What makes Ricardo special

6th October 2017 15:40

by Richard Beddard from interactive investor

OK Ricardo, I guess you're agonising about your namesake. It's just published its annual report...

I assume you mean me, and you're talking the engineering and environmental consultancy that manufactures supercar engines on the side?

That's it. Although I hear it's shifted up a gear. It's producing a transmission for a hypercar?

It's the Aston Martin Valkyrie. And don't expect me to tell you the difference between a hypercar and a supercar. Bugatti, another customer of , makes a car that costs over £1 million. Perhaps it's a hypercar, too.

Aston Martin has joined forces with Red Bull Racing to make the Valkyrie, so there is plenty of hype, and perhaps some bull.

We should be talking about the rest of the business, though, as it's responsible for 80% of revenue, and this isn't Top Gear.

Great. What does the rest of Ricardo do?

Well that's the tricky bit, because it's a consultancy, and you know what I think about consultancies...

No. What do you think about consultancies, Richard?

A load of bright people in offices doing whatever customers want them to do. They research problems, design solutions, test and certify things. They're guns for hire, which makes them a bit difficult to pin down.

As far as Ricardo shareholders are concerned the value is in the people, you see, not so much the things they create, which belong to Ricardo's customers.

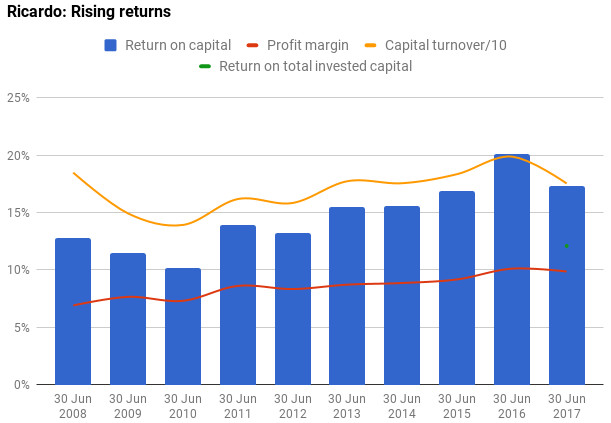

The company has probably amassed a great deal of expertise and valuable working relationships, which it earns reasonable profit margins from. Take a look at my usual chart:

Hmmm. Decent return on capital, rising profit margins. It's a good business, isn't it?

I think so.

Ricardo's heritage is in engineering. Its founder, Harry Ricardo, designed the Mark V tank engine in 1915. Believe it or not, the Mark V's unique selling point was lower emissions.

Cloudy exhaust plumes gave away tank positions on the battlefield, you see. Ever since then, Ricardo's designed lighter, cleaner, more powerful drivetrains and other components.

Ricardo took a bit of a kick in the teeth in the year just concluded because car manufacturers reconsidered their love of diesel and petrol-engined cars after a number of governments declared they'll phase them out (albeit in the distant future).

Manufacturers' newfound enthusiasm for electric vehicles shouldn't harm Ricardo, though. Most of us have got a few more internal combustion-powered cars in us yet, and Ricardo has electric capabilities too.

17% of new orders related to vehicle electrification projects in the year to July 2017, which was still a record year for Ricardo overall.

Just to give you a flavour of the breadth of Ricardo's activities, case studies in its annual report highlight collaborations with manufacturers and government bodies to research platooning, software that controls driverless vehicles travelling in convoy. It's assessing the safety of driverless metro cars in China, and developing new battery chemistries.

Ricardo's environmental consultancy, acquired in 2012, is working out how to measure and control potentially dangerous nanoparticles emitted by vehicle exhausts. It's also measuring emissions in the UK's busy shipping lanes...

Stop! Too... Much... Information...

No kidding, try reading the annual report. It's hard to see the wood for the trees.

Just give me the helicopter view

Tricky. I'll have a go. Ricardo knows important stuff. Governments and industry pay it to learn more stuff to guide their policies. Then they pay it to engineer better vehicles and design better transport systems.

It's probably a virtuous circle. The more it learns, the more it can do. The more it does, the more it learns.

Sounds intriguing. Why do I detect caution? Are the shares priced like a Bugatti?

