We’re headed for a ‘necessary recession’: here’s how to prepare for it

7th July 2023 09:58

by Theodora Lee Joseph from Finimize

Recessions are never pleasant or easy, but they may be necessary. That’s the uncomfortable spot we’re in now, according to abrdn, who maps out how things are likely to go. Here’s how to prepare your portfolio.

abrdn economists think a recession is a necessary evil to bring core services inflation back toward central bank targets in developed economies.

Interest rates are expected to remain higher for longer, particularly in the UK and eurozone. And that means housing markets there could take longer to recover, compared to other developed economies.

To be prepared for a possible recession, look for quality stocks, opt for defensive assets, and prioritize yield over capital appreciation over the next year or two.

Recessions are never pleasant or easy, but at times, they may be necessary. And that’s the uncomfortable spot we’re in now, according to abrdn. The Scotland-based global investment company recently published its closely watched worldwide economic forecasts, mapping out how things are likely to go. Here’s how you can prepare your portfolio for it all.

So what’s the view from abrdn?

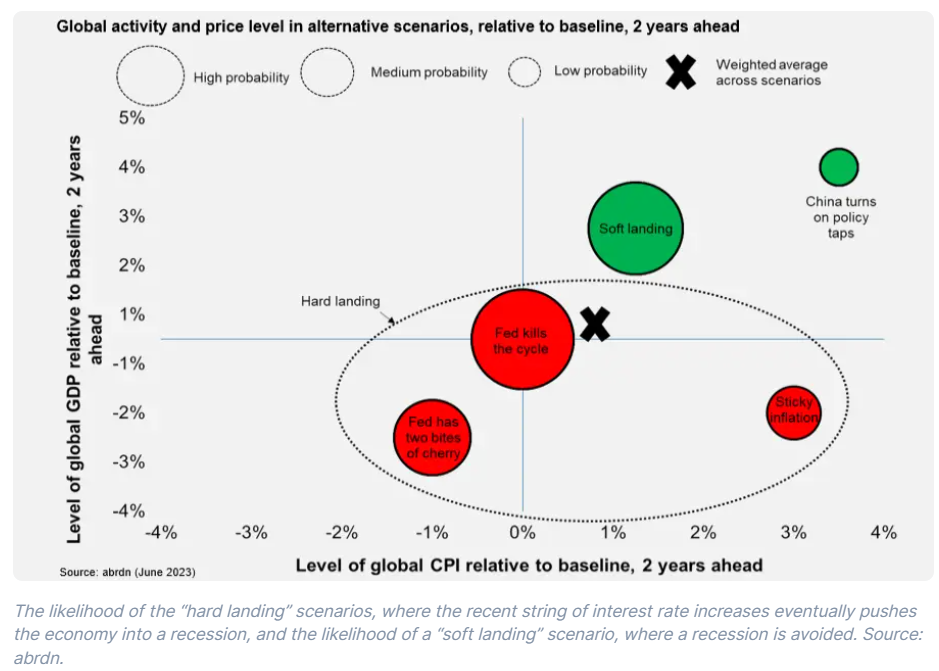

Economic growth. Concerns over a global recession have stretched for months, but just because the economy has been hanging on better than anyone expected, don’t get your hopes up too high. abrdn says it won’t last. Sure, job markets remain healthy, consumers have been willing to draw on their savings, and there are even signs that housing activity might be picking up again. But it’s not all sunshine: the banking sector is likely to face some challenges due to higher interest rates. And when credit conditions tighten, people and businesses find it tougher to borrow, ultimately leading to a recession. That’s why economists at abrdn (Finimize’s parent company) are forecasting that all these rate hikes will eventually lead to recessions in major developed economies (and some emerging ones). And they say it’s all likely to go down around the turn of the year.

Inflation. Their research shows that headline or “all-items” inflation will continue to drop sharply over the next 12 months, driven by lower energy and food prices, but won’t likely hit the long-term target of 2% until late next year. In the meantime, core services inflation will remain sticky – broadly because of competitive labor markets and strong wage growth – and it’ll take a recession to bring core services inflation to heel in most of the world’s advanced economies and in several emerging ones.

