US companies are doing awesome, actually

Analysts now expect US firms to make a 1% gain in profit this year – pretty remarkable given a predicted earnings slump. That’s worth dwelling on, especially because of what’s driving this strength: good old, underestimated, fundamental performance.

17th November 2023 13:38

by Paul Allison from Finimize

US companies proved once again that they’re just outright excellent when it comes to churning out consistent profit.

Against a challenging backdrop, and against all expectations, it looks like 2023 is shaping up to be a year of profit growth across much of the S&P 500.

And if Wall Street analysts are right, 2024 will be even better.

Earnings season is almost entirely in the bag, and you’ve got to admit, things don’t look too shabby. Some 82% of S&P 500 companies surpassed expectations, blowing past the five-year average “beat ratio” of 77%, despite everybody’s worries. And analysts now expect US firms to eke out a 1% gain in profit for the year – pretty remarkable considering how many people were predicting an earnings slump. That’s worth dwelling on, especially because of what’s driving this strength: good old, underestimated, fundamental performance.

How well did US companies do?

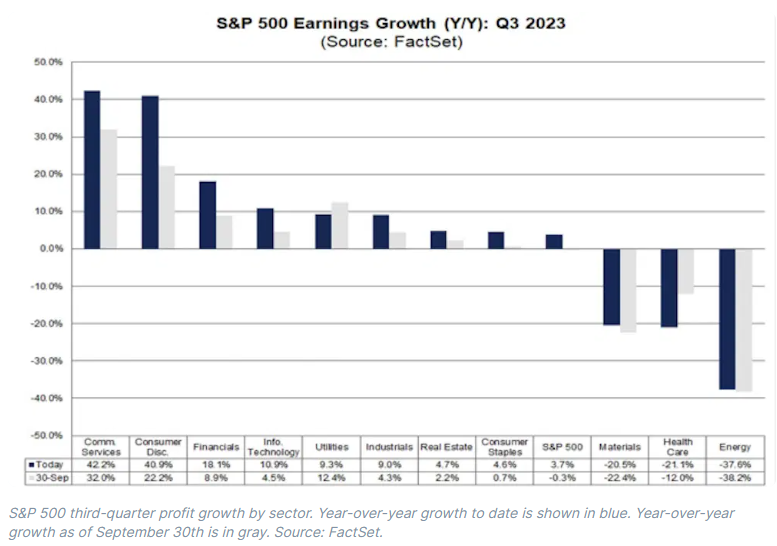

Companies across much of the S&P 500 have seen their profits expand this year. Eight of its 11 sectors managed to grow profit, with all eight performing better than the index itself (fourth from right).

When you unpack the details of these companies’ results, it’s clear that just a few mega-firms are propping up the overall performances. Just look at the communication services and consumer discretionary sectors: those growth rates in the 40% neighborhood are mostly down to a handful of large firms, like Meta Platforms Inc Class A (NASDAQ:META) (communication services) and Amazon.com Inc (NASDAQ:AMZN) (consumer discretionary). And, actually, if you take just those two out of the equation, then those growth rates fall to 29% and 23%, respectively. And let’s face it, that’s still pretty amazing profit growth.

Other, non-mega firms in sectors like industrials and consumer staples, meanwhile, also churned out solid growth.

And then there’s the tech sector itself. Its 11% profit growth is good, yep, but you can hardly say it explains all the index’s growth.

Here’s my point: today’s so-called magnificent seven (Alphabet Inc Class A (NASDAQ:GOOGL), Amazon, Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), Meta, NVIDIA Corp (NASDAQ:NVDA), and Tesla Inc (NASDAQ:TSLA)) might be responsible for a big part of the US stock market’s gains this year, but the actual underlying strength in other areas of the market stretches beyond these stock price leaders. Viewed another way: while these market leaders’ stocks have gone up in line with their fundamental performance (or even more so in some cases) other stocks haven’t. That means their valuations have actually contracted.

Now, I don’t want to sound like a broken record, but the profit picture is really pretty good.

