An update on Kepler’s investment trust tips for 2023

Kepler shares an update on the team's picks for the year.

25th August 2023 14:01

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

2022 was a volatile year in markets. Russia’s invasion of Ukraine and the pressures of inflation and rising interest rates hit growth stocks and the overall picture was miserable, although the FTSE 100 index had its time in the spotlight.

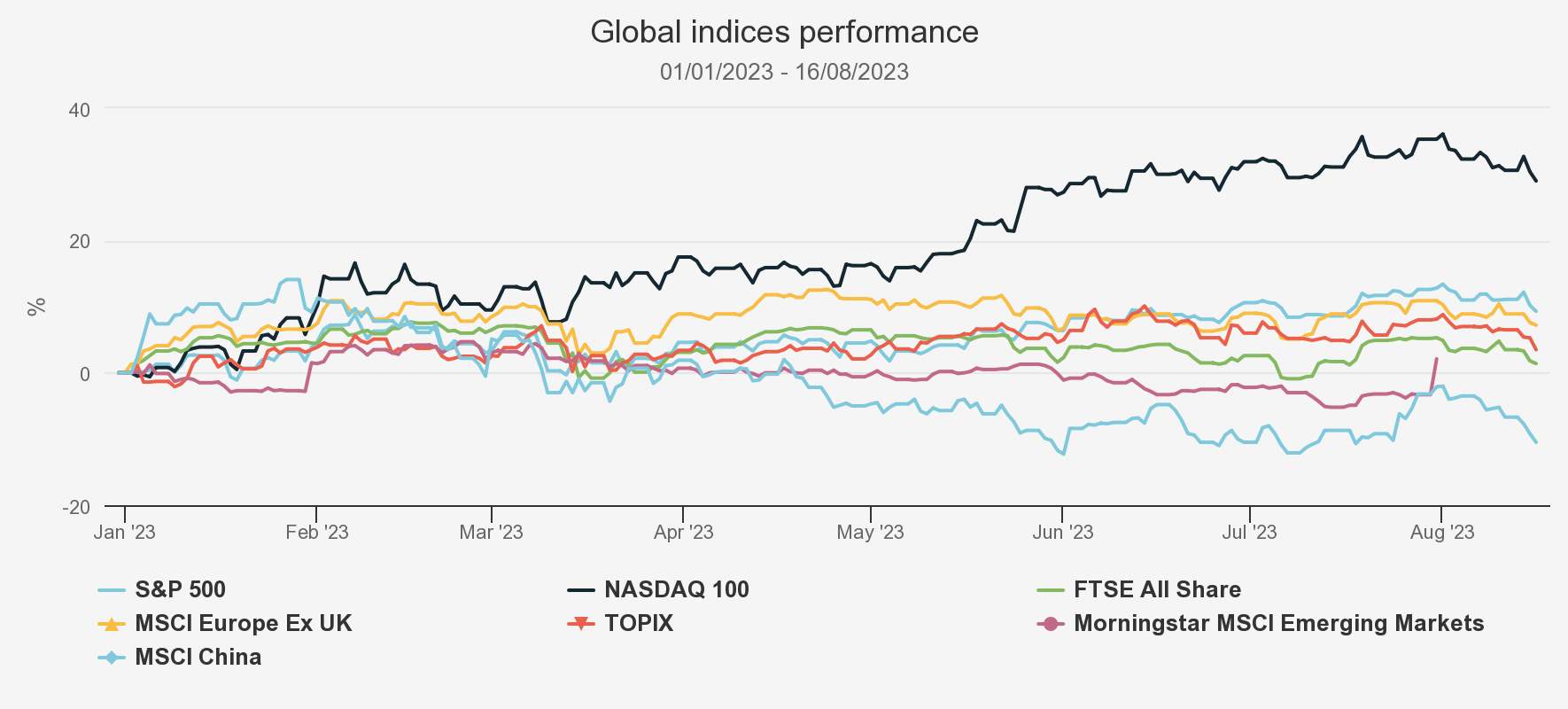

With little positive developments to consider, deciding which investment trusts were going to knock it out the park over 2023 was tough. There has been something of a rebound this year, led by large-cap US tech – unfortunately nobody picked a technology trust! However, investors remain jittery and even the sniff of bad news can cause significant moves in individual names and sectors.

