UK supermarkets, banks and travel: what’s the outlook after market sell-off?

In his FTSE Sector Watch column, Richard Hunter reviews three sectors that have been severely impacted …

28th April 2020 17:40

by Richard Hunter from interactive investor

In his FTSE Sector Watch column, Richard Hunter reviews three sectors that have been severely impacted by coronavirus, and considers their prospects for the coming months.

Tourism and travel

What has changed?

In a word, coronavirus. With the world in lockdown and for the most part with travel bans in place, it is of little surprise that this should have been one of the hardest-hit sectors.

The airlines are a prime example of the malaise that is currently prevalent. At the best of times the airline industry is cyclical, and at the worst of times it is squarely in the firing line. Whether that manifests as a financial crisis (decimating business and personal travel), the previous Sars virus, or even volcanic ash clouds, revenues can swiftly be reduced while fixed costs remain.

Such is the case now, with British Airways owner International Consolidated Airlines predicting a 75% reduction in capacity nearer-term and the additional necessity for severe cost cuts. There was a similar announcement from Ryanair, while easyJet opined that European aviation faces a “precarious future”, having made the move to ground its entire fleet.

- Read more of our content on equities

What is the outlook?

This is the proverbial million-dollar question. Enforced staycations may become a feature of 2020. At the current time, we are in an enforced staycation of the ultimate kind, without the ability even to leave home, apart from the well-known and limited daily exceptions. Yet these companies still retain an element of fixed costs with limited or no revenue, pushing some to make some severe cuts in terms of staffing and drawing additional lines of credit for cash flow purposes.

Even if some of the more stringent rules are relaxed, perhaps allowing travel on a local (but no more than national) basis, it is currently difficult to envisage when international travel may become possible once more – let alone how the events of the past few months may have altered consumers’ propensity to travel abroad at all.

This makes valuations almost worthless for the moment, making it impossible to gauge correct share price levels.

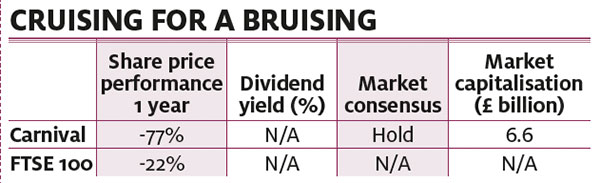

Carnival corporation

Cruise operator Carnival had a particularly tough time after the outbreak, exacerbated by its ship Diamond Princess being identified as a hotbed for the virus, with 10 deaths among passengers.

Since then the company has been in a fight for survival, having cut its dividend and raised nearly £5 billion through a cash-call exercise. At around the same time, a rare positive strand of news emerged as it was revealed that Saudi Arabia’s wealth fund has amassed a stake of over 8%, with Carnival remaining upbeat about its own prospects.

However, this was followed by the US Centers for Disease Control and Prevention extending a previous ‘no sail order’ from 10 May to 26 June; with Carnival’s estimated monthly cost bill of £800 million needing to be serviced, each delay adds further to the pressure.

Supermarkets

What has changed?

As the coronavirus pandemic began to unfold, shoppers switched into panic-buying mode such that, according to research agency Kantar, the UK grocery market saw its highest sales growth on record (21% year on year) in the four weeks to 22 March.

The estimated aggregate total of spending in that period was £10.8 billion, higher even than the traditionally busiest period of the year around Christmas, with sales of alcoholic beverages soaring 22% as consumers’ choice was crimped following the mandatory closure of pubs and restaurants.

Even though the levels of panic buying then subsided, prolonged closures in the hospitality sector further underpinned sales, while the supermarkets themselves introduced several changes to satisfy demand, as well as social distancing.

The introduction of screens for checkout staff, a ‘one-in-one-out’ policy at stores, and a one-way system within the stores, all with customers keeping two metres apart, led the Tesco chief executive Dave Lewis to observe that “our stores have changed more in the last three or four weeks than in the whole of the decade”.

What is the outlook?

The ongoing closure of pubs and restaurants should continue to bolster sales, although the excesses of March had already flattened by early April and will of course eventually peter out altogether.

In the meantime, the supermarkets have had to incur significant extra costs, such as employing more staff and redesigning the shopping experience (although some of that particular sting will be lessened by the 12-month business rates relief granted by the government). Indeed, the extra costs involved are bound to undermine some of the additional sales volumes.

