What will Chancellor Rishi Sunak announce in Wednesday’s mini-Budget?

With the UK facing an uncertain period, much rests on the chancellor’s summer economic update.

7th July 2020 13:10

by Graeme Evans from interactive investor

With the UK facing an uncertain period, much rests on the chancellor’s summer economic update.

Getting households and companies spending again will be the focus of Chancellor Rishi Sunak tomorrow when he sets out plans to deal with the economic aftershocks of coronavirus.

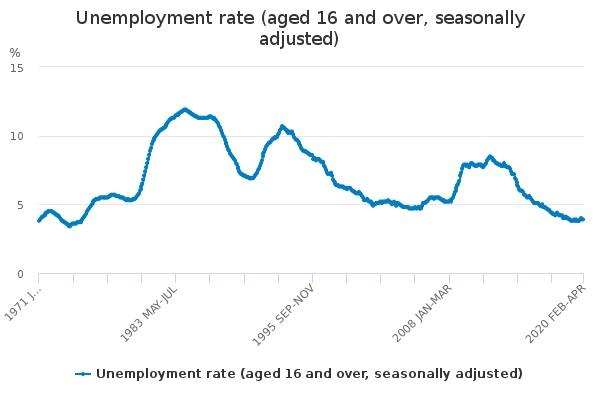

His mini-Budget is likely to be a pivotal moment for the UK's hopes of avoiding a jobs bloodbath of the kind not seen in this country since the 1980s. About 12,000 positions were lost in just two days last week, with that trend continuing today when Mirror and Express owner Reach revealed that it would be looking to cut about 550 jobs or 12% of its workforce.

With so much uncertainty over job security, it is unsurprising that families have been battening down the hatches in recent weeks. This was highlighted last week by figures from the Bank of England showing that UK household deposits grew in May by over £25 billion, the biggest month-on-month increase since records began in 1997.

Sunak will need to reverse some of this appetite for saving by stimulating consumer demand. This could mean VAT is cut to as low as 2% for pubs, restaurants and cafes, a move that would help to kickstart a services sector that's only just reopened after the lockdown.

Helping to protect some of the two million-plus jobs in the hospitality industry would go a long way to preventing a surge in youth unemployment, given that a large chunk of the roles are typically held by young people.

Source: Office for National Statistics (ONS)

In the same vein, Sunak is expected to offer employers across industries an incentive of up to £3,000 per apprentice to take on under 25s. This follows reports that the number of available apprentice positions had plunged by 80% during the Covid-19 crisis.

Many other jobs have been protected by Sunak's furlough scheme, which was put in place at the start of the crisis and has paid 80% of the wages of more than nine million people.

There are calls for Sunak to extend this scheme beyond October in order to help viable businesses, although former chancellor Philip Hammond admitted in an interview with the BBC today, that his successor must also be prepared to let some businesses fail.

Investment in infrastructure will be a key part of the recovery plan, as revealed by PM Boris Johnson last week following his vow to “build, build, build”. This is likely to include millions for new road projects, alongside a relaxation of planning rules to encourage more construction.

The package of measures from the Chancellor will also look at ways to keep the housing market ticking over, given the knock-on effect this has for spending elsewhere in the economy.

A move to raise the stamp duty threshold from £125,000 to £500,000 has been widely reported, although there are fears that any delay in introducing this incentive until the November Budget may cause the property sector to stagnate in the meantime.

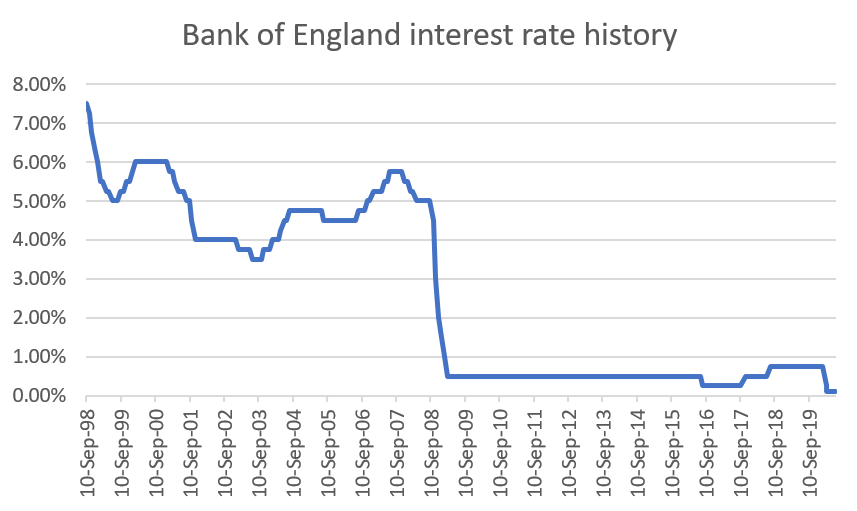

There are also questions about whether the industry really needs another incentive, particularly when people are likely to be more worried about their jobs rather than moving house. Interest rates are already at a record low of 0.1%, and the Help to Buy scheme continues to play a significant role in helping first-time buyers onto the property ladder.

Source: Bank of England

Lenders are also reporting that activity has bounced back strongly, with Halifax today disclosing that new mortgage enquiries were up by 100% compared to May. Average house prices fell by 0.1% in June, the first time since global financial crisis that prices have fallen four months in a row.

Halifax managing director Russell Galley said:

“We do expect greater downward pressure on prices in the medium-term, the extent of which will depend on the success of government support measures and the speed at which the economy can recover.”

In the meantime, speculation about the potential stamp duty incentive helped shares in housebuilders and estate agents to rise sharply, with Persimmon (LSE:PSN), Redrow (LSE:RDW), Countrywide (LSE:CWD) and Purplebricks (LSE:PURP) among the biggest beneficiaries on Monday.

- Bank of England approves another £100bn stimulus to prop up UK economy

- Bank of England cuts rates to record low: How the market reacted

Other measures due to be announced by the Chancellor tomorrow are likely to include a £2 billion grant scheme in England for green projects such as improving house insulation. It has been reported that the grants could help to support more than 100,000 jobs.

But faced with a £300 billion deficit this year, the big outstanding question for Sunak is how he plans to fund all the above measures. More details on this are likely to come with the main Budget in the autumn, when possible options might include changes to the triple lock on pension funding.

Matthew Cady, Investment Strategist at Brooks Macdonald, said:

“With UK public debt bigger than the economy in May for the first time in over 50 years, since 1963, there are ultimately limits to the support that the government can offer long-term.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.