What happens to UK bank shares in a recession?

30th June 2022 13:44

by Graeme Evans from interactive investor

UK bank shares have been a regular source of frustration for investors, and there is now serious talk of a recession either this year or next. New research examines the impact on UK lenders.

The worst-case scenarios driving UK bank valuations were today countered in City research highlighting “attractive risk-reward” across the sector, particularly NatWest (LSE:NWG) and HSBC (LSE:HSBA).

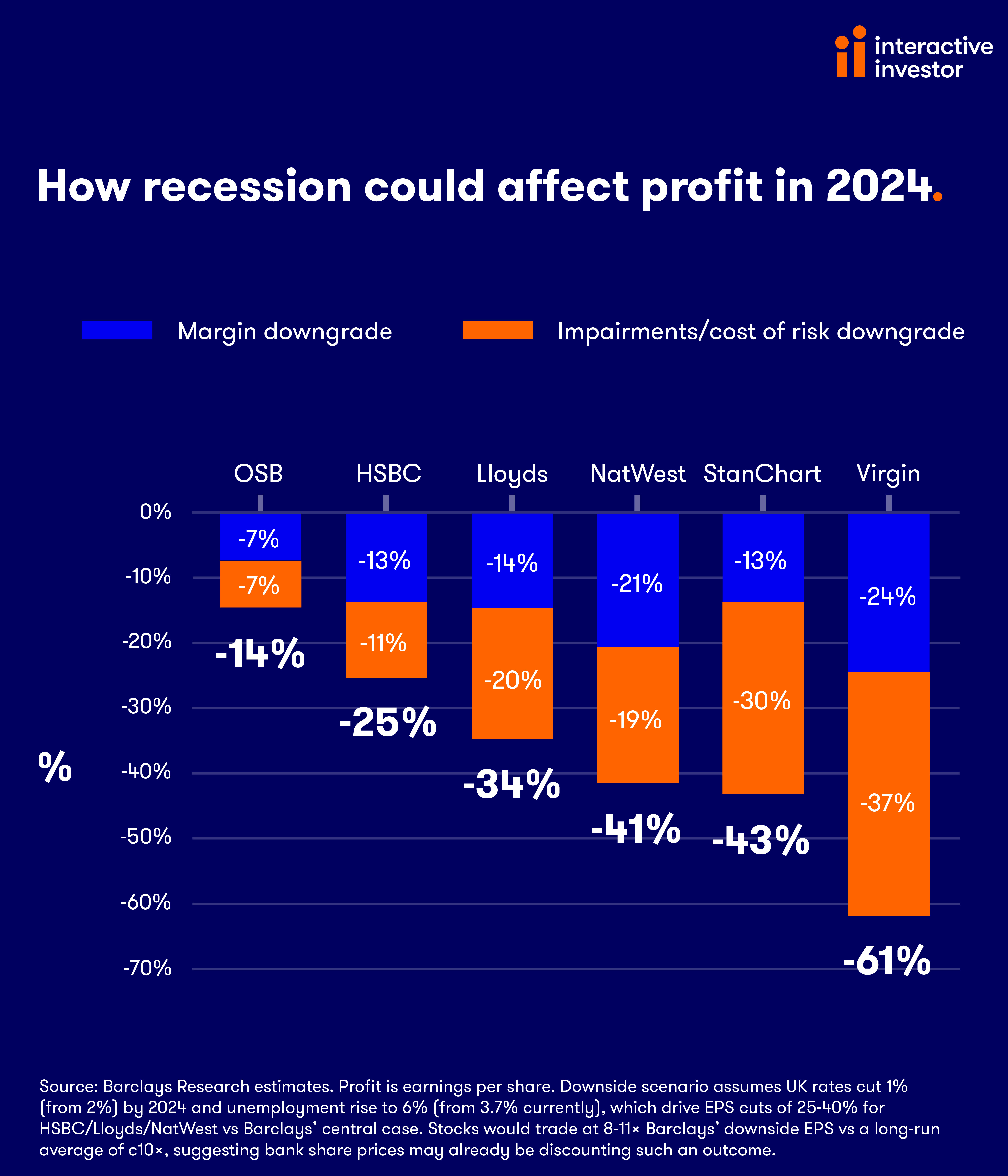

A note from analysts at Barclays estimates the earnings impact of four outcomes, including its central case for interest rates at a margin-enhancing 2% and unemployment at 5% in 2024, and a recession.

- Invest with ii: Share Dealing with ii | Top UK Shares| Cashback Offers

However, its research suggests that bank share prices may already be discounting one of its downside UK scenarios, where recessionary conditions cause a reversal in the rate hiking cycle back to 1% and unemployment hits 6% from 3.7% currently.

- The UK bank best placed to benefit from rising interest rates

- Interest rates rise by 0.25%: how will it affect me?

- What an inflation shock really looks like

This scenario would reduce earnings per share for the bigger lenders including Lloyds Banking Group (LSE:LLOY) by between 25% and 40% compared with the bank’s central case. But stocks would still be trading on between 8-11 times earnings, versus a long-run average of 10 times.

Applying weightings across all four of its scenarios, the bank sees an average potential share price upside of 40% across its coverage and rising to 60% if the central case is to emerge.

Barclays said this pointed to an attractive risk-reward across the sector: “We believe bank investors are struggling to gain conviction on the outlook for net interest margins in the face of volatile rate expectations, and loan impairments as recession risks mount.”

Its modelling of the historical relationship between UK unemployment and loan losses over 30 years also suggests a 1% increase in the jobless rate typically adds between 10 and 30 basis points to UK bank loan losses.