- Invest with ii: Top Investment Trusts | Sustainable Funds List | Transfer an Investment Account

Here, we analyse which of our picks has fared the best – with a surprising trust topping the tables.

Source: Morningstar. Past performance is not a reliable indicator of future results

As the table below shows, Alan Ray’s pick, European Opportunities Trust (LSE:EOT), has topped the leaderboard with NAV total returns of 9.4%, perhaps indicating the value in being contrarian – European equities were not in favour at the turn of the year. Fortunately for me, it is nice to comment from a position of relative strength, since my pick, AVI Global Trust Ord (LSE:AGT), has pulled it back from a challenging first few months of the year to a very respectable second in the rankings, and a return of 6.5% – let a brief period of gloating in the office begin. The Global Smaller Companies Trust Ord (LSE:GSCT), which is up 2.9%, and AVI Japan Opportunity Ord (LSE:AJOT), which is up 0.8%, have also both delivered positive NAV and share-price returns.

PERFORMANCE OF OUR TOP PICKS FOR 2023 (YTD)

| INVESTMENT | ANALYST | CUM FAIR NAV RETURN (CUMULATIVE) (%) | SHARE-PRICE RETURN (%) | LATEST DISCOUNT (CUM FAIR) (%) |

| European Opportunities Trust (EOT) | Alan Ray | 9.4 | 12.4 | -10.3 |

| AVI Global (AGT) | Nicholas Todd | 6.5 | 4.6 | -10.7 |

| Global Smaller Companies (GSCT) | Ryan Lightfoot-Aminoff | 2.9 | 3.8 | -10.7 |

| AVI Japan Opportunity (AJOT) | Thomas McMahon | 0.8 | 3.4 | 0.4 |

| Bellevue Healthcare (BBH) | Pascal Dowling | -4.4 | -0.1 | -4.3 |

| Hipgnosis Songs (SONG) | William Heathcoat Amory | -6.9 | -4.5 | -46.0 |

| abrdn China (ACIC) | Helal Miah (ret) | -17.7 | -16.2 | -12.2 |

Source: Morningstar, as at 14/08/2023. Past performance is not a reliable indicator of future results.

European Opportunities Trust (EOT)

Unfortunately for me, it wasn’t a close second, with EOT delivering very strong returns. 2022 was a year where higher-rated growth stocks were punished indiscriminately, regardless of their fundamental strengths. However, EOT’s focus on quality-growth stocks has been rewarded so far in 2023, as the companies that manager Alexander Darwall backs have delivered strong results in a number of cases, despite the difficulties of high inflation and rising interest rates. As a result, the trust has outperformed the MSCI Europe ex UK Index by 2.2% this year to date.

The limited exposure to consumer discretionary stocks and low average gearing across individual portfolio holdings has helped, however, European equities in general have also been quietly moving higher this year. In part, this may be due to relative valuations becoming extremely low, resulting in a resurgence in investor interest, but it is also because many companies are simply doing well. For example, EOT’s largest holding, Novo Nordisk A/S Class B (XETRA:NOVC), experienced y-o-y revenue growth of 26% for 2022. The company’s share price has also appreciated by 35% this year to 17/08/2023. This is predominantly a reflection of the success of its diabetes drug as a viable solution to obesity as well – although more recently, it has faced concerns tied to mental health and the development of a copycat drug being developed in China which may impact sentiment and revenues tied to the ‘wonder drug’, Wegovy. Moreover, Europe also has a stake in the AI revolution, with several semiconductor companies performing well, and of course the luxury goods marketplace, with LVMH securing its place as one of the world’s largest companies this year, helping to put a more positive light on European equities more generally. Fears around spiking energy prices have also abated, with Europe in the midst of pivoting away from its reliance on Russian gas. So, there is overall a more positive tone, even if fund flows suggest international investors haven’t yet begun to buy.

