US election poll: here’s what you think of Trump and Biden

Events in the US have consequences worldwide, but what’s the biggest concern for our customers?

26th October 2020 10:25

by Myron Jobson from interactive investor

Events in the US have consequences worldwide, but what’s the biggest concern for our customers?

Historically US markets have tended to do better under a Democrat than a Republican. But it has been a remarkable year to date for US companies, which could in part explain why more investors believe US equities would benefit most from a Donald Trump victory over Joe Biden in the upcoming US Presidential elections.

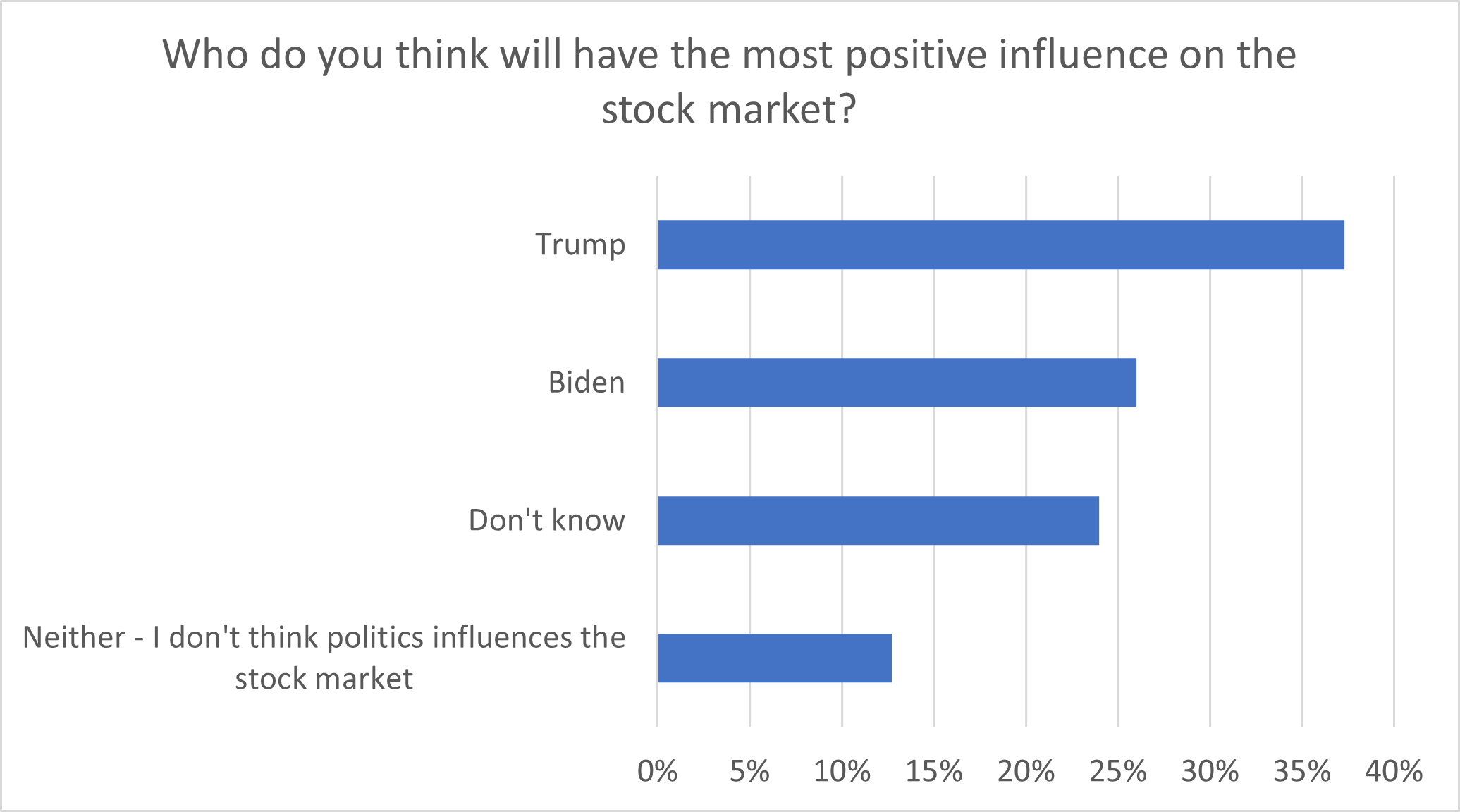

An interactive investor survey of 1,809 visitors to its website, conducted between 19 to 21 October, revealed that while a divisive figure, 37% of investors believe the re-election of Donald Trump would have the most positive influence on the stock market, while 26% said the same for Joe Biden.

One in four (24%) said they didn’t know and 13% believe politics does not influence the stock market.

