US bank sector results: this stock is the best buy option

After examining latest earnings reports from some of the world’s biggest banks, analyst Rodney Hobson reveals his favourites.

22nd January 2025 09:06

by Rodney Hobson from interactive investor

American banks have entered the New Year in great spirits following a profitable final quarter in 2024 in which they beat analysts’ forecasts. There are hopes of favourable policies towards the sector from new President Donald Trump, who seems in a hurry to push through his agenda. As always in this kind of situation, investors must decide whether share prices have run too far ahead of future prospects.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

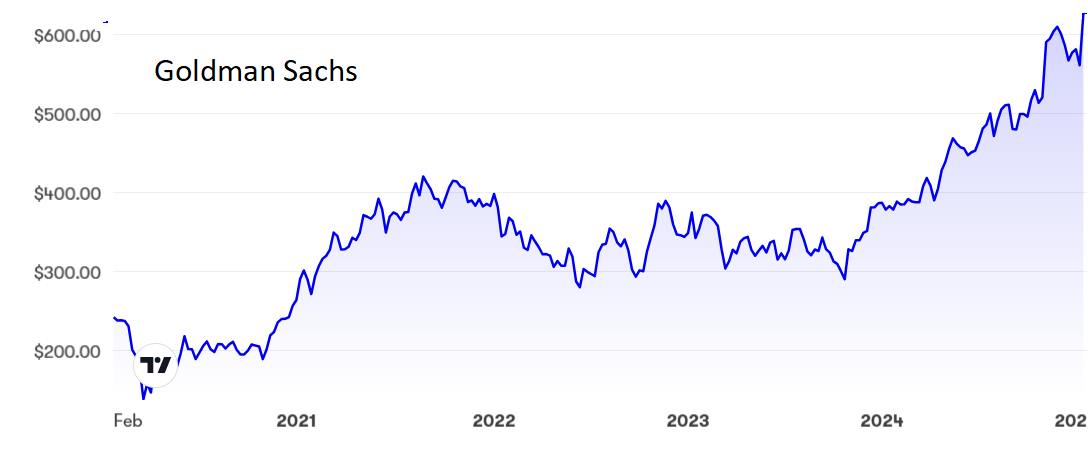

The dearth of dealmaking that was the bane of banks earlier last year has ended with a vengeance. The Goldman Sachs Group Inc (NYSE:GS), which claims to be the leading mergers and acquisitions (M&A) adviser in the United States, said it had spotted a meaningful increase in enquiries about such activity at the larger end of the stock market.

Goldman believes the regulatory backdrop is getting more favourable and the economic outlook "constructive". Clearly it has high hopes that the Trump presidency will reduce the regulatory burden.

Group net earnings more than doubled to $4.1 billion in the fourth quarter of last year, sending earnings per share up to $12.13. Net revenue improved 23% to $13.9 billion, less than a quarter of the leap in profits, but still a great figure.

These were much better results than for the previous nine months, taking the rise in net earnings for all of 2024 to 68% and revenue to 16%.

Global banking and markets led the charge, with revenue up a third in the final three months. Asset and wealth management is trailing, though, with growth in revenue a respectable but less inspiring 7.6%.

Source: interactive investor. Past performance is not a guide to future performance.

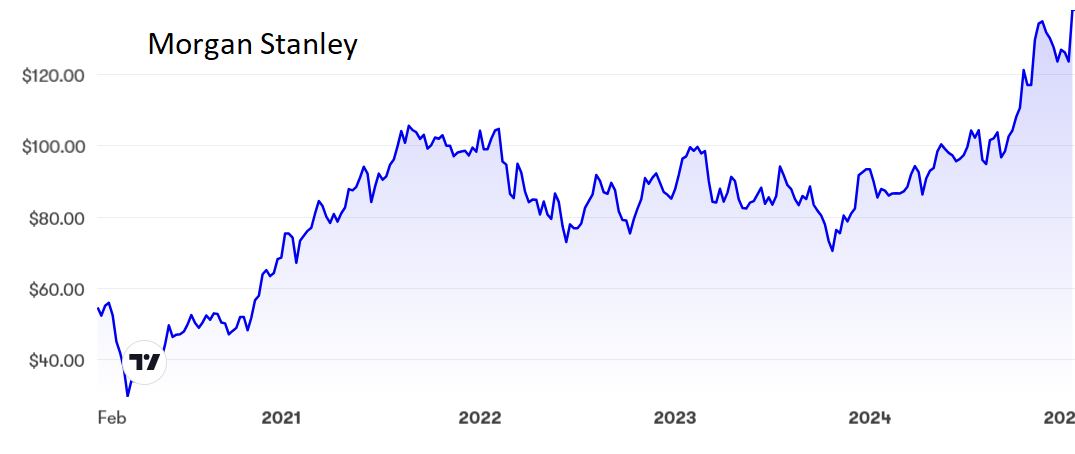

Like Goldman, Morgan Stanley (NYSE:MS) beat expectations in the fourth quarter, driven by growth in investment banking thanks to more M&A activity. Revenue rose 26% to $16.2 billion, a full $1 billion above consensus forecasts, and net income more than doubled to $3.7 billion, with earnings per share at $2.20.

