Victrex: One to own through thick and thin

2nd February 2018 17:15

by Richard Beddard from interactive investor

Take a look at this...

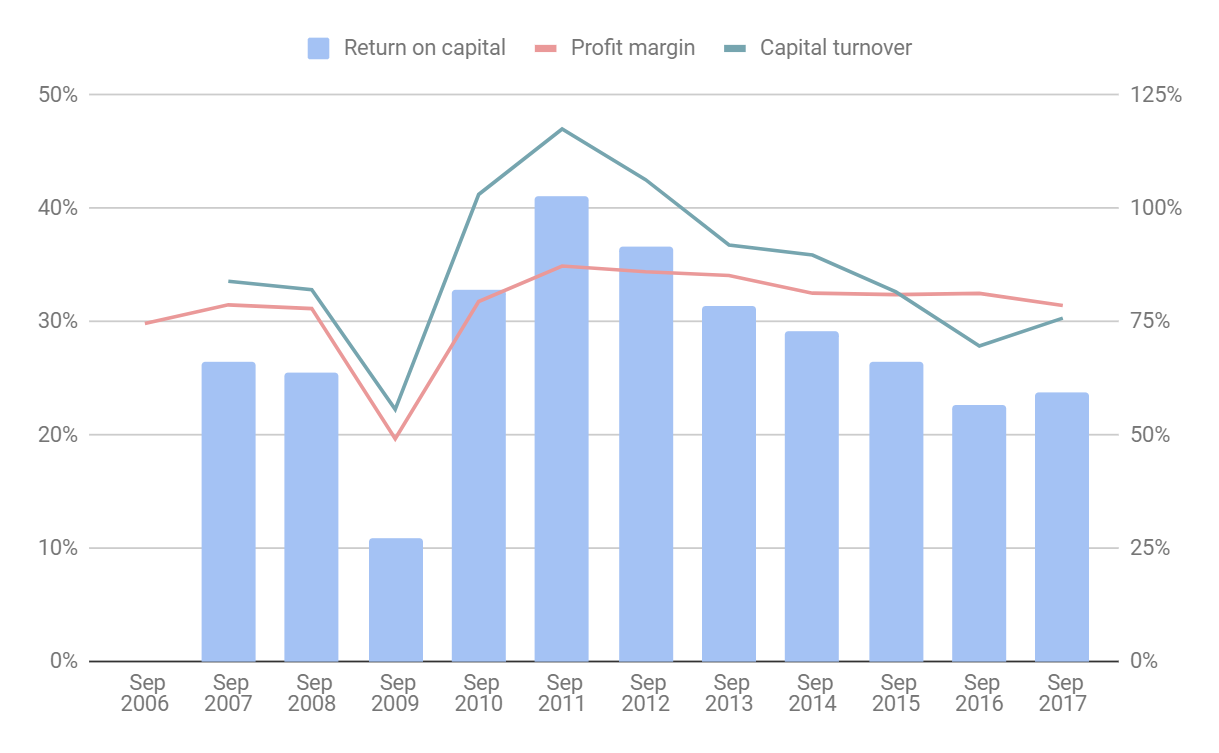

Hmmm... Looks like a good business, high return on capital, stable profit margin. Profitability has fallen, though. Tell me a bit more about the company.

It's . One of my favourite companies and something of an Olympian, not only because of its performance but because of what it does.

The Olympic motto is faster, higher, stronger. Victrex makes a particular kind of polymer (plastic to you and me, or thermoplastic if you want to get a little more technical).

It's lighter and more durable than metal, which means that companies designing parts for planes and cars can improve the efficiency of these vehicles by swapping out metal and swapping in Victrex's PAEK polymers.

The manufacturers also become more efficient because PAEK is injection moulded and doesn't require finishing like metal parts often do. PAEK is also used extensively in mobile 'phones, and medical implants (particularly for the spine).

OK. So what makes Victrex better than all the other polymer manufacturers?

It's a specialist. It only makes PAEK and PAEK composites. Before it was spun out of chemical giant ICI in the early 1990s, it invented PEEK, an especially high performance variant of PAEK.

Most of the PAEK manufactured by Victrex is PEEK. Though the original PEEK patent has long since expired and competitors, large diversified chemical companies like Solvay and Evonik, produce PEEK, Victrex remains the biggest supplier with over half the market's capacity.

It's the only supplier that concentrates all its efforts on the polymer family. Victrex continually develops new grades and forms of PEEK, and in recent years it's started moving downstream, into the manufacture of semi-finished and finished parts, a strategy it calls "Polymer and Parts".

As it does so, its inventing new chemistries and processes it can patent, and extending its know-how. It says no other producer of PAEK is doing this.

And profitability? Why's it fallen from that great height. Is Victrex experiencing more competition?

