We’ve swapped US and tech for this emerging market

Saltydog Investor explains why it has instigated this shake-up in one of its portfolios.

26th March 2025 09:12

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

This time last month, I highlighted the fact that while most stock markets were falling, the Hong Kong Hang Seng Index (HSI) was on track for a bumper month. It went on to finish February with a one-month return of over 13% and has since risen by a further 4%. So far this year, it has notched up a 19% gain.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

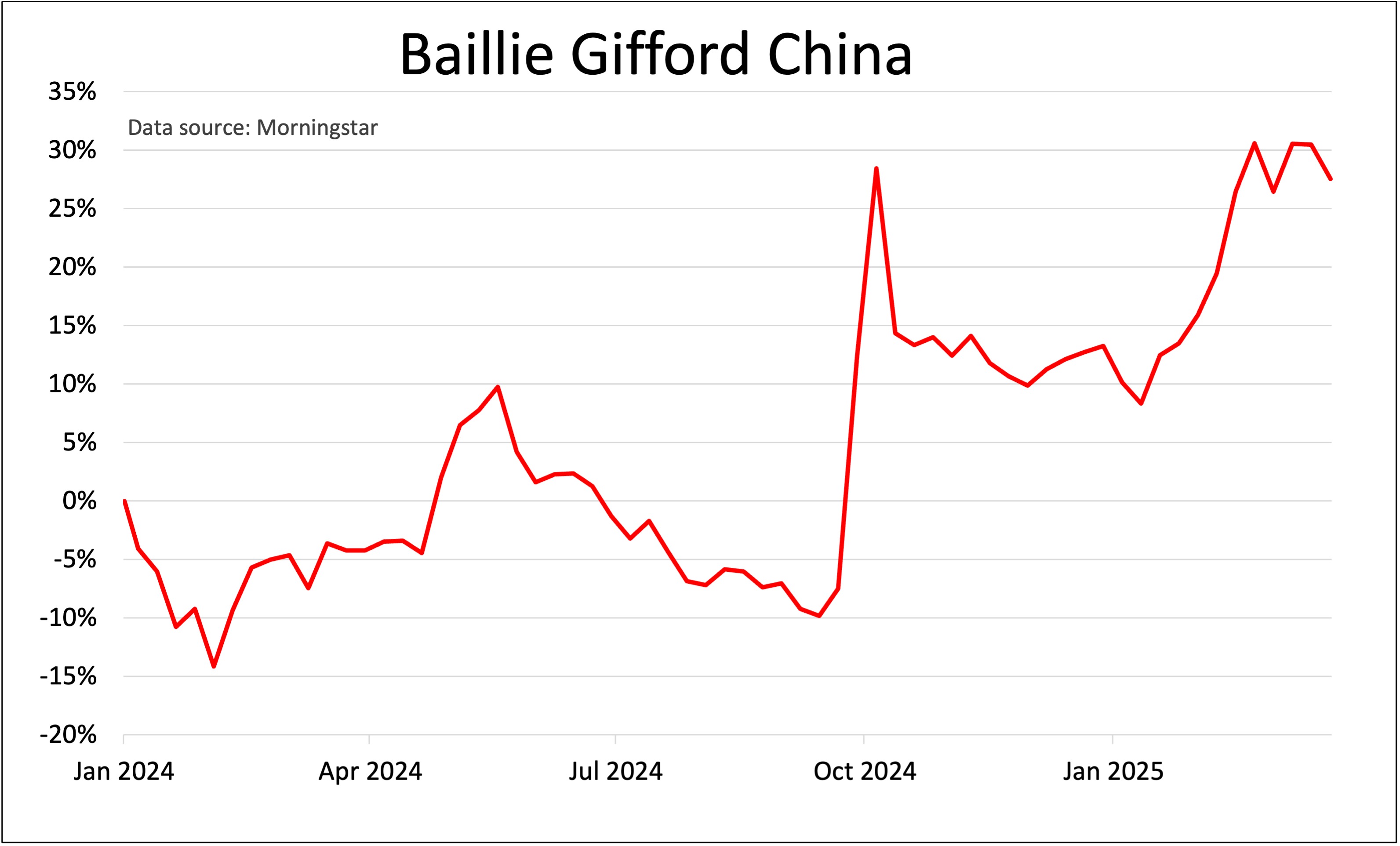

I also explained why the Hang Seng Index is probably more representative of the performance of the leading funds in the Investment Association’s (IA) China/Greater China sector than the mainland Chinese indices. Although the Shanghai Composite is only marginally ahead of where it was at the beginning of the year, the China/Greater China sector has risen by 8.6%, and the best-performing funds have done even better. The top 10 funds in this sector are all reporting gains of 12% or more, and the best, Baillie Gifford China, is showing a year-to-date return of 14.7%.