Again, the best of 2024 was saved for the last quarter. For the whole year revenue rose 14% and net income by 47%.

- ii view: new high for JP Morgan after beating forecasts

- What Trump 2.0 means for investments – and funds that could benefit

This improvement will undoubtedly tip over into this year. MS says the M&A pipeline is “at levels not seen for seven years” while corporate finance activity is back to levels last seen in 2020 when interest rates were much lower. The quarterly dividend has been raised again, from 77.5 cents in 2022 to 85 cents last year and 92.5 cents now.

Source: interactive investor. Past performance is not a guide to future performance.

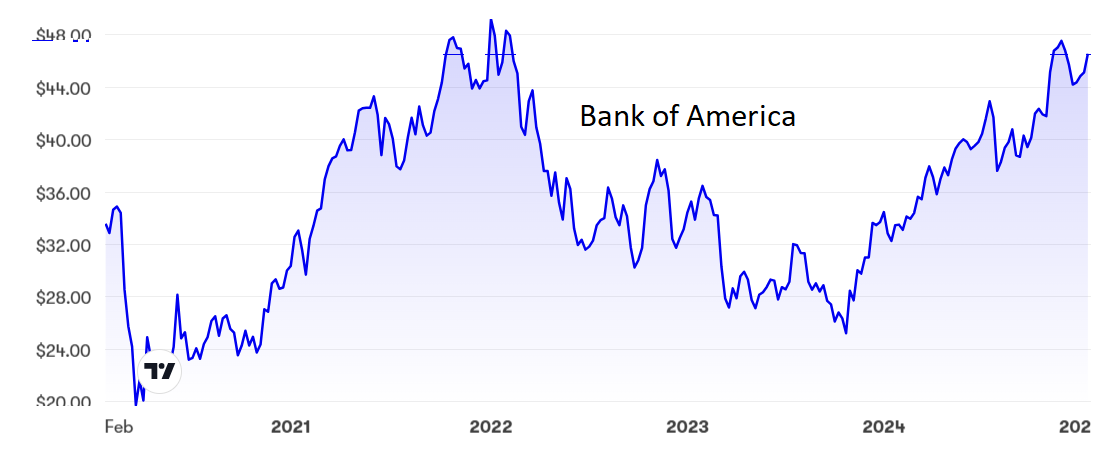

Bank of America Corp (NYSE:BAC) added to the good news with fourth-quarter net income that more than doubled to $6.7 billion on revenue 15% higher at $25.35 billion. This was dramatically better than in the previous nine months, with full-year revenue up just 3.4% and net income up only 2.3%.

BoA expects to do even better in the current quarter and has joined the trend in the sector to buy back shares.

Source: interactive investor. Past performance is not a guide to future performance.

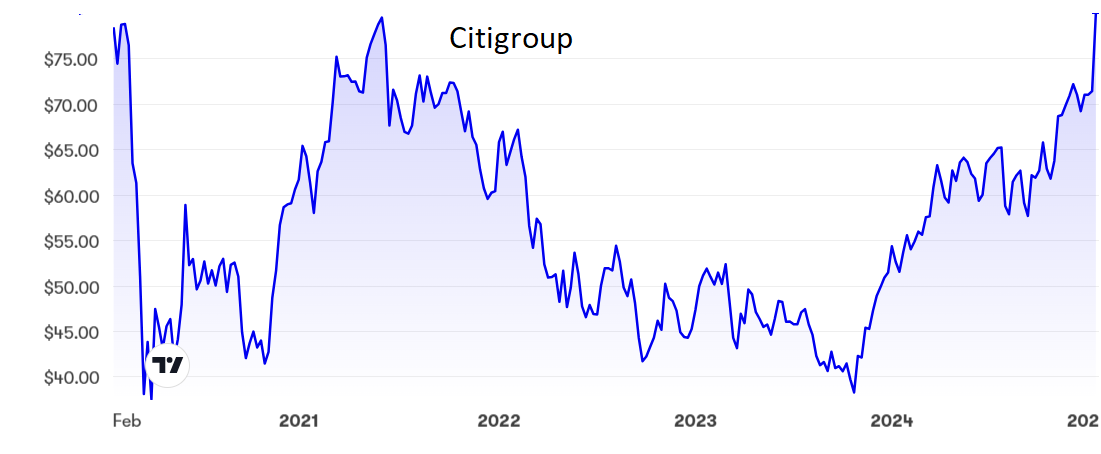

The big disappointment among banks results was at Citigroup Inc (NYSE:C) where strong earnings failed to avert a reduced profit forecast. The bank was back in profit after one-off costs distorted the performance in the previous final quarter. A fairer picture was net income of nearly $2.9 billion, little changed from the underlying figure a year earlier. Revenue improved by 12% to $19.6 billion.

