What to do with a share that’s tripled?

This stock is on a roll and our overseas investing expert is confident it can take upcoming change in its stride. But can solid growth continue?

20th December 2023 09:56

by Rodney Hobson from interactive investor

There is to be an immediate change at the top at membership-only retailer Costco Wholesale Corp (NASDAQ:COST) but shareholders need not worry about there being upheaval at this well-run company. The handover should be smooth and successful.

Chief executive officer Craig Jelinek plans to step down on 1 January, but he will remain with Costco until April to help with the transition. Stepping up is chief operating officer Ron Vachris, who has held that post for less than two years. However, he knows the company inside out, having joined as a forklift driver more than 40 years ago.

- Invest with ii: Buy US Stocks & Shares | US Earnings Season | Interactive investor Offers

Vachris takes over with Costco on a roll, a success largely of his making. In the 17 weeks to 3 September, the latest figures available, sales rose 9% to $77.4 billion, plus $1.5 billion worth of membership fees on top. That beat analysts’ expectations, although not by a wide mark it must be admitted.

With margins widening despite inflationary pressures on the supply side, net income climbed 16% to $2.16 billion, with earnings per share up a similar percentage to $4.86. The policy of keeping costs down by avoiding costly shop displays and using tightly controlled warehouses that are strategically placed has really paid off.

Net sales for the 53-week financial year were 6.7% higher at $237.7 billion and net income improved 7.7% to $6.3 billion, so the final quarter showed greater percentage rises than in the first nine months, particularly for net income. This is good news going into the important Christmas period, which falls in Costco’s first quarter.

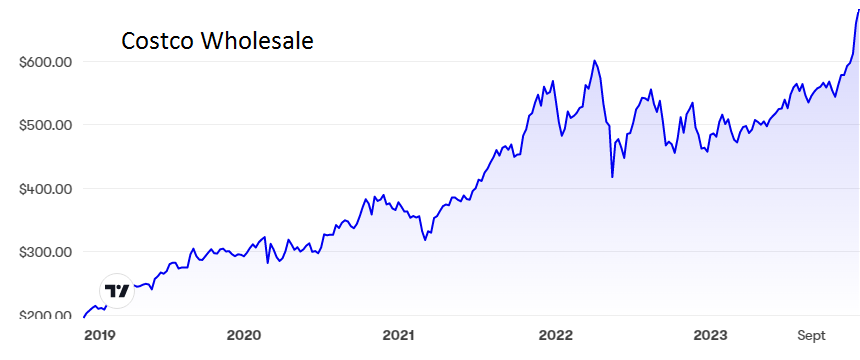

Source: interactive investor. Past performance is not a guide to future performance.

Costco was originally very much an American concept, spreading out slowly but surely from its base in Seattle on the west coast. It concentrated on buying in bulk at low prices and passing on the benefits to its subscribers, preferring to keep its ranges narrow rather than offer a wider selection at less-favourable prices. Goods on offer include food, non-food merchandise, pharmacy products and, at most outlets, fuel.

It has expanded carefully, avoiding overextending its management and facilities, but has eventually moved into retailing in a comparatively modest way. It now has approaching 900 outlets, mostly in the United States, following its policy of expanding where it knows its markets best.

However, the overseas operations are now coming into their own. Like-for-like sales outside the US grew by 5.5%, easily outstripping the US. Most of the 270 overseas warehouses are in neighbouring Canada and Mexico but Costco now has a strong foothold in Japan and the UK.

- Two stocks to buy and one to keep hold of

- US stock market outlook 2024: sectors to own in the year ahead

One slightly worrying feature is that existing warehouses and stores seem to be reaching the limit of their sales, which means that more outlets will need to be opened to maintain sales growth. The low-cost structure may be challenged, as setting up new outlets is more expensive than expanding existing ones.

Costco shares have more than tripled in value over the past five years, from $200 to a peak of $680, despite a sharp fall during the pandemic when Costco suffered heavily from having a low level of online sales. This climb has pushed the price/earnings ratio up to a hefty 46, while the yield is only about 0.6%, so the market is assuming continued solid growth, which could well happen.

Hobson’s choice: I drew attention to Costco shares in October last year when they hadfallen from $600 to £472 over the previous six months for no good reason. I said the shares were a buy below $480 with the downside limited to $450.

In fact, $454 proved to be a solid floor so the chance to get in below $480 was not available for long, but those who acted quickly have been well rewarded. If you are in for the long term, hold on. However, the shares are fully valued for now so if you are thinking of buying, it is probably best to hold off and hope for a correction.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.