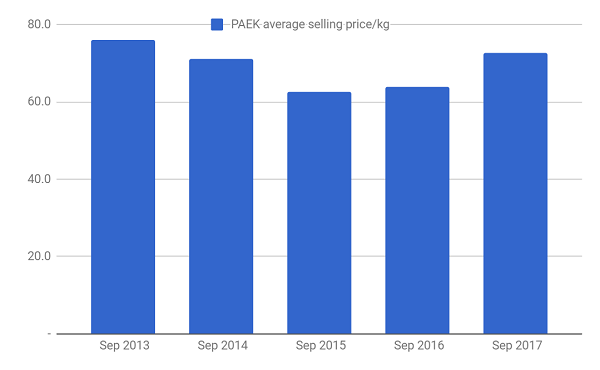

It is, at the commodity end of the market, which probably explains why Victrex is always developing the material and pushing into new markets. But I think Victrex is withstanding competitive pressures quite well. For the last five years it's published the average selling price it's achieved and it's reasonably stable.

The biggest factors in the variation you can see in the chart are movements in exchange rates, because Victrex exports 98% of PAEK by revenue, and by what the company euphemistically terms "the large Consumer Electronics order", widely thought to be material used in iPhones.

Demand tends to rise dramatically before a new iPhone model is launched, but since it involves high volumes of relatively modestly priced polymer, it lowers Victrex's average selling price. The high selling prices achieved in the year to September 2017, and four years earlier, were achieved when the pound was relatively weak, and the amount of polymer Victrex supplied for consumer electronics was relatively low.

If you look at the chart at the top of the page, profit margins have remained stable, but capital turnover, the capital tied up in the business compared to revenue, has declined. Return on capital is a product of profit margins and capital turnover, so it is declining capital turnover that has done the damage to return on capital.

The company is less profitable, despite growing revenue, because there is more than twice as much capital tied up in the business today as there was five years ago. That's because in 2012 Victrex began investing heavily. First to dramatically increase its manufacturing capacity, and more recently to support its move downstream.

I'm not saying profit margins won't fall. The company says it's prepared to sacrifice some margin if the overall profit opportunity is great enough.

OK, tell me more about this move downstream? What can we expect from it?

It's not a completely new development. Victrex has been edging downstream for a long time. In 2009, it produced its first semi-finished product, Activ film, which is used in consumer electronics and earns the company in excess of £20 million a year.

But Victrex sees an opportunity to add between 10 and 20% to revenue over the medium term by proving PEEK in new markets where no products or manufacturers currently exist.

This means it must partner with manufacturers, or buy in manufacturing expertise, to produce parts that it can demonstrate perform better than existing ones made from metal. Following the acquisition of Kleiss Gears, for example, Victrex has signed its first production agreement with a major European car manufacture, it will supply lighter and quieter gears.

Breaking into new markets that have used alternative materials for a long time is challenging though, and it's not clear how long it will take to commercialise Victrex's six biggest new projects, all of which the company expects to earn more than £50 million a year at their peak.

Victrex has formed a joint venture with Tri-Mack to produce composite loaded brackets for aircraft, and says it's closing on an agreement with a major dental implant manufacturer. Progress can be slow though, and in 2017, despite investing £10 million in its partner, Magma, Victrex earned less money from the Magma m-pipe programme than it did in 2016, when it breached the £1 million revenue mark for the first time.

M-pipe is a PEEK/carbon fibre/glass fibre composite pipe that can withstand the high pressures and temperatures of deep oil wells.

Phew, bit complicated innit?

It is quite a complicated story. Victrex must keep innovating if it's to stay ahead of the competition and develop new markets. Profitability fluctuates considerably depending on the state of the economy, interest rates, and with demand for consumer electronics devices, and this can obscure the overall growth trend.

Also David Hummel, chief executive since management bought the company out of ICI in 1993, is bowing out. It always makes me nervous when somebody as influential as him goes.

But Victrex is one of a kind, investing heavily to remain one of a kind, and its grown revenue and profit by nearly 150% over the last 11 years while at the same time generating enough surplus cash to pay shareholders special dividends. The company sees many opportunities to increase the polymer content of our cars, planes, electronics, oil pipelines and the human body.

The shares are not obviously cheap, a share price of £25.50 values the enterprise at over £2 billion, or about 23 times adjusted profit. But I think it's a good share to hold for the long-term, if you can withstand the inevitable buffeting that will come when the economy falters.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

ii publishes information and ideas which are of interest to investors. Any recommendation made in this article is based on the views of the writer, which do not take into account your circumstances. This is not a personal recommendation. If you are in any doubt as to the action you should take, please consult an authorised investment adviser. ii do not, under any circumstances, accept liability for losses suffered by readers as a result of their investment decisions.

The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.