Again, fourth quarter figures lifted the results for the year as a whole, with annual revenue rising 3.4% and net income 37%. However, the group reduced its forecast for return on tangible common equity from 11-12% to 10-11%, a less drastic reduction than some analysts had feared but an unwelcome cut nonetheless.

Citigroup has extended its share buyback programme with a further $20 billion allocated, including $1.5 billion for the current quarter.

Source: interactive investor. Past performance is not a guide to future performance.

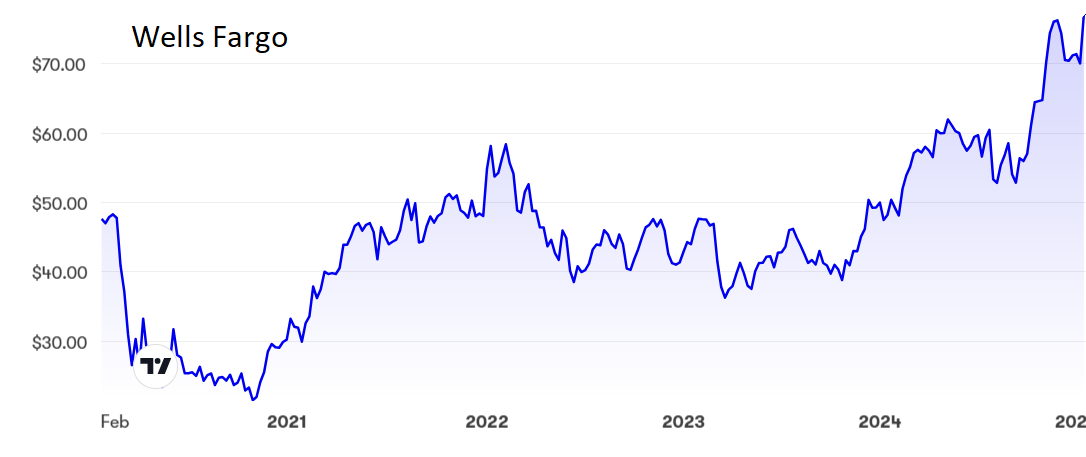

Also deviating from the standard message was Wells Fargo & Co (NYSE:WFC) which still managed to increase profits despite a tiny drop in revenue to $20.4 billion, caused by a fall in net interest income. Net income for the fourth quarter rose 47% to $5.1 billion, well above the 3% gain for the year as a whole.

Wells Fargo continues to improve after a period of struggling with legacy issues that have at last been consigned to the past. Fees from investment banking continue to improve as the bank gains market share.

Source: interactive investor. Past performance is not a guide to future performance.

Goldman shares have more than trebled over the past five years, including a surge since 10th January from $560 to a new peak at $630. The price/earnings (PE) ratio is still only 15 and the increased dividend offers a 1.84% yield, solid if unspectacular.

MS has followed a similar chart pattern to stand at around $136, with a PE of 17 but a higher yield at 2.57%.

Citi shares have risen sharply from $56 last August to just over $80 now on hopes that the bank has indeed been turned round after taking several hits last year, including lodging extra funds with the Federal Reserve Bank and suffering from devaluation in Argentina. The PE ratio of 13.5 and the yield of 2.7% reflect the higher risk compared with other US banks.

Wells Fargo shares have doubled over the past 15 months and could top $80 but the PE is 14.35 and the yield is just under 2%, at which level the surge has probably gone far enough for now.

BoA has eased from a peak in November, but the latest upturn has taken the shares to $47, where the PE is 14.5 and the yield 2.15%. This is the only major bank to be still below the level achieved in early 2022.

- Scottish Mortgage: Trump’s deregulation could boost these shares

- Nvidia’s CEO sees Physical AI booming: here’s one of its big opportunities

Resurgent banks are again campaigning for the kind of deregulation that ended so spectacularly in 2008 and resulted in the stress testing that they are trying to stop the Federal Reserve Bank from enforcing. If the banks succeed, as they are likely to under Trump’s lighter regulation programme, it will inevitably end in the same way that the last bout of deregulation did, but it will again take many years before the chickens come home to roost – time for investors to enjoy the good times and get out when it starts to turn sour again.

Hobson’s choice: Goldman Sachs will gain most from the expected upturn in mergers and acquisitions but if any of the banks covered are in your portfolio then hold on. Every international portfolio should contain at least one US bank.

New investors in the sector may be advised to see if shares ease back from current highs, which I think is likely as the latest wave of enthusiasm wanes.

For those seeking to buy in, I am least keen on Citigroup, which at this stage is still sorting itself out after restructuring. Wells Fargo, once on my sell list, is possibly the best option as a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.