What does Trump’s win mean for emerging markets?

The return of Donald Trump to the White House opens the door to a wide range of shocks for emerging markets, both positive and negative.

21st November 2024 14:58

by Michael Langham, Tettey Addy and Robert Gilhooly from Aberdeen

Key takeaways

Trump and the Republican party have swept the US’ political landscape, opening up a wide range of large policy changes that could shock the emerging market economic and geopolitical outlook.

We do not know the exact policy mix that Trump will follow the second time round. But one common feature across plausible policy constellations is more inflationary pressure and a higher-than-otherwise federal funds rate, reducing the magnitude of emerging markets central bank rate cuts.

A ‘market friendly’ Trump presidency may be noisy, but ultimately would be good for many emerging markets: the Fed may cut by less, but a stronger global economy and ‘risk on’ market sentiment would mitigate the impact of USD pressure.

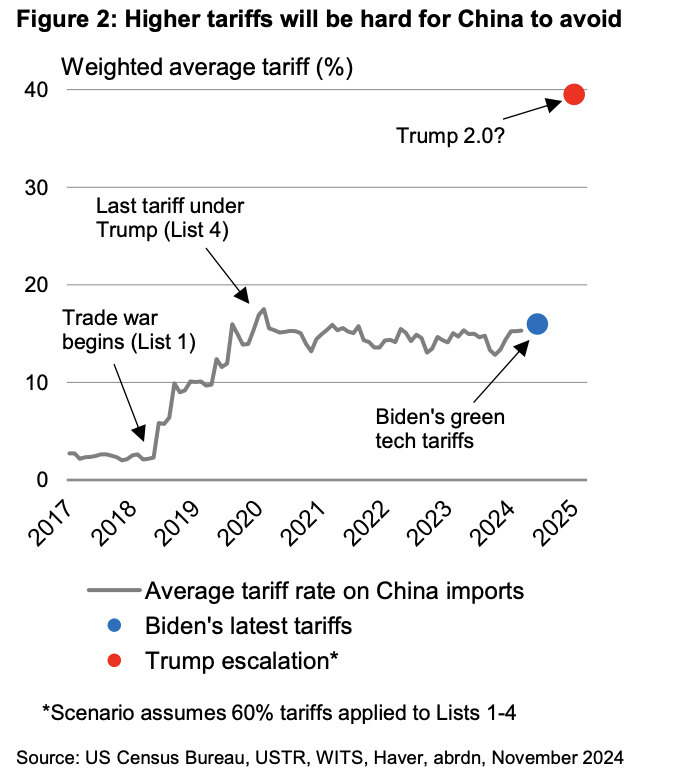

By contrast, a far-reaching trade war would be much harder to navigate, creating a wide range of winners and losers across emerging markets. This is a particular risk for China, but could ultimately benefit countries that are able to capture the reshoring of manufacturing.

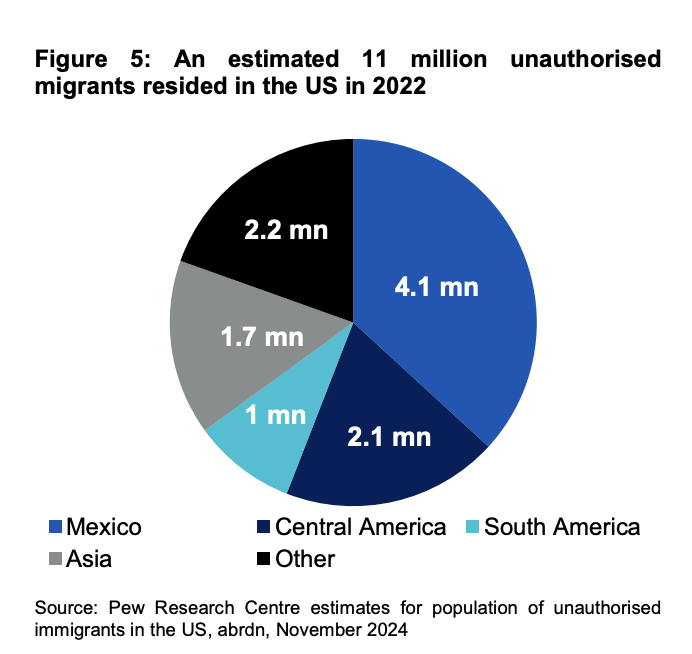

A tougher US stance on migration and deportations would be felt most in Latin America, complicating the 2026 USMCA (United States – Mexico – Canada Agreement) review. But, ultimately, the more the US decouples from China, the more it will need Mexico.

A wider range of foreign policy aims and outcomes is also possible under a second Trump presidency. Resolutions to the Ukraine-Russia and Middle East conflicts remain unlikely in the near term, but a more isolationist and transactional approach could recast relations with both friends and foes.

Read the full article here

Michael Langham is emerging markets economist at abrdn.

Tettey Addy is emerging markets economic analyst at abrdn.

Robert Gilhooly is senior emerging markets research economist at abrdn.

ii is an abrdn business.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.