UK savings ratio second peak predicted

Two sets of figures shed light on how Covid has affected household savings.

25th November 2020 16:35

by Rebecca O'Connor from interactive investor

Two sets of figures shed light on how Covid has affected household savings.

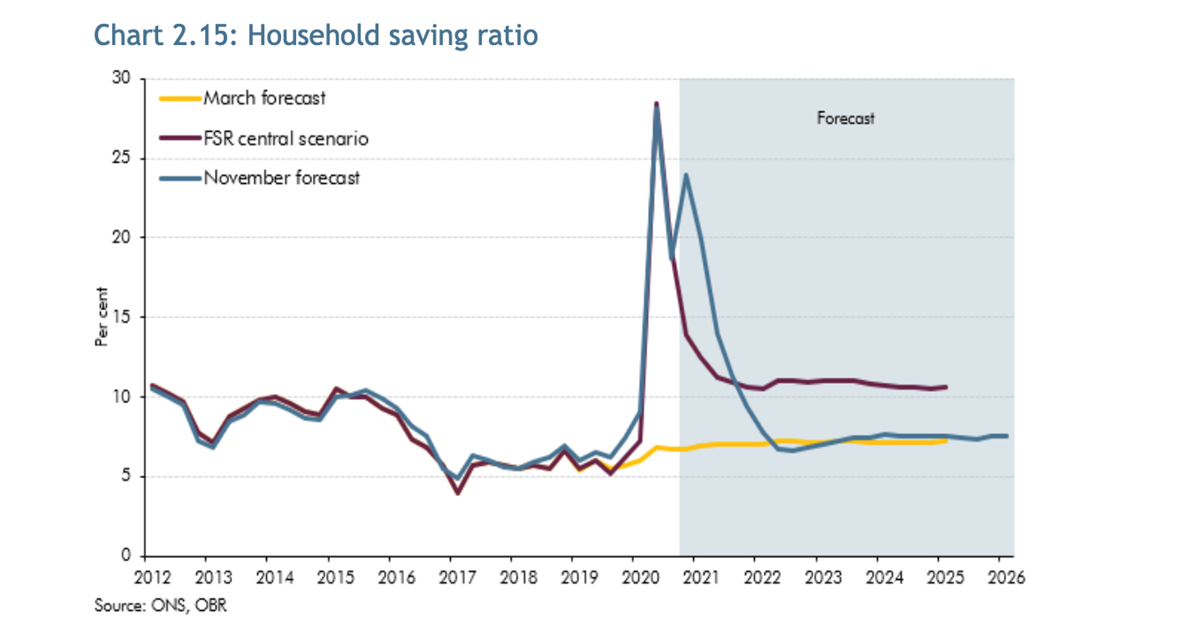

The Office for Budget Responsibility (OBR) published a forecast of a second peak in the household saving ratio in late 2020/ early 2021, alongside the chancellor’s Spending Review this afternoon.

Meanwhile, the Bank of England today published a summary of how Covid has affected household savings, showing average savings have risen substantially during the pandemic, due to lower spending and also government support for incomes.

