The UK smaller companies that stock pickers love

13th April 2018 10:49

by Rebecca Jones from interactive investor

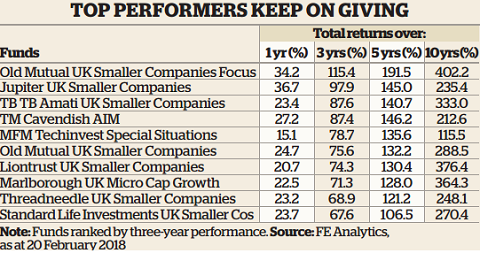

The UK smaller companies fund sector is historically a strong performer on a long-term view. Over the past 10 years to 14 February, it has returned more than any other UK sector for its investors.

It delivered 181% on a total return basis, compared to 89% from the UK all companies sector, making it the sixth best performer of the Investment Association's (IA's) 38 sectors.

This remains true over the medium term too, with UK smaller companies delivering more than any other British sector over five and three years.

Like their counterparts overseas (four of the top six sectors since 2008 are focused on regional smaller companies), British smaller companies benefit from lower valuations, stronger growth and the ability to be flexible and nimble in a buoyant domestic market.

The UK's position in global trade is also a boon for many smaller British firms that have benefited from easy access to Europe, as well as to the US and developing nations.

Brexit boom

The majority of smaller companies, however, are more domestically focused than their medium-sized and larger counterparts.

This means that when the home economy takes a nosedive, typically so do they. Thus one would expect UK smaller companies to have suffered after the vote to leave the EU in June 2016.

This has not, however, been the case so far: following the trend of previous years, the sector remains the top UK group over the 12 months to 14 February 2018, delivering 16.3% for investors while the UK all companies sector has returned just 4.5% over the same period.

On why this might be, Gervais Williams, co-manager of the , explains: "We've had a number of setbacks over the past 18 months: Brexit, a destabilising election, the first interest rate rise in 10 years and inflation rising above wage growth, all of which you would expect to work against smaller companies - but that's not been how it has worked out.

"This is partly because small-cap stocks were pretty cheap after the referendum, but also because the devaluation of sterling has been positive for manufacturers and companies competing against imports. So there have been opportunities for good companies to enjoy great trading conditions."

Neil Hermon, manager of the , agrees, arguing that the past year and a half have proved the Remain camp doom-mongers were, perhaps, wrong.

"Many of the negative predictions didn't come to fruition. While the UK economy has slowed, it's still growing, and the devaluation of sterling has boosted companies earning in foreign currency. In our portfolio, for example, half of earnings come from overseas markets, while improving growth in Europe and the US has been a positive."

Stockpickers' advantage

The UK smaller companies sector is also a true stockpickers market, where the characteristics of individual companies and the manager's skill at picking his or her winners give funds the edge.

According to FE Trustnet, for example, the UK smaller companies sector has more Alpha Rated managers - those who consistently beat their benchmarks - than any other in the IA universe. FE says that a third of UK smaller company fund managers (33%) have achieved this title, compared to just 4% of global equity income managers.

Over the past few years both Williams and Hermon have enjoyed strong success with small industrial firms based in the UK. For Williams, energy stocks have been of particular note:

"Many of the largest oil companies in the world have cut back on production since 2014, and this is becoming a pressing supply issue. At the bottom end of the market we are now finding some very good opportunities that are set to generate excellent profits going forward."

Williams points to , shares in which have risen 120% since February 2016 and which is currently trading on a bargain-basement price to earnings ratio of 4.5 times.

For Hermon, healthcare has been a valuable investment. Weybridge-based , which provides speciality pharmaceuticals and clinical trial services and whose share price has risen 72% in the past two years. London-listed but Dubai-based has also done well, as has veterinary medicine brand . The manager is also rather proud of his domestic investments in fashion label Ted Baker.

Source: FE Analytics Past performance is not a guide to future performance

Sound financials

As Williams highlighted above, low valuations post-Brexit have underpinned growth in the sector since mid to late 2016, and continue to be attractive. Hermon adds that many firms are also boasting sound finances that should support them through potential political turmoil.

"For the companies that we hold, earnings growth is pretty strong - around 17 or 18% in 2017 and forecast for 14 % this year. Balance sheets are also in very good order and leverage is nowhere near the levels of 2008. M&A is picking up and dividends are growing. Really, the world of small cap is pretty OK," he argues.

Williams agrees, also pointing to strong earnings and dividend growth as drivers in his portfolio, as well as new IPO activity - despite some negativity around new launches recently.

"We've seen one or two small companies coming to market that we think have been overlooked. These include specialist insurer , which covers the riskier end of the market. That came on at around £2.30 and is now around £2.60 - so it's already performing well." The manager also points to small business consultancy firm it has been a stellar performer since its IPO in April last year, since when shares have risen from £1.22 to £2.15.

Storm clouds

Despite this relatively rosy picture, however, there are hints of storm clouds on the horizon. Hermon observes:

"The UK market has definitely been lagging of late. Looking at the stats, since the end of May my benchmark index (Numis Smaller Companies ex IT) is down 2%. We had a really strong 2017 but lots of global managers are now going underweight the UK due to political fears. So we're a bit unloved in the UK currently."

Indeed, strong as the sector is individually, neither Hermon nor Williams claims it is entirely Brexit-bombproof. The UK's ongoing and fractious divorce negotiations with the EU are still important to the future of all British companies, and will be watched closely by investment managers.

Looking to history, however, UK smaller companies have proved resilient through even the most turbulent times.

Williams points to the 1970s, when, he says, British smaller companies dragged the UK out of a productivity slump through targeted investment and growth, facing off a sliding pound, sky-high interest rates and heavy political wrangling.

He concludes: "Many larger companies are struggling to generate productivity improvement and that differential - in my view - is the bigger feature and the reason why smaller companies outperform over the longer term."

Fund Profile: Jupiter UK Smaller companies

The is unquestionably one of the sector's standout performers. Over the past five years to 14 February 2018, manager James Zimmerman has returned 131% for investors - placing him seventh in the sector - while over three and one years his fund is the best of the group, delivering 90% and 31.7%, respectively.

Zimmerman credits his esoteric investment process, in which he targets owner-managed businesses, for his success: "I am convinced the sectors that underperform in the very long term are those where there are very few owner-managers. Essentially, these are the sectors where founders have chosen to sell out of the businesses they've built, to deploy their wealth elsewhere."

The nature of his favoured businesses means he holds a number of firms in the technology, retail and financial sectors - where owner-managers are abundant; in contrast, he observes, within the UK smaller companies space there are very few owner-managers in the support services sector.

On his best investments, the manager says he is particularly proud of , a Cambridge-based video game developer whose shares - after going nowhere for two years - skyrocketed 500% in just 18 months between 2016 and 2017. Among his biggest regrets, he names online fashion retailer , which he sold much too soon - proving that even the best managers get it wrong sometimes.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.