UK mid-cap stocks: is history about to repeat itself?

Are FTSE 250 stocks set to bounce back? Hannah Smith considers names linked to the ‘homebody economy’.

2nd October 2020 17:59

by Hannah Smith from interactive investor

Are FTSE 250 stocks set to bounce back? Hannah Smith considers a slew of names, including those linked to the ‘homebody economy’.

Global investors shunned UK shares in the run up to the Brexit withdrawal deadline, but mid-cap shares bounced back strongly once it became clear the world wouldn’t end. Now, research shows that global fund managers are running their largest underweight to UK equities in two years. Will history repeat itself and mid caps rebound once more?

Jean Roche, co-manager of the Schroder UK Mid Cap (LSE:SCP) trust, argues that EU negotiations should result in some kind of agreement, which could cause a relief rally in the UK stock market that could especially benefit smaller and medium-sized companies.

- Invest with ii: Top UK Shares | Top Investment Trusts | Open a Trading Account

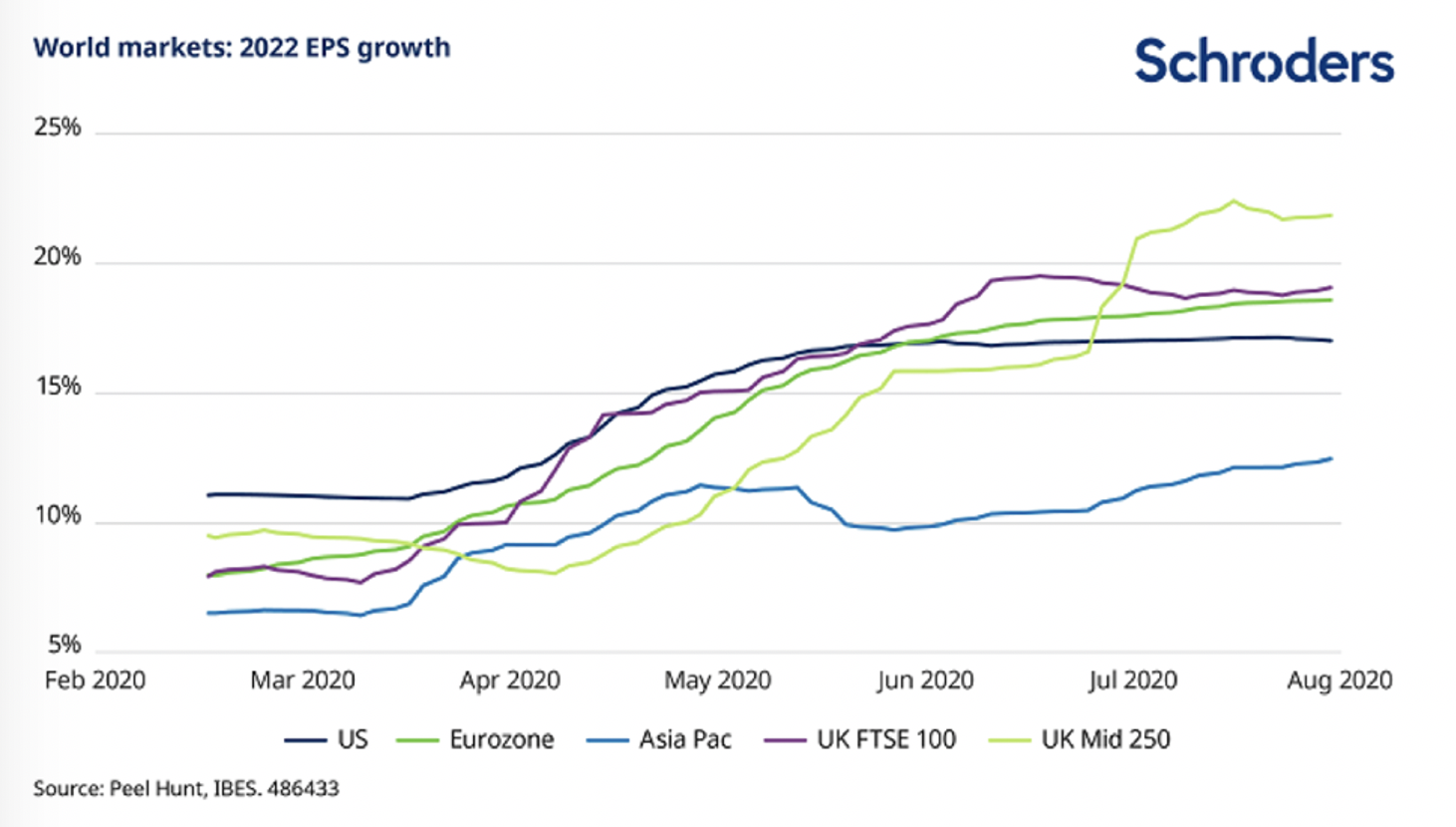

She points to data from Peel Hunt showing analysts’ forecasts for increases in earnings per share in major global markets. The FTSE 250 is the market tipped to recover more strongly than others worldwide.

Unemployment to spike?

However, Richard Hunter, interactive investor’s head of markets, sounds a note of caution here because, aside from whatever happens with Brexit negotiations, the UK is probably in for another spike in employment. This “could in turn affect consumer sentiment and spending, both of which are very important to the UK economy”, he notes. With FTSE 250 stocks seen as the “barometer” of the UK economy, they could be disproportionally affected by more bad news. That said, he adds that the FTSE 250 does not have exposure to the cyclical stocks, such as banking and energy, which have held back the FTSE 100 this year, which means small and mid caps could have “more room to grow”.

It sounds promising, but right now global investors could not be less impressed with the UK, even with valuations at historic lows. “Quite simply, institutional international investors, which tend to obviously look at the investment scene on a global stage, are just filing the UK under ‘too difficult’ at the moment and looking elsewhere for value,” says Hunter.

- Nick Train: global investors’ aversion to UK is ‘getting ridiculous’