AVI Global (AGT)

As for my pick, following a pullback in valuations over 2022, AGT’s manager, Joe Bauernfreund, sought to increase his exposure to his highest-conviction positions with a focus on more idiosyncratic, event-driven strategies. This included renewed interest in the US and also increased allocations to alternative asset managers KKR, Apollo Global Management Inc Class A (NYSE:APO) and Oakley Capital Investments Ord (LSE:OCI), all of which appear in the top 10 holdings. Joe remains confident in the long-term strategies of these holdings and the defensive nature of their revenues, with management fees predominantly charges on long-duration committed capital. The three investments have returned 30.6%, 28.5% and 10% respectively this YTD.

Impressively, AGT is the top performer in the global sector over the past three years, which has been helped by the manager’s valuation-sensitive approach in the high-inflation and high-interest rate environment. The allocation to Japan has helped performance this year, as the adjustment in the Bank of Japan’s monetary policy stance has had a positive impact on the basket of four Japanese regional banks held in the portfolio. AGT’s double discount remains close to its widest level since the Eurozone crisis, which may offer a particularly strong long-term entry point.

Global Smaller Companies (GSCT)

In general, smaller-companies- focused strategies have had a harder time compared to large-cap-focused strategies since the start of 2022. Although small-cap performance has shown signs of picking up this year, the MSCI ACWI Small Cap Index has generated a return of just 1.5%, as at 16/08/2023, and the discounts of smaller companies’ investment trust strategies remain wide. However, the manager of Global Smaller Companies (GSCT), Peter Ewins, argues there are a range of attractive valuation opportunities in the market. NAV performance for the trust has come in as positive this year, demonstrating the value of a balanced, valuation-sensitive approach.

Peter and his team of regional specialist portfolio managers diversify the portfolio across several regions, with the significant overweight allocation to UK smaller companies, which may provide an opportunity given their relatively unloved status and excellent value. The value in the UK has been highlighted by recent M&A activity involving the trust’s holdings. Over the year to date, shareholders would have also benefitted from a narrowing of the relatively wide discount.

In picking this trust, Ryan argued there would be some volatility in the earlier part of the year as recessionary fears remained a core consideration, but he expected a bounce-back in the second half which GSCT could benefit from. The trust’s reasonable performance in the first half seems to bear out his thesis, so let’s hope the second half is the better period for markets he predicted!

AVI Japan Opportunity (AJOT)

The NAV performance of AVI Japan Opportunity (AJOT) has been relatively muted over the period, however, share-price performance has picked up, resulting in the trust regaining its premium rating. AJOT is also managed by the team at AVI, who take a truly benchmark-agnostic approach to investing in Japan, leading to a returns’ profile far less correlated to the more internationally-driven TOPIX Index. This results in a portfolio more focussed on the domestic market and the team’s ability to identify cash-generative businesses that could benefit from consultant-like, active engagement with managers to improve balance sheet efficiencies.

In the past, the focus on smaller companies and on value means they haven’t benefitted during periods where growth and large-caps outperform, which it can be argued has been the status for Japanese indices this year to date. A combination of the weak yen, a belated reopening after the pandemic and the Bank of Japan’s governor, Kazuo Ueda, seeking to exit a negative interest-rate policy has contributed to an environment of renewed international investor interest. Warren Buffet has invested more, while BlackRock recently argued Japanese companies “stand out” from others in the developed world. Many overseas investors now turning bullish on Japan cite corporate governance reforms as the key reason to be bullish in the long run – this is the argument AVI have been making ever since they launched the trust. In our view, AJOT is a premium investment product to access this story, as demonstrated by its strong performance since launch in October 2018.

