What ‘unpleasant shock’ means for world’s biggest drug company

This business has been in a great position and risen over 700% in five years. Analyst Rodney Hobson assesses current circumstances and asks whether it’s time to sell.

6th November 2024 07:40

by Rodney Hobson from interactive investor

Quality companies in solid sectors, where competition is limited, naturally command premium share prices. One of the hardest tasks in stock picking is deciding if the share price has run too far ahead of current prospects.

The difficulty in making such assessments was exemplified by pharmaceutical giant Eli Lilly and Co (NYSE:LLY), which announced a strong set of results for the third quarter but then spooked the market by downgrading profit forecasts for the full year.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Revenue jumped 20% to $11.44 billion in the three months to the end of September and, if recent disposals are taken into account, the leap in revenue become an even more impressive 42%. Equally important, Lilly swung back to making a net profit of $970.3 million compared with a loss of $57.4 million in the previous third-quarter when figures were affected by those disposals. This swing was a remarkable achievement given that Lilly poured $2.73 billion into research and development, 13% more than a year ago, while marketing, selling and administrative costs rose 16%.

Lilly chair and chief executive David Ricks pointed to new regulatory approvals and encouraging data in the pipeline for new drugs. It all looks so good. Alas, he spoilt the effect by downgrading full-year 2024 guidance, drastically reducing expected earnings per share (EPS) from $15.10-15.60 to $12.05-12.55.

Guidance on revenue was trimmed only marginally, with the top of the range reduced from $46.6 billion to $46 billion. At least that is still well ahead of the $34.12 billion recorded in 2023.

The downgrade was an unpleasant shock, but hardly surprising given that third-quarter figures fell well short of what analysts had been hoping for.

In particular, sales of Zepbound, the weight loss drug for which there are high hopes, came in at $1.2 billion against expectations of $1.6 billion. Levels of stock held by wholesalers moved erratically but on the whole the wholesalers had excess stock so will not need to order more supplies immediately.

Apart from the immediate future, though, Lilly is facing a rather more pleasant difficulty. Demand for weight loss drugs is set to soar. Lilly and Danish rival Novo Nordisk with its Wegovy jab.

- Harris or Trump: funds to play the US election result

- US election: what a Trump or Harris win means for share prices

- An election-year playbook for investors

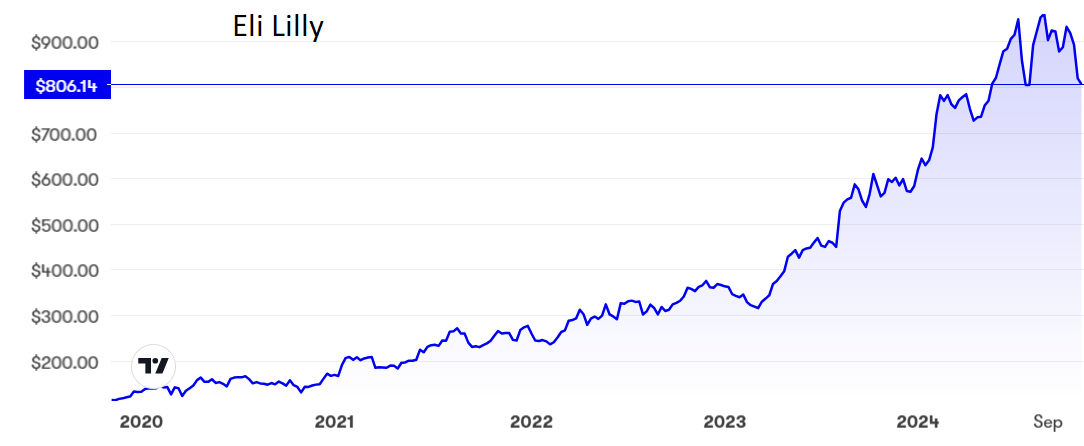

Lilly shares have defied gravity in a way that is nothing less than extraordinary. They trebled over three years to top $300 in March 2023, but even that was pedestrian compared with what has happened since. They topped $900 in August this year, fell back, then powered to an even higher peak before the month was out.

The full-year downgrade finally injected a much-needed note of reality, causing a sharp retreat to $810. Even now, the price/earnings ratio is over 80, a level that assumes phenomenal growth and constant upgrades, not downgrades. The yield at a measly 0.6% offers no consolation if the share price falls heavily.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: No investor gets it right all the time and I admit that I have consistently underestimated the power of Eli Lilly shares to keep on rising, arguing that they had run too far ahead of current circumstances. Then they ran even higher. This time the shares really could be heading to more realistic territory. Sell. I expect the shares to retreat to around $770 where they found support the last time they dropped from above $900.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.