US bank sector review: stocks to buy, hold and sell

20th October 2021 10:03

by Rodney Hobson from interactive investor

Tailwinds are building for banking empires. Here’s where our overseas investing expert thinks the good times have further to roll, and where they don’t.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Back in the 2008 financial crisis, banks were too big to fail; in the pandemic crisis they have proved to be too strong to fail. American banks are bouncing back with a boom in dealmaking that has boosted third-quarter profits.

The low interest rates that have held back profits in consumer banking have been the spur to increased activity in mergers and acquisitions. It’s a timely reminder that whatever the economic circumstances, there is always at least one part of any banking empire that can thrive at any given time.

Another plus point is that cash set aside in earlier years to cover potential losses caused by Covid-related shutdowns is being added back into profit figures. That’s because the impact of the pandemic has been less severe than expected, and loan defaults have been much lower than the pessimistic provisions banks were forced to make to appear prudent.

Since the extraordinary circumstances of the past two years have created the scope for pent-up demand to be released, it is likely that the good times for banks have further to roll, notwithstanding the likelihood of supply chain disruptions upsetting economic calculations into next year.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Read more of Rodney's articles here

So far, US consumers have managed to cope with rising prices, while the industrial and manufacturing sectors have survived September shutdowns during the hurricane season and shortages of computer chips.

JPMorgan Chase & Co (NYSE:JPM) set the ball rolling with a 24% rise in net income to almost $11.7 billion in the three months to 30 September and, although revenue increased by only 1% to $29.65 billion, that was a big improvement on the 7% drop in the second quarter. The big surge came in the global investment banking division thanks to a stream of initial public offerings, mergers and acquisitions.

The bank released $2.1 billion in provisions from loan losses; taking this, and a one-off income tax benefit out of the calculation took underlying profits down to a still healthy $9.6 billion against analysts’ expectations of about $8.9 billion.

- ii view: JP Morgan earnings boosted by US economic growth

- Where to invest in Q4 2021? Four experts have their say

The shares are around their five-year high at around $168, but they still offer a decent yield of 2.4% and the price/earnings (PE) ratio is an undemanding 10.6, so there is plenty of scope for further share price rises on top of gains recorded since I tipped the shares at $115 in September 2019.

Source: interactive investor. Past performance is no guide to future performance

The surge in dealmaking also helped Morgan Stanley (NYSE:MS) to triple its advisory fees to $1.27 billion, which boosted revenue in the investment banking arm by 67% to $7.5 billion. Group net revenue rose 26.5% to $14.8 billion, with net income 5% higher at $3.85 billion.

Its shares have had a fantastic run from $20 at the depths of the pandemic to more than $100. The yield is down to 1.73%, but that reflects the bank’s phenomenal run of boosting earnings per share in recent years. The PE rating is still quite undemanding at 12.9. It wouldn’t be wrong to take profits but, if you do, look for a chance to buy back in if the recent share price weakness runs much further.

Source: interactive investor. Past performance is no guide to future performance

It was a similar picture at Bank of America (NYSE:BAC), where a 65% jump in advisory fees enabled the investment banking arm to increase fees earned by 23% to $2.2 billion. This was another bank able to release previous bad loan provisions. Particularly encouraging was a rise in spending on credit and debit cards, an area that held back the banking sector while consumers feared for their jobs.

Overall, net income soared by 64% to $7.26 billion, a really impressive performance, with revenue 12% ahead at $22.8 billion. The bank claimed, with some justification, that it had returned to the momentum that it enjoyed before the pandemic.

Bank of America’s share price recovery is somewhat less spectacular than Morgan Stanley’s but is still pretty good, going from just under $20 to $46.50. The yield is 1.6% and the PE is 13.8, making the shares look fully valued.

Source: interactive investor. Past performance is no guide to future performance

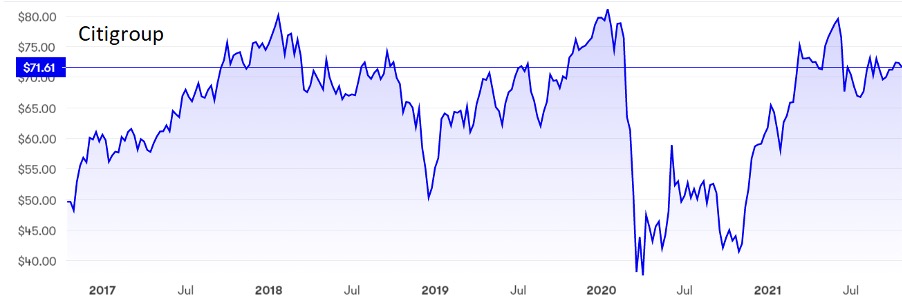

Citigroup (NYSE:C) also benefited from a strong showing in advisory fees to raise investment banking revenues by 39% to $1.9 billion. It, too, released bad debt provisions, to the tune of $1.16 billion, so although total revenue slipped by 2% Citibank was able to boast a 48% rise in net income to $4.64 billion.

The shares have come off the boil recently, opening up a possible buying opportunity at around $72. The yield is among the most appealing in the sector at 2.85%, while the PE is only 7.34. Investors should be warned, however, that Citigroup has hardly moved since I thought they merited considering just below $70 two years ago.

Source: interactive investor. Past performance is no guide to future performance

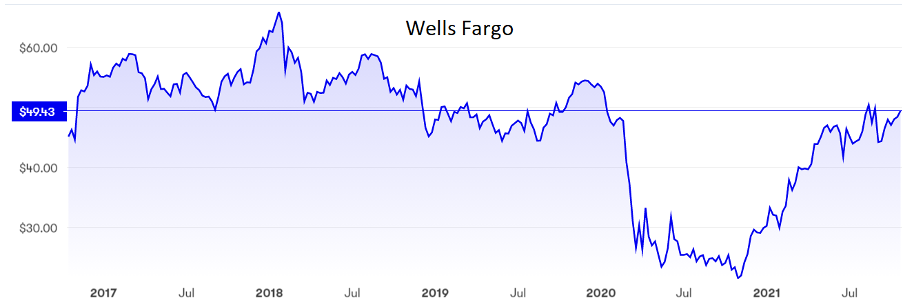

Wells Fargo (NYSE:WFC) does not quite fit the general picture, as it is still paying the price of a mis-selling scandal dating back five years – $250 million in the latest quarter. However, it too benefitted from a $1.7 billion writeback of loan loss provision as it raised net income by 59% to $5.12 billion.

It is facing softer demand for loans and seeing margins on those loans it does make being squeezed by low interest rates, so more than its rivals it will be hoping US interest rates start to edge up soon.

At $50, the shares remain clearly below pre-pandemic levels, although they are well up on my 2019 recommendation at $30. They look riskier than other major US banks but the potential rewards, once past misdemeanours are out of the equation, are correspondingly greater. Meanwhile, though. The yield is only 1%.

Source: interactive investor. Past performance is no guide to future performance

Hobson’s choice: JP Morgan has a recent history of getting the US banks’ reporting season off to a great start and its shares still rate a buy even though the best chance to get in has gone. I’d be inclined to sell Morgan Stanley, as the shares have run ahead of themselves, but to hold at Bank of America, which is up about 50% on my 2019 recommendation. Buy Citigroup below $73, a potential ceiling. The downside looks limited to $67. Wells Fargo is only for those with an appetite for risk, otherwise sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.