What next for Nvidia stock after losing top spot?

Only last week, the artificial intelligence hot stock was the world’s largest public company. Now it’s third again. Graeme Evans looks at some interesting facts and potential outcomes.

25th June 2024 15:22

by Graeme Evans from interactive investor

NVIDIA Corp (NASDAQ:NVDA) buying resumed today after the AI chipmaker’s earlier run to a $3 trillion valuation saw it grow more in a month than the entire value of Warren Buffett’s Berkshire Hathaway Inc Class B (NYSE:BRK.B) investment vehicle.

The tech giant’s shares rallied 3% to $122 Tuesday afternoon, putting back some of the $400 billion lost during a correction from the intraday high above $140 on Thursday.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

A week ago, Nvidia overtook Microsoft as the world’s most valuable public company after its market capitalisation hit $3.3 trillion on the back of a $2.1 trillion year-to-date rise.

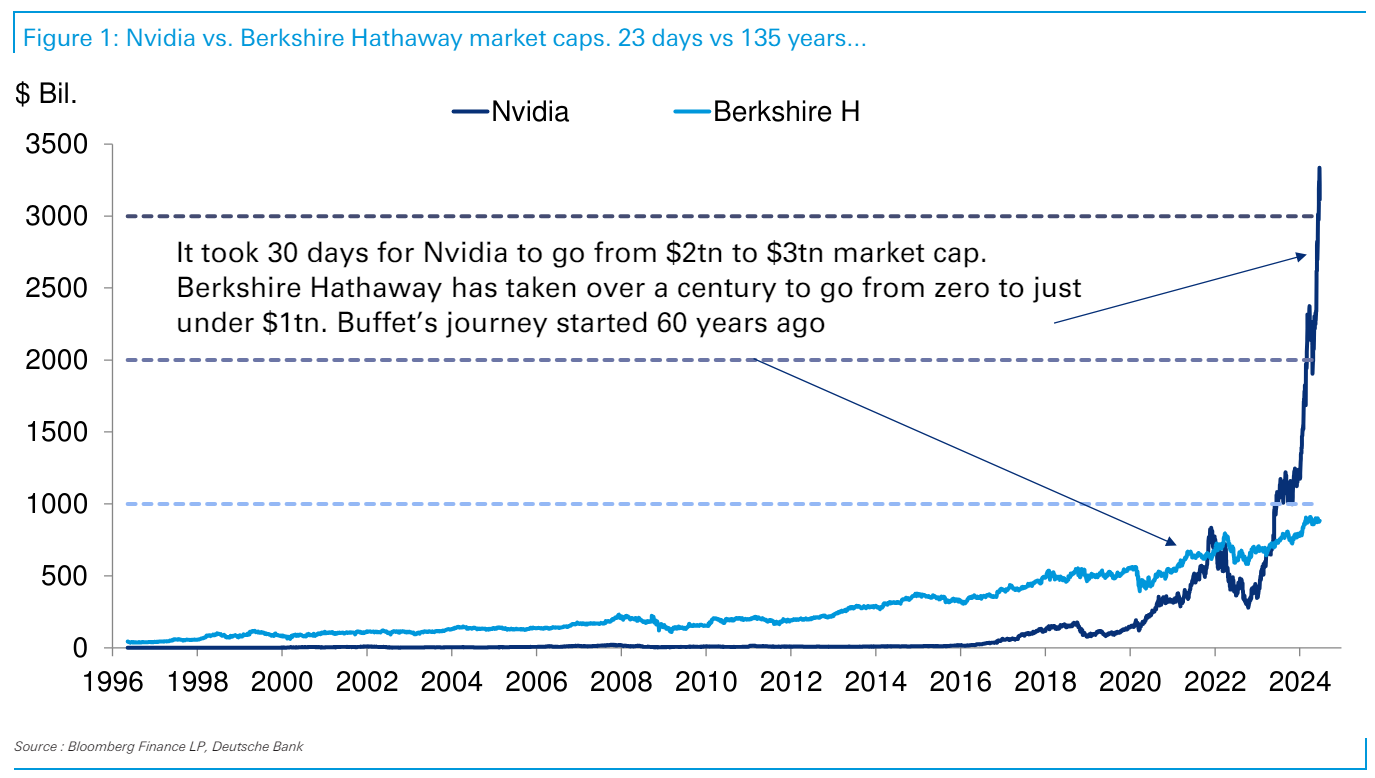

The surge from the $2 trillion landmark on 24 April to $3 trillion took place in just 30 trading days, narrowing to only 23 days for the last one trillion up until last Thursday’s record.

In a collection of charts under the “Wow” heading, Deutsche Bank drew a comparison with the milestones of Apple Inc (NASDAQ:AAPL), Coca-Cola Co (NYSE:KO) and American Express Co (NYSE:AXP) investor Berkshire Hathaway.

The City bank noted: “It's taken 60 years for the most famous and arguably successful investor in the world, namely Warren Buffett, to build Berkshire Hathaway up to just shy of a trillion-dollar company ($883 billion at Friday's close).

“Indeed the company's origins began in the 19th century so the full journey has taken well over a century and it’s yet to hit a trillion dollars."

Nvidia’s remarkable ascent reflects an 80% share of the rapidly expanding market for AI chips, ensuring that its quarterly results have comfortably exceeded the high bar set by analysts and its own management team led by Jensen Huang.

Interest has also picked up since this month’s 10-for-1 stock split, which has made each share more affordable to retail investors.

The surge in valuation has been the driving force behind a series of record highs for the S&P 500 index, with Nvidia accounting for about 35% of the benchmark’s rise this year.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Why I’d still buy this popular tech stock

- Nvidia now world’s biggest public company after passing Microsoft

The company has since slipped back to third in the S&P 500 rankings in what Wall Street has seen as either a pause for breath or signs the air is being let out of the balloon.

Yesterday’s decline of 6.7% for Nvidia left the S&P 500 in negative territory even though 70% of its constituents finished higher. Cambridge-based ARM Holdings ADR (NASDAQ:ARM) also fell sharply as the SOXX semiconductor index retreated 2.9% and the Nasdaq declined 1.1%.

Amid some evidence of a rotation into value, the S&P 500 energy and banking sub-indices rose 2.7% and 1.5% respectively.

Without taking any single-name views, UBS Global Wealth Management said today it continued to believe AI offered significant opportunities for growth with potential value creation likely amounting to trillions of dollars.

It added: “But the global tech sector is not cheap, and pockets of excessive leverage are adding to complexity for individual investors managing their exposure.

“With AI demand remaining robust and the technology likely to disrupt and transform industries in the years to come, we still think it is important for investors to ensure they’re sufficiently invested.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.