Volatility triggers Premier League funds overhaul

3rd February 2016 10:40

by Rebecca Jones from interactive investor

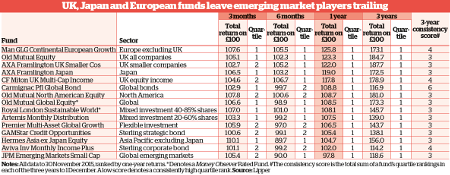

Of the 15 funds selected for our sister magazine Money Observer's Premier League in the annual review in November, only three made the grade over the past quarter as a late relief rally gave fresh impetus to rival players.

These stalwarts were , and , which have proved their worth as top players in our all-star fund league.

The Premier League aims to highlight and celebrate the best-performing open-ended funds and managers from each of the Investment Association's 15 most popular fund sectors.

To gain a place in the league, a fund must have consistently outperformed the funds in its sector in each of the past three years, have had the same manager at the helm throughout that period and have more than £10 million of assets under management.

Premier League explained

To assess performance, we review total returns over three years and the consistency of short-term returns during that time, looking for the funds that reliably outperform.

Funds that meet all of the criteria may still not make the league if they are soft- or hard-closed to new investors, impose large initial charges, are not widely available to buy or are too niche to represent their sectors.

In each of our quarterly reviews, a fund's most recent annual return must also be in the first or second quartile of its sector.

Sectors we have excluded include targeted absolute return, specialist and property. This is due to the wide variety of regions and asset classes they cover, which we do not feel makes for a fair comparison.

We have also excluded the global emerging markets bond, mixed investment 0-35% shares and global equity income sectors, because of the relatively small number of funds in each.

Major indices across the globe enjoyed a brief respite from an otherwise disappointing year in the three months to 1 December. The and Euro Stoxx indices returned 3.6% and 3.8% respectively over the period.

Meanwhile, the US's S&P 500 gained 8.2% and China's Shanghai Composite returned 9.4%. The latter enjoyed a welcome break from a torrid summer during which Chinese markets lost more than 20% of their value.

Strong returns from Japan and North America

Accordingly, our league players from the Asia ex Japan and North America sectors delivered the strongest returns over the quarter.

- a new entrant to the league - returned 10%, and regular fixture returned 8%.

Over one year, Europe, the UK and Japan lead the packThe weakest returns among our group came from our bond funds, and , which delivered 1.1% and 0.6% respectively over the three months to 1 December as bonds continued on a relatively flat path for the year.

The picture is markedly different over one year, however. Over that timeframe, Europe, the UK and Japan lead the pack.

Again, this reflects the situation in wider global markets, where Japan and the non-blue-chip segment of the UK market performed particularly well over the year.

In the 12 months to 1 December, Japan's Topix index returned 14.4%, while the FTSE 250 returned 12.8% - both significantly outperforming the US's S&P 500 index (6.2%) and the MSCI Asia ex Japan index, which shed 7% over the same period.

European star

There is greater disparity in Europe, where the Euro Stoxx index gained just 1.3% over the year to 1 December, while our European league member, , gained an impressive 25.8% over the same period.

This makes the fund the best performer in our squad over one year, as well as the best in the Europe ex UK sector, which returned an average of just 4.9% over the same period. Arguably, this underlines the value that can be added by a good active fund manager.

The current manager of Man GLG Continental European Growth is Rory Powe. He began running the fund on 1 October 2014, and so its spectacular year can be attributed to him.

Danish jeweller Pandora, accounts for 7.4% of the fundPrior to his tenure, the fund was largely invested using computer-driven trend data, and its holdings numbered in excess of 200. On taking over the fund, Powe's first move was to slash the number of stocks to just 10. He added a further 20 on 2 October 2014 and has added only four more since.

The manager's top 10 holdings account for more than 50% of his total portfolio. Evidently, this highly concentrated, high-conviction style has paid off. His top holding, Danish jeweller Pandora, accounts for 7.4% of the fund.

The firm's share price rose by 66% over the year to 1 December, making it a stand-out winner for Powe. In an interview with Money Observer in December he said he simply looks to invest in "Europe's strongest companies". So far, he seems to have done just that.

UK bright spot

Our other top outperformers over one year come largely from the UK. was the second best performer, with a return of 23.3%.

This made the fund the third best performer in the UK all companies sector - the Investment Association's largest, containing more than 270 funds - over the period.

The fund, managed by the highly rated Richard Watts since 2010, also has the second best three-year performance in our current lineup, having returned close to 85%.

Making a welcome re-entry to the league in this review is , which achieved the third best one-year performance, with a return of 22%, and the best performance over three years, with a return of nearly 88%.

This fund, managed by young rising star Henry Lowson since 2012, is a true smaller companies vehicle in that it has less than 18% in medium-sized companies; it maintains a large weighting to consumer products and industrial companies (41.5%).

Our final top UK fund over one year is , which is also a new entry in this review. The fund returned nearly 18% over the 12 months to 1 December.

The most disappointing returns over 12 months came from emerging markets and AsiaIt is the fifth-best performer in the league over that period, and the second-best performer in the 80-fund UK equity income sector.

It has been managed by small- and micro-cap expert Gervais Williams, alongside Martin Turner, since its inception in 2011 and boasts an attractive yield of 3.8%.

Emerging market falls

The most disappointing returns over 12 months came from emerging markets and Asia, where a brief end-of-year rally wasn't enough to mitigate a devastating summer of sell-offs.

delivered the weakest return among our squad, shedding 2.2% over the period. However, this amounted to the third best return in the global emerging markets sector, which lost an average of 12.8% over the year to 1 December.

Hermes Asia ex Japan Equity - our best performer over the quarter - returns to the bottom three over one year, with a return of just 4.7%. Again, however, this compares well against an average loss of 6.2% from its sector over the period, making it the fourth best performer overall.

The fund is also the best performer in the sector over three years, having returned 56%. That is testament to the skill of Jonathan Pines, who has managed the £1 billion fund since 2012. He likes technology- and consumer-focused companies.

Bonds also disappointed over the year - as they did over the past quarter - as fixed income continues to be out of favour in a low-interest rate environment.

Our sterling strategic bond offering - GAM Star Credit Opportunities - delivered a total return of 5.4% over the period, while sterling corporate bond fund Aviva Investors Monthly Income Plus returned 2.2%.

Again, however, these were among the best returns in their respective sectors, while annual yields of 4.5% and 3.6% continue to make them attractive funds for more wary income-seekers.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.