts.

Just click here now.

As has been seen so markedly within the tourism and travel sector and, indeed, connected businesses such as WH Smith, prospects largely rest on the return to something of an economic normality. The US market could potentially provide an early fillip to restored revenues, where 80% of air passengers take domestic flights.

The question mark over the wider issue of international travel, however, is a major concern for the likes of WH Smith. Equally, train travel looks likely to be subdued with fewer passenger numbers in the short-term, while pressure on an already embattled High Street is likely to resume on the other side of the pandemic.

Against this extraordinary backdrop, the shares have lost 54% over the last year, as compared to a decline of 18% for the wider FTSE 250 index, with a drop of 62% in the last three months alone.

Despite the business being inextricably tied to the as yet undefinable impacts of the current crisis, investors remain staunch supporters of a strong potential rebound for WH Smith, with the market consensus still coming in at a ‘strong buy’.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.