Bellevue Healthcare (BBH)

Rising interest rates have also impacted the smaller company focus of Bellevue Healthcare Ord (LSE:BBH). Unfortunately for Pascal, it looks as though he may have to surrender his crown at the end of this year, as BBH’s strategy of investing in the most innovative ‘picks and shovels’ areas of the healthcare sector has suffered, due to its perceived sensitivity to interest-rate movements. The more defensive nature of the healthcare sector has resulted in relatively poor performance compared to the broader market, with the MSCI World Health Care Index generating a return of 2.4% YTD compared to the MSCI ACWI Index’s 19.3%. Furthermore, in our most recent note, we highlighted how all this return so far has been driven by only two stocks – diabetes and anti-obesity plays, Novo Nordisk A/S ADR (XETRA:NOVA) (held in EOT) and Eli Lilly and Co (NYSE:LLY) – and with an active share of 91%, BBH has found it hard to compete with the benchmark.

The area of focus for managers Paul Major and Brett Darke is the improvement in input costs and efficiencies across the healthcare ecosystem; however, the most innovative solutions tend to be found in the smaller end of the market-cap spectrum. Looking over the long term, the need for improvements in healthcare is more important than ever, with an ageing and wealthier global population. The portfolio is high-conviction, with top ten holdings accounting for 53%, which has impacted performance and at times enhanced the portfolio’s volatility with some holdings experiencing significant share-price swings based on limited news flow. However, the variety of sub-sector opportunities helps improve diversification, while being well-positioned for any realisation in the fundamental value of their portfolio holdings.

Hipgnosis Songs (SONG)

Despite the interesting long-term opportunity, unfortunately, and I apologise for this, Hipgnosis Songs Ord (LSE:SONG) performance has not topped our charts. Both SONG’s NAV and share price have fallen in the year to date. As has been common with many other alternatives, SONG is viewed by investors as interest-rate sensitive. This means that with bond yields much higher than two years ago, SONG faces greater competition for investors' money than it did previously, as many are now putting more money into safer, less risky bonds. It also means that some investors are less confident about SONG's NAV, which is calculated with reference to interest rates.

Various factors, such as the improving quality of earnings in the music industry, mean that SONG's NAV has not significantly fallen as interest rates have risen, but the share price is essentially saying that not all investors agree. This continues to be reflected in the wide 46% discount to NAV - a level it has traded at since the start of Q4 2022. SONG is scheduled to have a continuation vote in September, however, despite the seemingly negative sentiment coming from some investors, we believe strong transactions in the market may indicate the discount is unwarranted. If the music knowledge of the KTI team is a sufficient sample, then the popularity of the catalogue combined with the discount may present a good long-term opportunity for investors.

abrdn China (ACIC)

Finally, it has been a challenging period to say the least for China-focused investment strategies and abrdn China Investment Ord (LSE:ACIC), the choice of an esteemed former colleague, has not escaped these effects. The short-term impacts of China’s weaker-than-expected recovery, and the ongoing political tensions associated with certain sectors, has impacted investor sentiment. However, perhaps the opportunity remains for longer-term investors that can stomach the volatility? Rising consumer aspiration, growing demand for healthcare, the digitalisation of services and the development of green technology, as well as the growing wealth of the Chinese middle class, are structural growth themes which feature highly in ACIC. The trust has an experienced management team, with a locally based team of analysts which makes them well-placed to uncover the opportunities across the market-cap spectrum as the portfolio continues to evolve, following the change in mandate to cover China in late October 2021.

Conclusion

Despite my slightly smug feelings writing this article, the last several years have taught me that no two halves of the year are likely to bring the same results. This is especially true as markets continue to react to monetary policy announcements and a range of economic data – most recently poor Chinese data - which the tea leaves give us no insight into predicting.

We note that while this continues to be an enjoyable exercise in the office which can ensure an individual’s bragging rights for the next year and beyond, the volatility does highlight the importance of a long-term investment mindset being applied to all investment decisions.

Sipping cocktails on the beach would have been my ideal way to spend my time during August, however, writing this has been almost as much fun, and it has been a good opportunity to evaluate where we have come from since the start of 2023. I look forward to evaluating the results when the winter coats and boots come out of the closet at the end of the year, and I have already chosen the wall on which I will be hanging my winner’s medal.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.