Another area to watch will be the key area of supply chain management. Although this is always tight, it is nonetheless designed with supply shocks in mind. Supermarkets run worst-case scenarios based on (previously theoretical) pandemic consequences, while stockpiling planning measures ahead of the UK’s exit from the EU also provided topical experience.

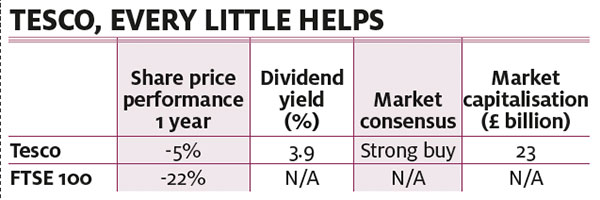

Tesco

Tesco’s full-year numbers in early April reported a boost to sales (an uplift of 30% was seen during the initial panic buying phase) which, alongside the current business rates relief and prudent operations management, will bolster the numbers on an exceptional basis.

On the other hand, staff costs will also spike (Tesco employed another 45,000 people in the two weeks prior to the results); moreover, there are costs associated with the necessary store restrictions, and distribution in general will also be an additional drag. Indeed, Tesco has estimated an overall increase in retail cost lines of anywhere between £650 million and £925 million as a consequence of these measures.

More positively, in this environment where dividend deferrals are becoming almost standard, the projected yield of around 4% will give starved income-seekers a welcome option.

The banks

What has changed?

At the behest of the regulators, the announcement that banks would be suspending existing and future dividends and share buybacks ticked the boxes of moral duty and an additional capacity to lend, but from an investment perspective it removed a core plank of the case for buying bank shares.

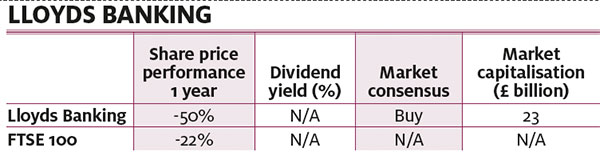

Up to that point, the yield of the UK banks, soon to evaporate, was testament to the fact that some were traditionally core portfolio holdings. Lloyds Banking had a dividend yield of 10.5%, Barclays 9.6%, HSBC 9%, Standard Chartered 4.9% and Royal Bank of Scotland 4.4%.

For the most part, domestic banks globally are being spoon-fed liquidity by the central banks in an effort to promote lending to beleaguered consumers and companies. Seen almost as a moral payback for having largely been the cause of the financial crisis of a decade ago, this push to lend could be vital in keeping the wheels of the economy oiled.

What is the outlook?

By the same token, however, this additional lending could well result in additional impairments, or bad losses. A strong canary in the coal mine came from JP Morgan Chase, who opened the first quarter reporting season in the US. First-quarter profit tumbled 69%, but of equal importance was the fact that the bank set aside a huge $6.8 billion (£5.5 billion) to cover potential losses to businesses and consumers struggling to stay afloat in face of the economic impact of the coronavirus shutdown. In addition, its largest corporate clients drew down billions of dollars on credit lines and sought billions more in new debt.

This is quite apart from the issues which banks globally had already been facing, such as the prospect of lower margins, given the historically low interest rate environment. However, they are undoubtedly in a significantly stronger capital position to withstand these shocks, following regulatory tweaks to their capital cushions after the financial crisis of over a decade ago.

At its full-year results in February, Lloyds reported pre-tax profit down 26% year-on-year, shy of analyst expectations. It was also hindered by other regulatory costs, while compression on asset margins remained. Elsewhere, impairments rose by 38%, net income slipped 4% and the outlook comments made little mention of proposed growth, rather concentrating on further cost control.

Seen as a barometer for the UK economy, its fortunes are likely now out of its hands as the UK struggles to boost its fortunes over the coming months. In the meantime, the lack of a dividend (temporarily) is a serious blow to the investment case, although the precipitous drop in the share price has prompted serious valuation questions on whether the drop is overdone.

Share price figures ProQuote/Digital Look, as at 14 April 2020.

Richard Hunter is head of markets at interactive investor, Money Observer’s parent company.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.