What to make of Lloyds Bank results

1st August 2018 10:42

by Richard Hunter from interactive investor

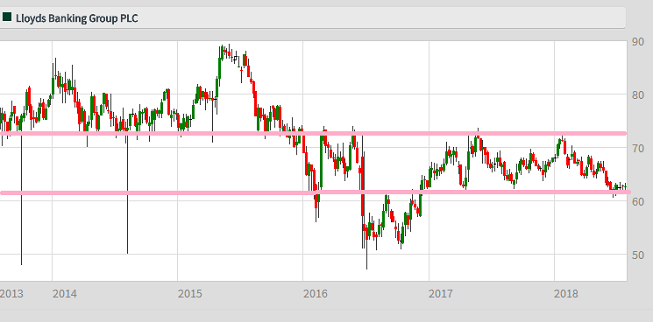

Lloyds shares may be the most widely held, but 2018 has been disappointing so far. Richard Hunter, head of markets at interactive investor, assesses recovery potential following latest numbers.

Lloyds Banking Group is enjoying the benefit of the doubt as the strength of these numbers is enough to offset the disappointment of another PPI hit.

The key metrics are in very good shape, with a rise in Net Interest Margin, improved earnings per share and a cost income ratio which now sits below 48%.

In addition, the return on equity number is robust and the capital cushion healthy, enabling an increase to the dividend which puts the projected yield at 5.4%, a clear attraction in itself.

Meanwhile, the supportive share buyback programme is nearing completion, with further schemes a distinct possibility. Unsurprisingly, these factors have all combined to drive the profit figure sharply higher.

Source: interactive investor Past performance is not a guide to future performance

The additional PPI provision is an unwelcome development. The issue has long cast a shadow over the sector and Lloyds in particular. It is especially galling given that the Q1 update suggested that these provisions were on a downward trajectory and that the issue was close to being consigned to the history books.

This will not sit comfortably with the current view that the UK economy may have some troubling times to come, with Lloyds being potentially exposed to consumer defaults through its credit card business, let alone any difficulties which higher interest rates could bring.

This may explain why bears of the stock have the upper hand at present. The shares have fallen 5% over the last year, as compared to a 5% hike for the wider FTSE 100, and are down 10% in the last six months.

Despite an undemanding valuation and undoubtedly robust numbers, the market consensus has also slipped to a 'hold', albeit a strong one.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.