This is what coronavirus could do to company profits

Disruption in Q1 will inevitably hit corporate earnings, but a recession is not yet priced in.

10th March 2020 15:24

by Graeme Evans from interactive investor

Disruption in Q1 will inevitably hit corporate earnings, but a recession is not yet priced in.

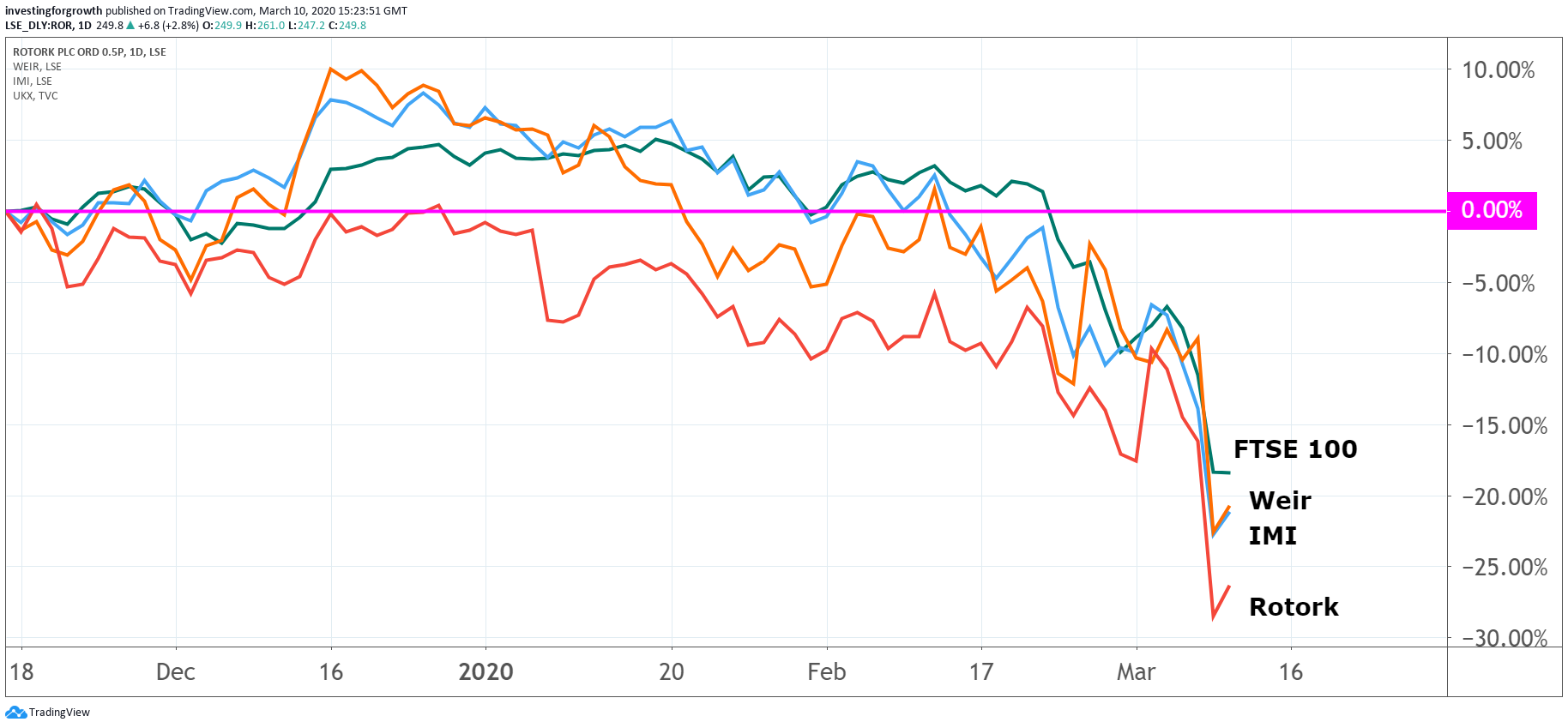

The City's best efforts to calculate the cost of coronavirus increasingly highlight the threat of an industrial recession, with implications for London-listed Rotork (LSE:ROR), IMI (LSE:IMI) and Weir Group (LSE:WEIR).

Deutsche Bank has published a note in which it assumes the disruption will deprive short-cycle businesses about 25% of sales in China and an average of 5% elsewhere in the second quarter.

Assuming that two-thirds of the lost value in China and half of the lost sales in other regions can be recovered during the rest of the year, this leads to initial earnings downgrades of about 4% on average for the industrials sector on a full-year basis.

The bank highlights the three most exposed companies in its coverage as Atlas Copco, Knorr-Bremse (XETRA:KBX) and Schneider Electric (XETRA:SND), with 14% of more sales in China. Bath-based Rotork, which operates in markets where the flow of gases or liquids needs to be controlled, generates about 13% of sales from China and is the most exposed to Italy with more than 10% of sales, according to Deutsche.

- Investors pile in on hopes of turbocharge from stimulus

- Want to buy and sell international shares? It’s easy to do. Here’s how

Investors have responded by sending the industrials sector down 16% in the two weeks prior to Monday, compared with 8% for the utilities sector and over 20% for hotels and leisure.

Deutsche said: “Investors' strategy has been fairly logical: stay defensive and get prepared to rotate into more cyclical names as the news flow around containment or stimulus programs improves.”

And despite the company's significant China and Italy exposure, the bank noted that shares in Rotork were among defensive, high-quality names to have generally performed better. They have a target price of 315p for Rotork, with Weir at 1,500p and IMI on 1,230p.

Source: TradingView Past performance is not a guide to future performance

Deutsche analysts add that Siemens (XETRA:SIE) presents a “very attractive buying opportunity”, having returned to its 2019 lows despite a diversified portfolio and one of the highest exposures to long-cycle markets. The bank also likes Schneider due to its flexible supply chain and increasing focus on India.

The SARS experience suggests that activity can return very quickly as soon as people feel the outbreak is under control, even before governments officially declare it over. In Hong Kong, retail sales dropped by 15% year-on-year in April 2003 but had recovered by July of that year.

However, Deutsche added: “The caveat for the manufacturing sector is that, as the virus expands well beyond China, then the backlog of work will almost certainly be too large to be fully compensated in the second half.”

Analysts at UBS, meanwhile, think that growth overall is likely to turn negative in the second quarter. However, the underlying strength of economic conditions could make it possible for a quick rebound once it appears that the virus is under control. They add: “With support from both monetary and fiscal policy, our base case is that a sustained downturn will be avoided.”

It believes that a recession is “almost, but not fully, priced in.”

“Virus containment measures in the US seem to be behind the curve, and it's not clear that politicians will be able to agree on stimulus measures. Therefore, we can’t rule out an even deeper and longer hit to the economy.

“In that scenario, which would likely include a 2020 midyear economic recession, S&P 500 earnings could fall [12%] in 2020, resulting in a year-end price target of 2,500 for the S&P 500.”

But talk of a quick rebound will be little consolation for many retailers, particularly those in the fashion sector without a second chance to sell spring ranges. This won't just be felt through lost sales, but through gross margin pressure relating to markdowns on unsold stock.

UBS said: “We estimate the most exposed retailers to disruption in March are those with a high store-based sales mix, high seasonal product mix, low margins and high ticket, discretionary purchases.”

They add that the market's coronavirus fears were no longer solely focused on supply side risks and factory closures, but now on demand side risks. UBS sees low exposure to disruption with Howden Joinery (LSE:HWDN), Kingfisher (LSE:KGF), and Marks & Spencer (LSE:MKS), but high exposure for H&M and DFS Furniture (LSE:DFS).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.