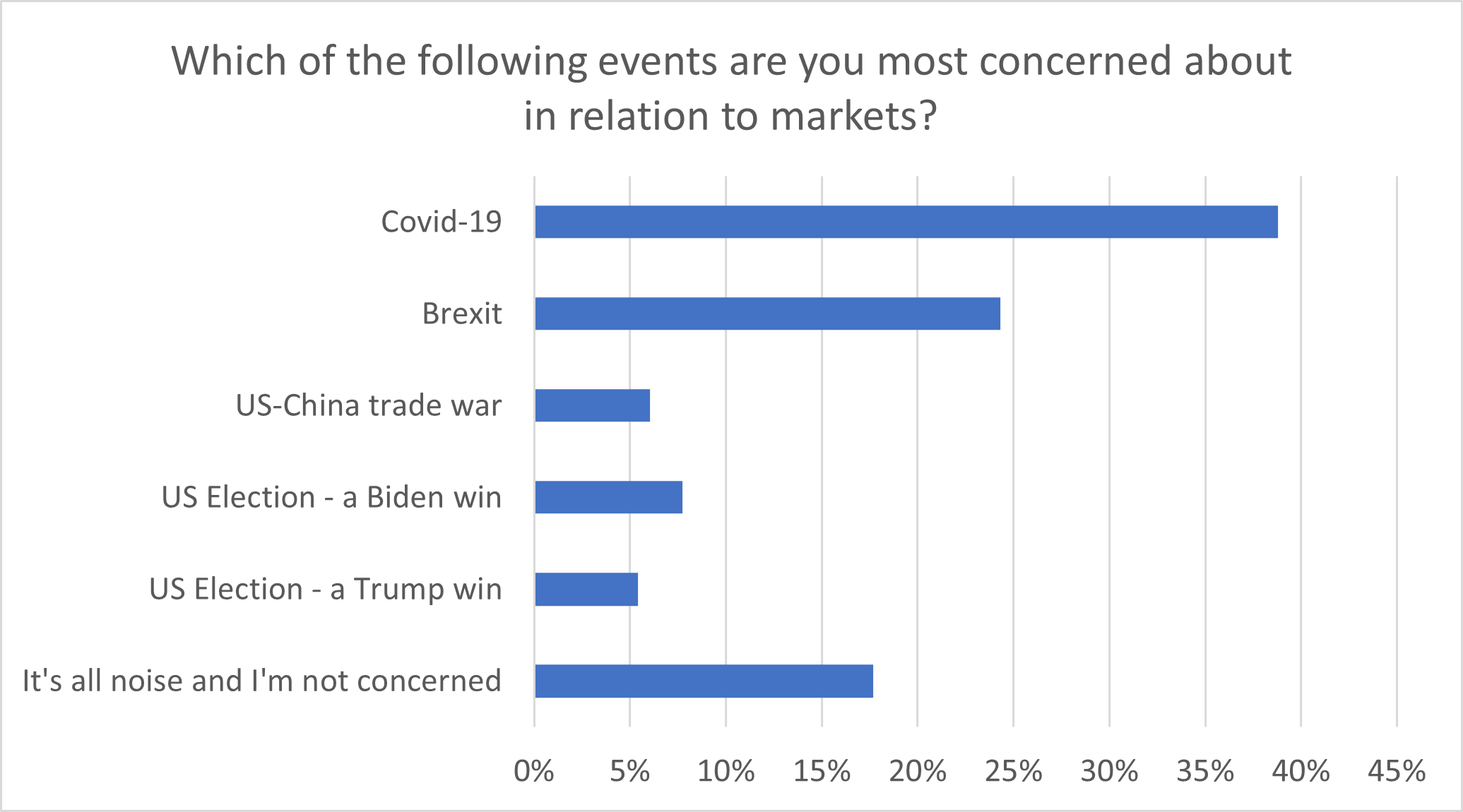

However, the US election ranks low in the list of events that concern investors. Covid-19 pandemic is the most pressing concern for 39% of respondents, ahead of Brexit (24%). Respondents are more concerned about a Biden victory than the US-China trade dispute – although this is from a low base (8% versus 6%), while a Trump victory is at the bottom of the list of worries (5%).

But almost one in five respondents (18%) share the view that ‘it’s all noise’ and are unconcerned about the forthcoming events.

Lee Wild, Head of Equity Strategy, interactive investor, says: “There are just days to go until we find out who will be next president of the United States, but our customers have more important things on their mind. A second wave of coronavirus infections continues to force regional lockdowns in the UK, and there is a real chance that Britain and the EU will fail to strike a post-Brexit trade deal. The economic consequences of either one, or in combination, have potential to dissuade already sceptical investors from putting money into UK Plc until both issues are resolved.

“A remarkable period for US share prices perhaps explains a belief that Trump is more positive for stock markets than Biden. However, history tells us that US markets typically do better under a Democrat than a Republican. And it is the Democrat candidate that currently leads the polls and who is said to be ready to push the button on massive fiscal stimulus if he wins the presidency. That would be a huge catalyst for a market in desperate need of a boost as a Covid recovery loses momentum.”