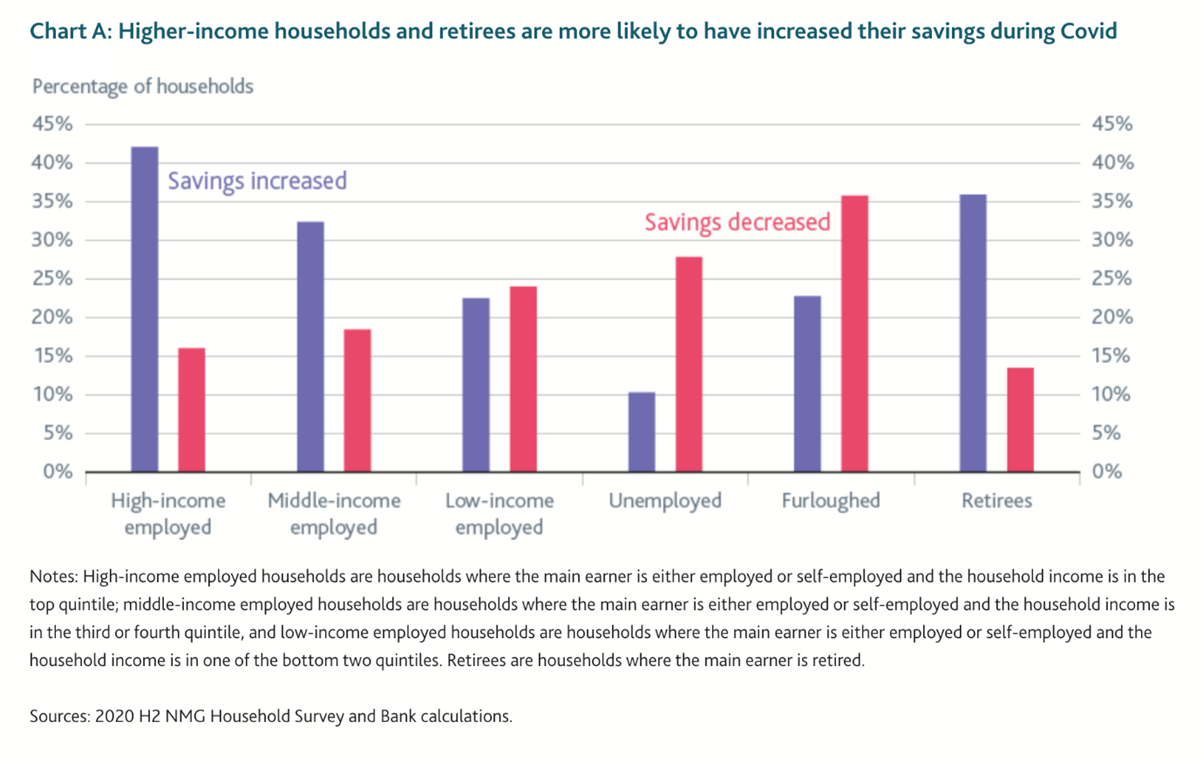

Overall, 28% of those surveyed had accumulated savings, while 20 % had depleted them.

However, the Bank’s survey showed that the ability to save was skewed disproportionately towards high-income households.

High-income, employed households were more likely to have made big savings during the pandemic than low-income, employed households, with 42% of high-income households saving more compared to 22% of low-income households. Middle-income, employed people and retirees were also more likely to say their savings had risen.

For those who were unemployed or furloughed, savings were more likely to decrease.

The Bank’s analysis stated “the accumulation of saving has been concentrated among wealthier and less financially distressed households”.

In general, only 10% of households with increased savings planned to spend it, with 70% saying they planned to hold the savings in their bank accounts. Others said they would use them to pay off debts, invest or top up their pensions.

Becky O’Connor, Head of Pensions and Savings at interactive investor, said: “The Bank of England data and OBR forecast show what many suspected – that outcomes from the pandemic have been massively unequal in more ways than one.

“One of the biggest inequalities of outcome has been the ability to save for the wealthiest households, contrasting with the urgent need to use them up for those who have suffered a loss of income or job loss.

“Lower spending and steady incomes have given some a huge savings boost by default rather than design. With limited spending options, some people have had no choice but to save. This looks set to be repeated as a result of this second lockdown and the likelihood of a subsequent one in January after Christmas.”

“That extra savings ratio could look like a sitting duck to a government hoping to increase taxes next year, particularly ‘wealth’ taxes, so this period of extreme saving may not only come to an end with the end of lockdowns, but because it could be used as a resource by a government looking to pay for support measures in a few months’ time.

“It’s important people don’t hold more than they need in cash savings, which currently earn next to nothing and can lose money in real terms.

“For those looking to bolster investments, ISA and SIPP allowances should be used, as these are tax-free.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.