No, the shares aren't particularly expensive. I'd say they are in Audi territory, or perhaps even Volkswagen, which is more my kind of currency.

A share price of 815p values the enterprise at just over £550 million or about 16 times adjusted profit in the year to June 2017.

It's a candidate for further investment, but I am cautious because my theory about Ricardo the learning machine is just a theory, and though there's bound to be an element of truth in it, I don't know why it's a better learning machine than any of the few large consultancies and many boutique ones it competes against.

The answer is likely to be wrapped up in its culture, its long history, and how it trains, rewards, and retains employees.

Also, Rhomboid1 has got me thinking.

I beg your pardon, Rhomboid1?

He's one of my Twitter buddies.

You've been discussing Ricardo with an irregular parallelogram? I thought you were a serious investor?

I think he's a serious investor.

OK, so what's bothering our straight-edged friend?

Receivables.

Receivables? That means it's owed lots of money... It's a good thing, isn't it? I wish I was owed a lot of money...

I bet you'd rather just have the money. The vast majority of receivables are owed by customers for consultancy work. Ricardo counts the value of the work it's done as revenue whether it's been paid, it's invoiced the customer and has yet to be paid (trade receivables), or it has yet to invoice the customer (other receivables).

This is the way accounting works, it matches costs and revenues to show how the company has performed in the year irrespective of the payment schedule the company has agreed with its customers.

It's fine as long as the company is paid. When a company is owed a lot or receivables increase rapidly, investors get nervous, though. Since the revenue has already been recognised, the company may have to write off receivables and revise revenue and profit down should a customer fail to pay.

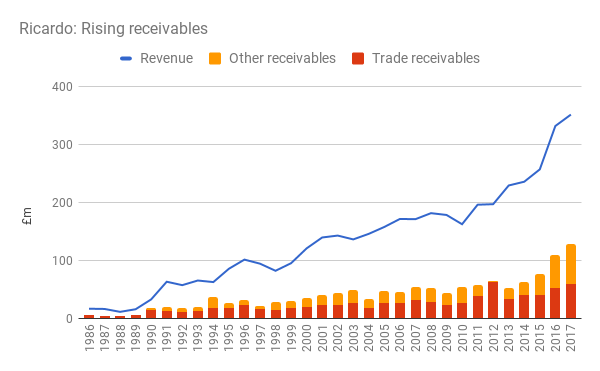

Ricardo's trade receivables have increased significantly over the last few years. In 2013, a year in which receivables were lower than average, they've increased from £52 million to £129 million or by nearly 150%. In 2013 trade and other receivables accounted for 23% of revenue. In 2017, they accounted for 36%.

So, receivables account for 36% of revenue. Is that too risky?

Honestly? I don't know. I don't think so. Here's a chart showing Ricardo's revenue and receivables over many decades:

I exported the data from SharePad, rather than collect it myself. The last time Ricardo had such a high level of receivables was in 2003. However, in 2013, the starting point in my comparison, receivables were at their lowest ebb for the entire period.

On average, Ricardo's receivables are 32% of revenue, so perhaps there's not too much to worry about.

In the annual report, Ricardo's chief financial officer says receivables have risen for three reasons. Revenue has risen (50% over the last four years) and you would expect receivables to rise in tandem. If it's doing more work, it will be owed more money.

He also blames the ‘phasing' of revenue into the fourth quarter of 2017 because of earlier disruptions. This is the kick in the teeth I mentioned earlier, when customers delayed orders while they reconsidered their priorities.

If the company did a disproportionate amount of work near the year end it will be owed more at the year end.

His third reason is less reassuring. Ricardo is earning more from the Middle East and Asia, where payment terms have been longer.

This could become a problem, but I should also say the company's auditor devoted a page of its report to receivables and is happy with the accounting.

So, it's a buy then? Just say it!

I want to. I really do. The heart says yes but I'm concerned about weak cash flow, which is partly the result of unpaid receivables (remember what I said about having the cash now), and also executive remuneration, which is high and complicated.

High pay may be necessary, not just at board level, to stop expert staff leaving, but it reminds me that I don't really know what else makes Ricardo special. It's borderline, but for now I'm not buying.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.