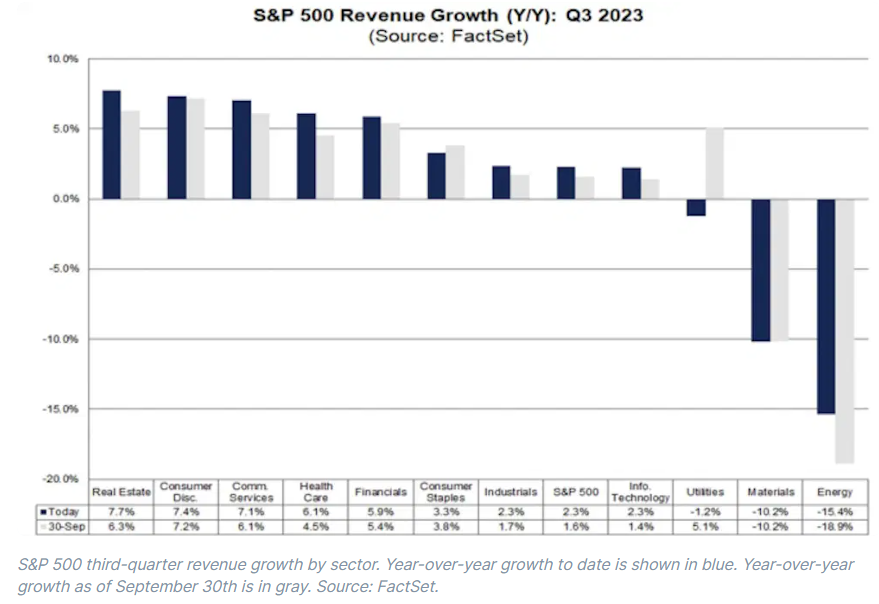

Just take a look at this next chart, which shows revenue performance for the third quarter.

Yes, revenues did grow in the third quarter – by 2.3% – but that’s slower than the quarter’s profit growth, and that can only mean one thing: wider profit margins. And take a look at all the sectors: only in materials, healthcare, and energy did margins actually shrink – meaning profit either grew more slowly than revenue or it declined faster. And for materials and energy, revenues do tend to fall with lower commodity prices – which has happened. And it’s nearly impossible to grow margins when revenues do that.

So what’s the big takeaway here?

It’d be a stretch to say US firms had their backs against the wall this year – the seemingly inevitable recession hasn’t yet materialized, after all. But it’s been a worrying year all the same.

When there’s any sort of trouble in the forecast, bosses tend to be quick to streamline the business, improve efficiency, and trim the fat where they can – sort of battening down the hatches before a coming storm. Later, after the storm passes (or maybe changes course), revenues start to roll in on a lower cost base. And if some of those expenses that were slashed had been fixed costs (meaning: not tied to sales growth), then those would be permanent cost savings, and any new revenue would convert to even more profit. So think about it: the margin improvements that firms delivered this year will likely hang around into next year, and the year after that. That’s a very good thing for future growth.

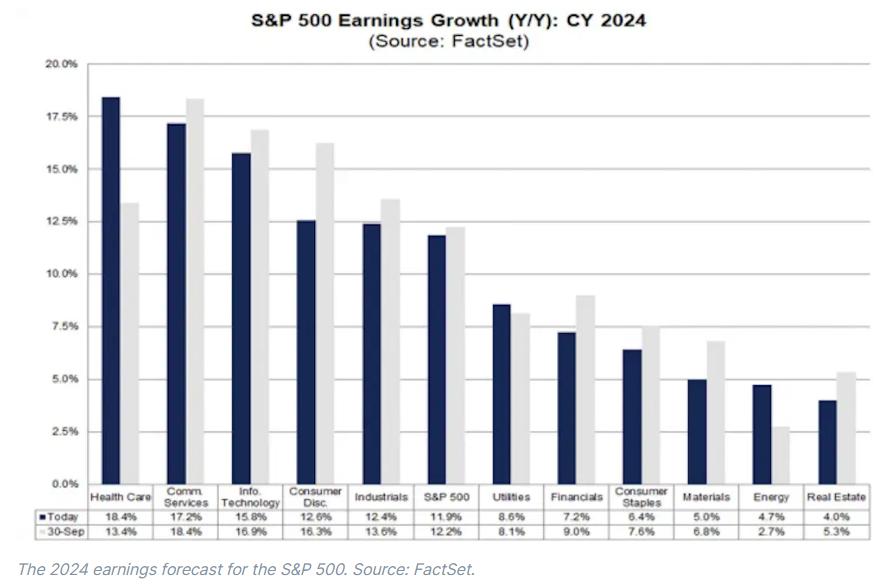

As for that future, well, we already saw that analysts now think 2023 will be a year of surprising – albeit modest – profit growth. With less than three months remaining, there’s a decent chance that forecast is accurate. And next year, things may look even more interesting. This chart shows what analysts expect from earnings growth in 2024.

If they’re right, that 12% earnings growth would mark one of the fastest paces in the past decade. Only 2018 saw speedier growth – though to be clear, I’m ignoring the bounce back in 2021 after the Covid earnings recession. That’s incredible – especially when you consider that interest rates are higher, global trading conditions are tougher, and there are two hot wars raging on.

Look, this might seem obvious, but it’s just really important to take a step back sometimes from the cacophonous market noise. American companies are machines at cutting costs and finding ways to grow profit over time, no matter what the economy’s doing. That’s worth remembering the next time the market takes a dip.

Paul Allison is a senior analyst at finimize

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.