Having made losses of 10.5% in 2021, 15.9% in 2022, and 20.4% in 2023, the China/Greater China sector bounced back with a 13.9% return in 2024.

As trend investors, we would have liked to have taken advantage of this change of momentum, but it was hardly a gradual transition, so we didn’t really have a chance.

After a disappointing start to the year, the sector rose fairly steadily from the start of February until mid-May, at which point it was showing a year-to-date gain of 12%. However, it then went into decline and by mid-September had given back all of its gains and was showing a loss of 7%. Then, in the next three weeks, it rose by 30%.

Past performance is not a guide to future performance.

The dramatic rise at the end of September and beginning of October was triggered by a series of aggressive policy moves by the Chinese government aimed at revitalising the struggling economy and boosting investor confidence. The People's Bank of China reduced interest rates and reserve requirement ratios for banks, freeing up liquidity to stimulate lending, and introduced additional liquidity measures, such as loans for stock buybacks. At the same time, the government also announced fiscal stimulus measures, including direct support for capital markets and regulatory adjustments to boost consumer confidence and corporate activity.

After the sudden spike, stock prices eased off towards the end of the year as investors waited to see how the policies would be implemented and whether there would be a broader economic recovery.

- ISA ideas: short-term plays and long-term holds

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

This year has started well. In addition to the government stimulus and improving economic outlook, a couple of other factors have influenced the Chinese markets.

In January, the Chinese start-up DeepSeek released its R1 artificial intelligence language model. Initially, it was reported to be on par with OpenAI’s ChatGPT but developed at a fraction of the cost, using less powerful processors. Although some of the initial claims may have been exaggerated, it has questioned the gulf that was thought to exist between US and Chinese technology companies. This has reinforced China’s push towards technological self-reliance, encouraging Chinese companies to invest in local artificial intelligence (AI) development and reduce dependence on foreign technologies. This has boosted Chinese technology stocks.

Of more concern has been the trade war instigated by President Trump and the American government. On 4 February, a 10% tariff was imposed on nearly all imports from China; this was increased to 20% earlier this month. China has responded by imposing additional tariffs on US goods. These include a 15% tariff on coal, coke, liquefied natural gas (LNG), and certain agricultural products such as chicken, wheat, and corn, and a 10% tariff on crude oil, agricultural machinery, large-engine vehicles, soybeans, pork, beef, seafood, fruits, vegetables, and dairy products. It has also restricted the export of five critical minerals widely used in the defence, clean energy, and high-tech industries: tungsten, tellurium, molybdenum, bismuth, and indium.

To strengthen its domestic market and mitigate the impact of US tariffs, the Chinese government has implemented strategies focusing on stimulating consumption, industrial upgrades, and structural reforms. This includes expanding its trade-in subsidy programme, where the government covers 15-20% of costs for mid-range smartphones, appliances, and new energy vehicles. The government has also increased its budget deficit target, allowing it to boost spending, and is investing in public projects to improve infrastructure and advanced manufacturing.

- Watch our video: mining stocks, Trump, tariffs, China and critical metals

- Important last-minute checklist for tax year end 2025

- The funds delivering under Trump as US shares drop

While the trade wars could reduce global economic growth, affecting both China and the US, the Chinese stock market might be getting a temporary boost as investors reduce their exposure to the US, particularly to the so-called Magnificent Seven technology stocks. This year, Chinese equities have significantly outperformed US stocks, yet their valuations still compare favourably to their US counterparts.

In our Ocean Liner portfolio, we have sold our holdings in the North America and Technology & Technology Innovations sectors and, a couple of weeks ago, invested in the Baillie Gifford China fund. Its performance is very similar to the sector average, although it is slightly more volatile. That is advantageous when things are going well but could be problematic if trends reverse. We are hopeful that the transition away from the US towards China and Europe does not prove temporary.

Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.