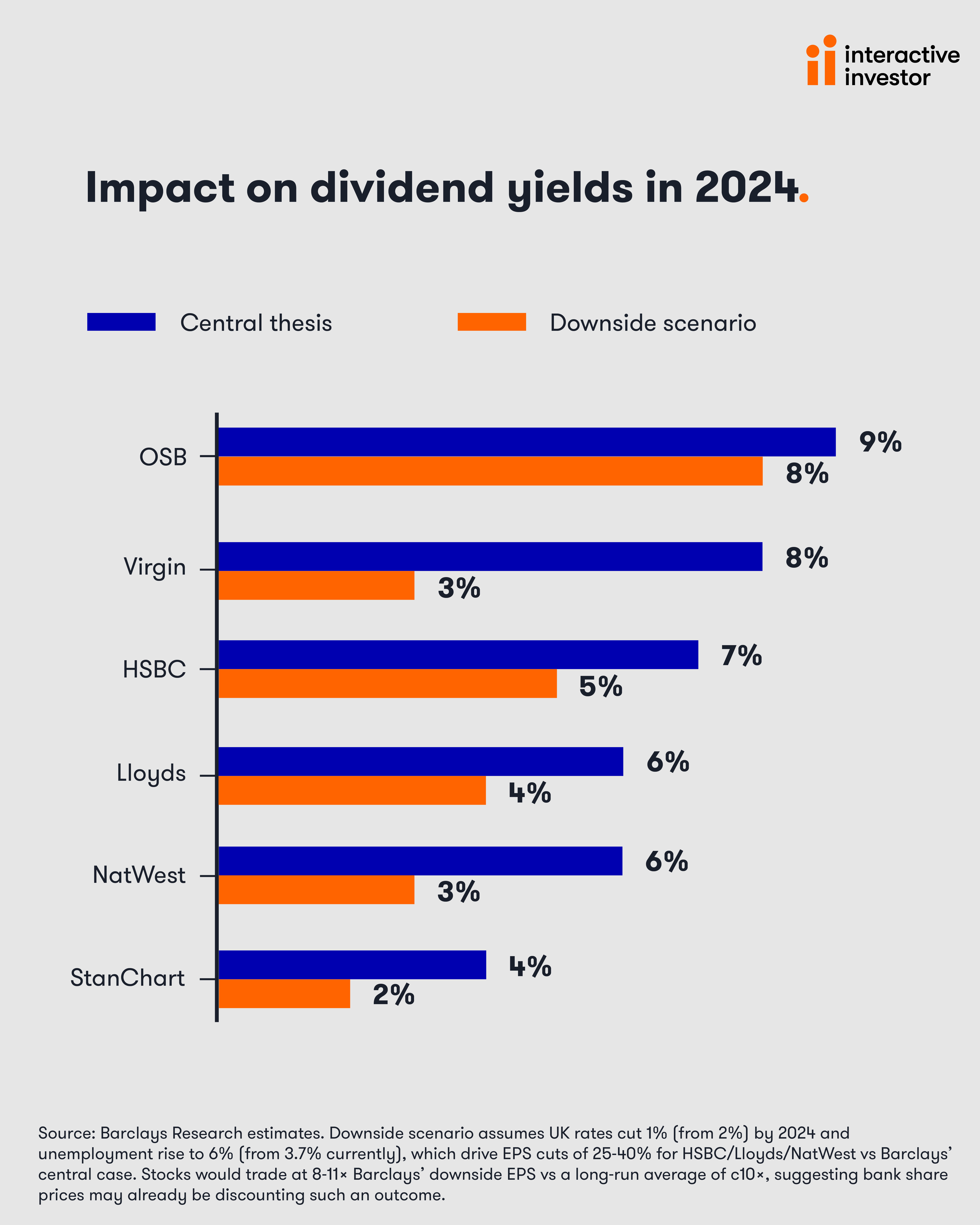

Dividend yields would fall to low-to-mid-single digit versus high-single digits in Barclays’ central case, which excludes share buybacks.

In its central case, the bank is 8% ahead of consensus on net interest income across 2023-24, with the most upside at NatWest and HSBC. Barclays trimmed its price targets to 315p and 720p respectively but retains “overweight” recommendations on both. It lowered Lloyds to 52p, although this still represents an upside of 23% on the current price.

Today’s note lifted Virgin Money (LSE:VMUK) to “overweight” with a price target of 200p, which compares with today’s improved 131p after the FTSE 250-listed lender announced an inaugural share buyback worth £75 million.

- Why I have real concerns about the future of NatWest's share price

- Markets fall again but these three UK bank stocks are a buy

- The investments that will keep growing – even during a recession

The move represents about 4% of the group’s current market capitalisation and is in line with other larger UK banks that are returning surplus capital through buybacks.

Virgin’s capital buffer of 14.7% is comfortably above its target range of 13%-13.5%, but the bank required the approval of regulators before it could announce the capital distribution. It forms part of a framework announced in May that includes a 30% full year dividend pay-out.

Peel Hunt said the authorisation suggests a measure of confidence in Virgin Money’s outlook despite wider macro concerns.

The broker said it expects more buybacks to follow on a regular basis, noting that a new capital buffer of 14.3% still offered plenty of headroom.

At the recent interim results, Virgin disappointed investors with its guidance for its net interest margin to decline in the second half despite further rises in UK interest rates.

Peel Hunt believes this was reflective of management conservatism and that it continues to expect the interest margin to continue to evolve positively. If that happens, it sees plenty of upside after reiterating a price target of 282p today.

Goldman Sachs, meanwhile, edged up its estimate on the UK lender to 220p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.