US funds back in the spotlight, but should you buy?

Saltydog investor made no changes to his portfolio last week, although he is ready to act.

12th April 2021 17:28

by Douglas Chadwick from ii contributor

Saltydog investor made no changes to his portfolio last week, although he is ready to act.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After last year’s ‘coronavirus crash’, the market recovery was led by the US and the large technology stocks in particular. The Nasdaq index went up by over 40% in 2020, even though it lost 14% in the first quarter.

The UK markets fell further and did not bounce back as quickly, however they have performed better in recent months. Last week, the FTSE 100 closed above 6,900 for the first time since February 2020, and the FTSE 250 has recently broken through 22,000 for the first time in its history.

Each week, we look at the performance of the Investment Association (IA) sectors over various different time periods. We focus on the four-week return as an early indicator that a trend is beginning to form.

At the beginning of the year, the best-performing sector, based on its four-week return, was UK Smaller Companies.

- How Saltydog invests: a guide to its momentum approach

- Stocks that made you a fortune in the 2020-21 tax year

- Check out our award-winning stocks and shares ISA

Towards the end of January, the China/Greater China sector took the lead and remained in the top spot all the way through February. The UK equity sectors continued to perform reasonably well, and by March were dominating the tables again. Throughout March the UK Equity Income sector had the best four-week returns, but the UK All Companies and UK Smaller Companies sectors were never far behind.

Where we invested our demo funds

Our demonstration portfolios started investing in funds from the UK equity sectors in November, when this trend first emerged. We currently hold these funds: Artemis UK Select, Schroder Income, Franklin UK Smaller Companies, Premier Miton UK Smaller Companies, Marlborough Nano Cap Growth and FP Octopus UK Micro Cap Growth.

In last week’s analysis, the UK equity sectors were still looking good, but others had done slightly better.

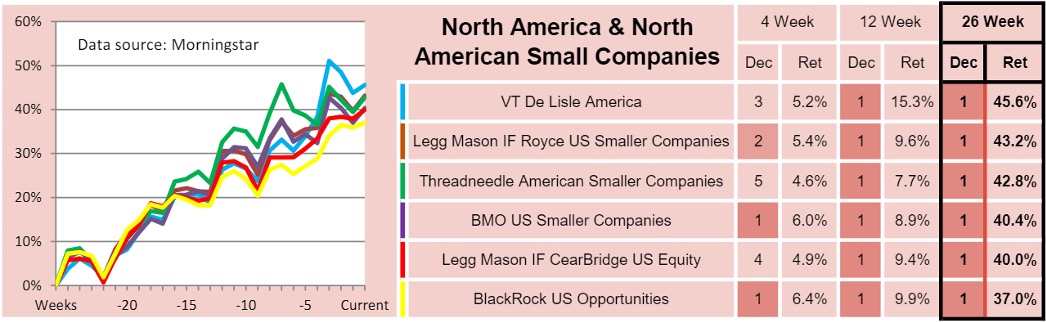

The UK Smaller Companies sector was showing a 4.0% four-week gain, UK All Companies was up 2.5% and UK Equity had made 2.3%. However, in the lead was the combined North America and North American Smaller Companies sector, up 5.2% followed by Global Equity Income, up 4.7%.

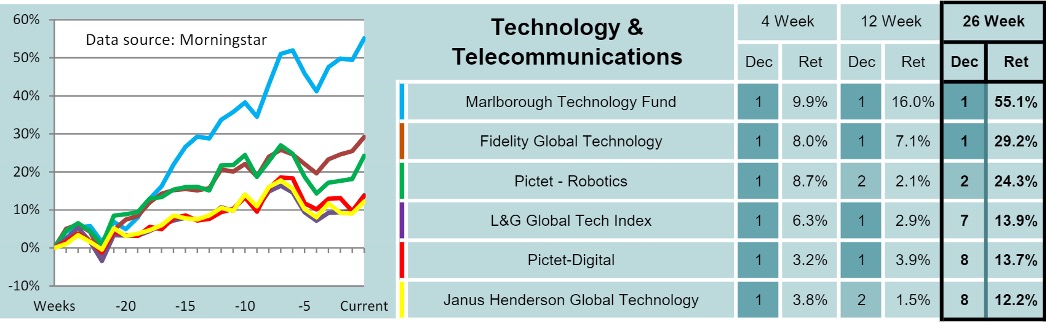

The Technology and Telecommunications sector had the best one-week return, gaining 3.4% and lifting its four-week return up to 4.7%.

As well as providing our members with performance data on the IA sectors, we also highlight the leading funds over four weeks and 26 weeks.

In the North America and North American Smaller Companies sectors, we have now identified five funds that have gone up by over 40% in the last six months.

Another fund that caught our eye was the Marlborough Technology fund which has gained 9.9% in four weeks and over 55% in 26-weeks.

We did not make any changes to our portfolios last week. The American and Technology sectors have only just started to outperform the UK equity sectors over four weeks, and this could easily be another false dawn. However, if this trend continues then we look forward to rebalancing the portfolios to take advantage.

- Month in the markets: value rally in US and Europe continues

- How AIM took over the world during the pandemic

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.