What now for Woodford Patient Capital Trust shares?

As Neil Woodford is sacked from his fund, our chartist studies prospects for the trust he still runs.

15th October 2019 09:38

by Alistair Strang from Trends and Targets

As Neil Woodford is sacked from his fund, our chartist studies prospects for the trust he still runs.

Last time we reviewed Woodford Patient Capital Trust (LSE:WPCT), we'd given 52.60p as a level, below which opened the gates of hell. Once again, we've had a few emails asking us to explore what may be coming next.

There's a fairly major issue as last time we were unable to calculate below 52.60p without casually throwing minus signs into the conversation.

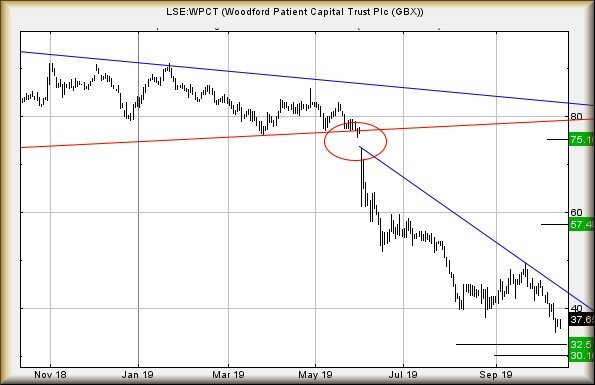

This is still the case but, if we opt to work on the period from the point the share was forced down (circled) from the 80p region, there's something potentially interesting.

- Woodford Patient Capital Trust: Where's bottom going to be?

- Woodford Equity Income fund to be wound up

- Neil Woodford sacked, but investor cash remains trapped

- Woodford Patient Capital shares dive, but board tight-lipped

At time of writing, it's trading at 37.6p, needing below 35p to once again serve notice of trouble. This time, below 35p indicates the potential of movement to 32.5p with secondary, if broken, down at 30p.

Given these are virtually the same number, the usual suggestion is of a share approaching a real bottom, a level at which a rebound can be indicated.

All this Brexit nonsense was the subject of conversation at the weekend. A chum was visiting, a bloke whose company specialises in asbestos survey pre-renovation or demolition.

Over the years, we've learned to associate the volume of his work with how busy the economy is going to be. The thinking is fairly simple, if corporate bodies are employing him, there's a fair bit of money about to be spent.

Presently, he's turning away contracts, due to being deluged with public and private sector requests. Given historical experience, thoughts of a slump post Brexit are liable to fade.

For the likes of Woodford, a trust fund suffering some investment choices which, for now, appear dreadful, if there is a miracle surge in share prices post Brexit (if it ever happens) we'd suspect Woodford's share price to echo the wider market.

This is why we're a little bit interested at the "feel" of it approaching a bottom.

Sensible people, opting to play safe, will doubtless wait and see if the share recovers above 50p. In such an event, we're calculating an initial ambition at 57.5p with secondary, if bettered, a longer term 75p.

Beyond 75p and we shall need shake the tea leaves again.

Otherwise, it is worth remembering the share, despite our slight enthusiasm, is trading in a region where the Big Picture cannot calculate a bottom without minus signs!

Source: TradingView Past performance is not a guide to future performance

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang, or interactive investor will be responsible for any losses that may be incurred as a result of following a trading idea.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.