Tech giants vs US President

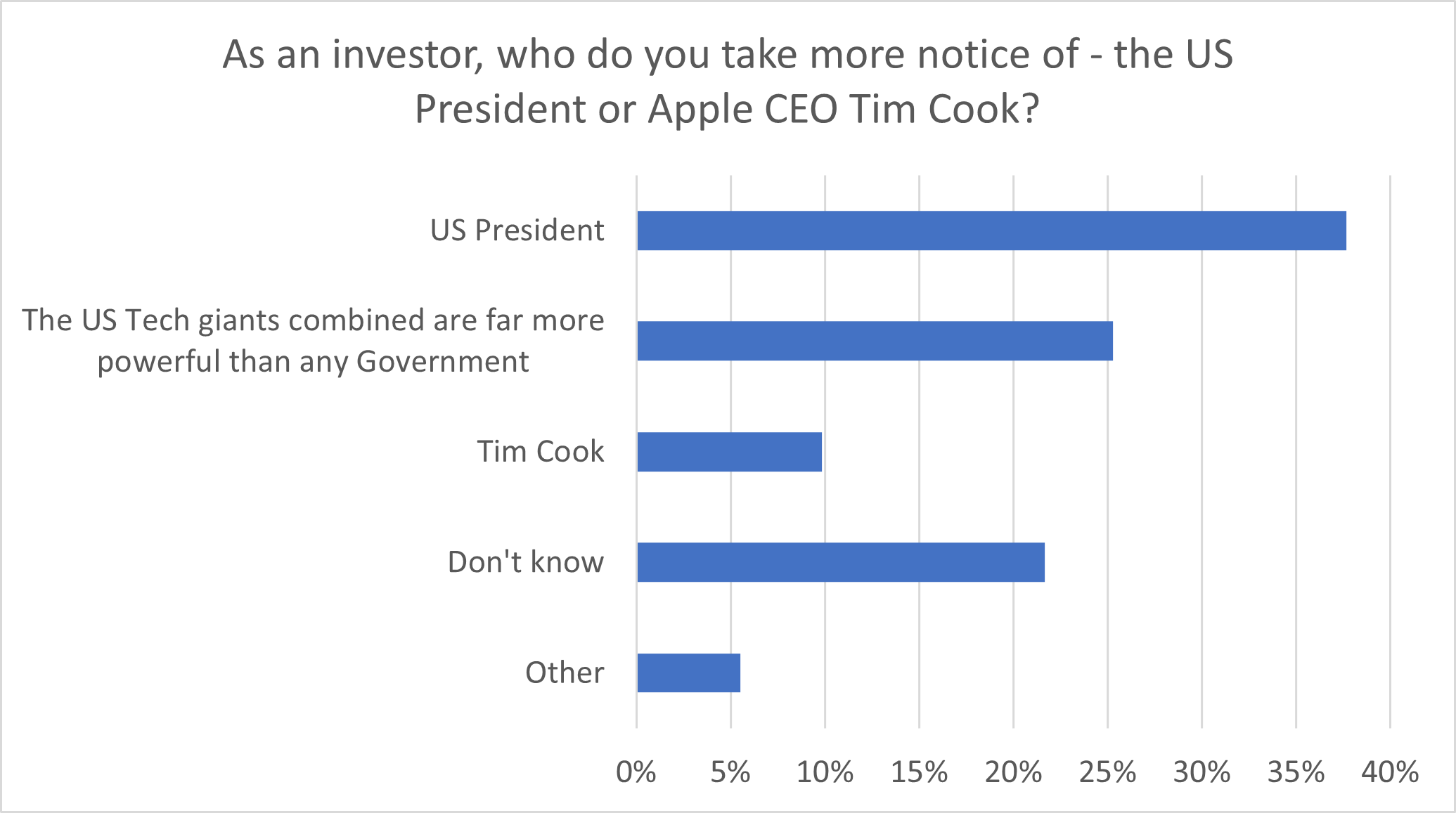

To gauge investors’ sentiment on the increasing influence of the major tech stocks on global markets, interactive investor asked the sample if they take more notice of the US President or Tim Cook, CEO of Apple. The US president came out on top (38% versus 10% for Cook), but one in four (25%) believe the US tech giants are more powerful than any government. 22% said they didn’t know and 6% said they take greater notice of other individuals.

Richard Hunter, Head of Markets, interactive investor, says: “As legendary investor Benjamin Graham noted – ‘In the short-run, the market is a voting machine, but in the long-run, the market is a weighing machine.’

“There is traditionally a slight underperformance in the year leading up to the election, so the current strength of US indices (year to date the S&P500 is up 7% and the Nasdaq 28%) is an exception, driven by a post-pandemic relief rally which has resulted in markets nudging all-time highs.

“Shorter term volatility becomes more likely depending on the likelihood of a sweep of both House and Senate, thus enabling future bills to pass with a simple majority. Conversely, a split of power has the potential for future political deadlock. Meanwhile, a contested or delayed vote would increase uncertainty in the very short term, with resultant potential pressure on the dollar and some rotation to haven assets.

“Longer term, there tends to be less of an impact with markets reverting to the mean, as investors return to concentrating on the fundamentals. Of course, government policy may affect certain sectors – healthcare sector reform is usually associated with a new President, even though it has not materialised to any radical extent – but for the most part, companies will themselves be responsible for determining the direction of the economy.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.