- Stockwatch: a share that’s finally got its act together

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Tapping into the ‘homebody economy’

The Schroder fund is focusing on “the homebody economy”, as Roche believes there are a number of mid-cap names that are well placed to benefit from consumer behaviour during the pandemic.

She points to “under-appreciated technology or technology-enable growth companies” as a great way to get exposure to the stay-home theme.

“All this increased working from home is only made possible by good connectivity and reliable ‘kit’. Homeworkers are at the whim of technology, so companies providing infrastructure and support have naturally thrived amid the homebody digital economic boom,” she says.

“Examples include under-appreciated UK tech companies such as Computacenter (LSE:CCC), which seems to keep upgrading its earnings forecasts, and Softcat (LSE:SCT).”

Pets at Home (LSE:PETS) has seen huge sales growth thanks to a boom in pet ownership, while both online and table-top gaming have flourished as people spend more time at home and more of their disposable income on entertainment – Roche’s holding Games Workshop (LSE:GAW) has benefited from this trend.

DFS (LSE:DFS) and Dunelm (LSE:DNLM) have also done well as consumers spruce up their homes with new furniture and homewares, while online trading platforms and spread betting companies IG Group (LSE:IGG) and CMC Markets (LSE:CMCX) have grown their audience in recent months.

And, although offices may be ghost towns for a while to come, flexible office space platform IWG (LSE:IWG) could be well placed to respond to a changing backdrop in which people mix and match working from home with meetings in shared workspaces, Roche suggests.

Discounted stocks

There are some interesting themes here that may continue to play out and, as Roche points out, valuations look attractive with small and mid caps trading at around a 25% discount to similar stocks globally. So would Hunter be buying mid caps right now?

“There’s a lot to be said for the argument that if we were going to see a bounce back of the fortunes in the UK economy, the FTSE 250 would benefit more than the FTSE 100, although that’s quite a big call to make at the moment,” he says. “The thing to do is to take a bottom-up approach, in other words, stock-specific rather than broad-brush buying the index.”

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.