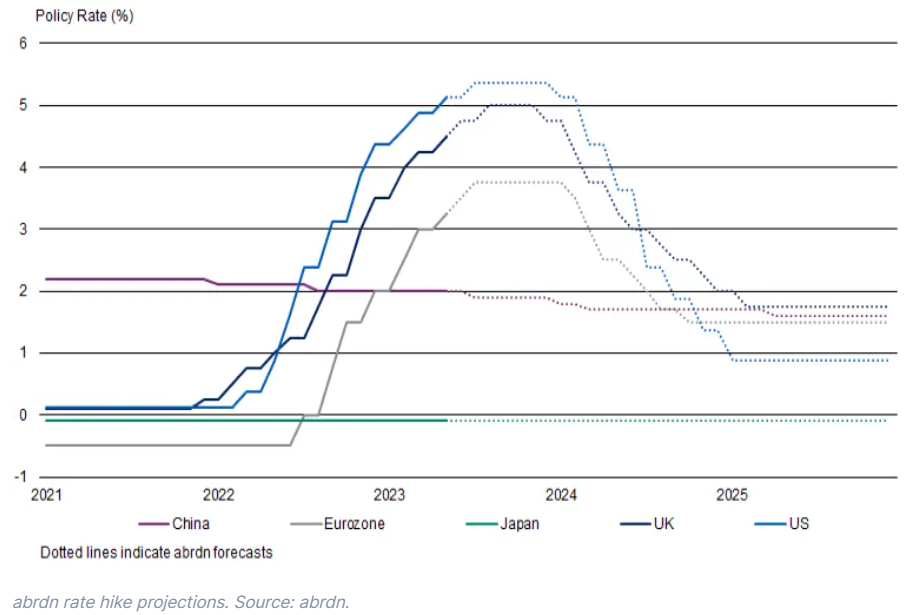

Interest rates. Until inflation falls back to the 2% target, central banks will have to keep interest rates on the high side. abrdn economists are forecasting a US Federal Reserve rate hike in July, and two more hikes apiece for the European Central Bank and the Bank of England. Now, interest rate increases are the best weapon we’ve got against inflation, but it’s not a fast-acting one. And with the consumer, the labor market, and the overall economy all showing so much resilience and with spending continuing apace, that’s kept inflation stubbornly hot. So central banks have been forced to hike rates higher and will be forced to keep them high for longer, which abrdn’s economists say eventually will cause a “necessary” recession that’ll sustainably tame that inflation beast.

Most developed economies are expected to cut interest rates by mid-to-late 2024, but you shouldn’t expect them to go anywhere near as low as they were before the pandemic. The higher-for-longer scenario is expected to be worse in the UK and the eurozone, and that means the housing markets there may take longer to recover.

So what does this all mean for your portfolio?

First, go defensive. It’s anyone’s guess when a recession will hit, so you’re probably better off staying on guard and making sure your portfolio is well-diversified. If a recession happens, interest-rate-sensitive sectors with frothy valuations (hello, tech stocks) can be hit hard. So, if you’re already invested in a market index ETF, you might want to consider investing in an equal-weighted market index ETF instead. Those traditional, market-cap-weighted index ETFs have always seemed like a good diversification tool, but that diversification advantage has actually crumbled over time as big firms (mostly from tech) have become a whole lot bigger, holding some outsized sway over some indexes. You could also consider investing in Treasury bonds or alternative assets like commodities and real-estate, to potentially improve your risk-weighted returns.

Look for quality. Investing in the typical defensive sectors – like consumer staples, healthcare, and utilities – won’t come cheap in a recession. After all, that’s where most investors will run to hide, bidding up prices as a consequence. And simply buying good companies in cyclical industries won’t make much sense when a recession hits. Instead, think about hunting for quality companies in niche industries. Consider investing in the industrial gas industry for the defensive nature of its income, which comes from long-term take-or-pay contracts, or the trash industry for its resilient growth, driven by industry consolidation.

Prioritize yield over price gains. With interest rates set to creep even higher and recession risks rising, it makes sense to prioritize your investment yield potential over capital appreciation for the next year or two. Look at it this way: the average annual return from the S&P 500 over the past two decades was 8.14%, and with interest rates where they are now, you can lock in more than half that return through relatively risk-free deposits. Plus, many of these options have a low correlation to the market – meaning, they won’t necessarily fall if stocks fall – and that can help diversify your portfolio, better insulating you against a possible recession.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.