Weighing up the recovery for energy funds

31st October 2022 13:42

by Douglas Chadwick from ii contributor

Saltydog Investor has its eyes on the sector which benefits most from higher oil prices, but is holding off investing more money.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

As anyone who runs a car will know, the price of fuel has started increasing again. Household energy bills are also at record highs. Therefore, it should not come as a surprise that last week, when we did our usual review of the best-performing funds, the top two from the specialist and thematic sectors were BlackRock BGF World Energy and TB Guinness Global Energy. Next, were two more general commodity funds, BlackRock Natural Resources and JPM Natural Resources.

Specialist & Thematic Sectors

| Fund | SubZone (If Applicable) | 4 week | 12 week | 26 week | ||||

| Decile | Return | Decile | Return | Decile | Return | |||

| BlackRock BGF World Energy | Natural Resources | 1 | 12.2% | 1 | 14.2% | 1 | 18.6% | |

| TB Guinness Global Energy | Natural Resources | 1 | 7.4% | 1 | 16.2% | 1 | 16.1% | |

| BlackRock Natural Resources | Natural Resources | 1 | 4.2% | 2 | 11.3% | 3 | 1.5% | |

| JPM Natural Resources | Natural Resources | 1 | 2.8% | 2 | 8.7% | 3 | 0.5% | |

Data source: Morningstar

There is another fund that invests in energy companies, the Schroder ISF Global Energy fund, which is in the Investment Association’s Global Sector. It has also had a good run recently and was showing a four-week return of 6%.

Explore: Top Investment Funds | Transferring an Investment Account | Free regular investing

The largest holdings in these funds are the major oil companies such as Shell (LSE:SHEL), BP (LSE:BP.), ConocoPhillips (NYSE:COP), Exxon Mobil (NYSE:XOM), TotalEnergies SE (EURONEXT:TTE) and Chevron Corp (NYSE:CVX). The fortunes are closely linked to the price of oil. During 2020, when the world went into lockdown, the price of oil fell as demand plummeted. It then started to recover during 2021 and that continued through the first half of this year. Partly because of increased economic activity, but also exacerbated by Russia’s invasion of Ukraine.

The price of Brent crude, which briefly dropped below $20 per barrel in April 2020, rose to over $120 earlier this year.

During the summer the narrative changed. Global economies were struggling with record levels of inflation, interest rates were rising, and the focus turned towards the threat of a global recession. Perhaps the demand for oil would not be as high as previously thought. By the end of September, the oil price had dropped to around $85 per barrel.

- How to become a successful long-term investor

- Seven biases that could be hitting your investment returns

- Listen to the latest On the Money podcast: why investors are deserting funds, but should not panic-sell

Since then, the price has started to strengthen again. There are a couple of contributing factors. On 5 October, OPEC+, which includes Russia, announced that from this November it was going to cut its global output by two million barrels per day. That is equivalent to about 2% of global usage. According to them, it is due to the “uncertainty that surrounds the global economy and oil market outlooks”, and they say that it is necessary to maintain stable energy markets. Others are not convinced and see it to keep prices high. It could also be a political move, coming just before the European Union embargo on seaborne Russian oil imports comes into effect in December.

So far, the price of oil has gone up by only around 10%. However, if supply remains constrained and demand increases (which it could if China relaxes its Covid restrictions), then we may well see it rise another 25%, taking it back to where it was earlier this year.

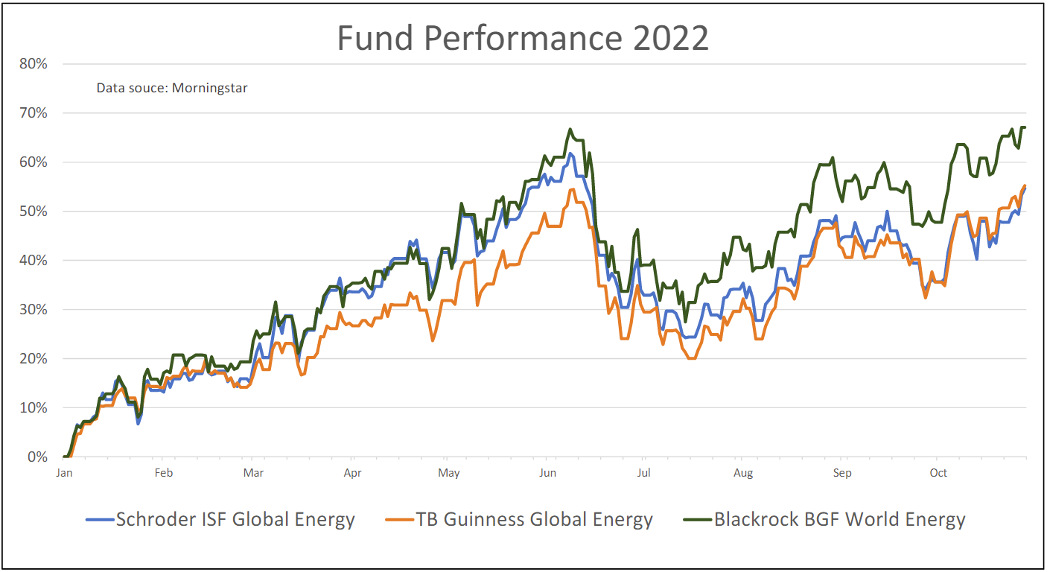

Energy funds have moved in sync with the oil price. They started the year well and in January our demonstration portfolios began investing in the TB Guinness Global Energy fund and some of the other commodity funds. Later we added the Schroder ISF Global Energy fund.

In June, they started to fall in value, so we sold most of our holdings but kept a small position in the TB Guinness Global Energy fund until September.

Past performance is not a guide to future performance.

With most funds showing losses so far this year, these ones have bucked the trend and we profited from holding them earlier in the year. We now have to consider whether it is time to go back into them again.

For the time being, we have decided to wait and see if they continue their current trajectory, or whether they struggle to get above the highs that we saw earlier in the year.

For more information about Saltydog, or to take the to-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.