UK mining sector shares now offer 30-70% upside

Mining stock prices are already discounting a shallow recession, offering a good buying opportunity for patient investors, argues one analyst. City writer Graeme Evans has the details.

9th April 2025 13:36

by Graeme Evans from interactive investor

The heavily sold shares of Glencore (LSE:GLEN) and Anglo American (LSE:AAL) today received the support of two City banks after tariff turmoil led to the mining sector’s worst run since 2020.

While flagging the near-term risk of further downside, UBS said there looked to be a good buying opportunity for patient investors to pick up selected industrial miners.

- Invest with ii: Open a Stocks & Shares ISA | What is a Stocks & Shares ISA? | ISA Offers & Cashback

Deutsche Bank added that mining valuations appeared to be approaching trough levels and that investors should seek selective exposure on a six to 12-month horizon.

Demand fears caused by the US tariffs has triggered a 5-15% correction in key commodity prices, leading to falls of about 15% for Glencore and Anglo American since “Liberation Day”.

Glencore is back at levels seen at the end of 2020, having fallen from 497p last May to 233p today. Anglo American is at a one-year low of 1786p, down 25% this year as investors worry that its divestment programme may be delayed by the turmoil.

Deutsche Bank has lowered its 2025 earnings estimates by an average of 10% but on a mid-cycle basis sees attractive value in most names in its coverage with a 30-70% upside.

- Anatomy of a stock market crash and playbook for the recovery

- Stockwatch: Buffett, Trump, China and trading tactics

- Trump tariffs create this potential buying opportunity

Its new forecasts lead to price targets for Anglo American of 2,600p and Glencore at 400p, alongside Buy recommendations and price targets for Rio Tinto Ordinary Shares (LSE:RIO) of 5,500p and 1,850p for Chile-based copper miner Antofagasta (LSE:ANTO).

The bank’s base case now assumes global growth verging on recession over the next two quarters, prompting it to cut copper, iron ore and aluminium price forecasts by 5-10%.

Its analysis of previous downturns shows that metal prices fall on average 41% peak to trough during recessions and that a hard-landing scenario such as no de-escalation of the trade war and potential renminbi devaluation implied a further 20% downside risk to metals.

It said equities have sharply underperformed metal prices and are already discounting a shallow recession, with market implied earnings 10-20% below current spot levels.

The bank added: “While there is still the risk of further downside in the near term, mining valuations are approaching trough levels, debt levels are low and we believe investors should seek selective exposure on a six to 12-month horizon.”

- Stockwatch: four defensive shares to consider amid market wreckage

- Insider: big director deals at Glencore, Diageo and Vistry

- Can Africa replicate Asian economic miracle?

Glencore was under pressure even before the trade turbulence after its cash-generative coal division was hit by a sustained fall in price dating back to October.

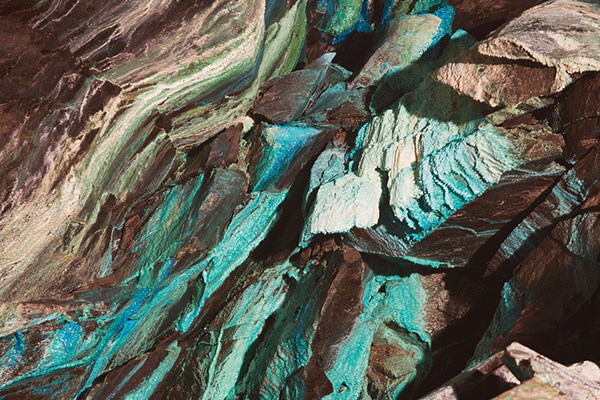

This contributed to Glencore reporting a 16% fall in 2024 earnings to $14.4 billion (£11.2 billion), while the uncertainty over demand from China as the world’s major coal consumer has added to pressure in recent days. The company also produces and markets copper, cobalt, zinc, nickel and ferroalloys among others.

UBS said today that spot prices of nickel, platinum group metals, coal and alumina are close to their cost curve, whereas in a recessionary scenario it sees further downside for zinc, copper, aluminium and iron ore.

It expects the impact of tariffs on economic growth to outweigh supportive supply constraints in copper and aluminium and secular demand drivers such as the energy transition. The emergence of physical surpluses has potential to weigh on commodity prices further.

However, it adds that China is likely to provide more policy support to offset tariffs.

UBS said: “We see upside to base metals prices medium-term and for patient investors we ultimately see this as a good buying opportunity for selected industrial miners.”

The bank’s preferred stocks include Anglo American and Glencore, as well as Antofagasta.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.