UK economic recovery gets off to very slow start

In these exceptional circumstances, the City had hoped for a better rebound in growth than this.

14th July 2020 14:08

by Graeme Evans from interactive investor

In these exceptional circumstances, the City had hoped for a better rebound in growth than this.

The V-shaped recovery underpinning the valuations of many UK-facing stocks was cast into doubt today after figures showed activity rebounded by much less than expected in May.

The shallow 1.8% improvement in GDP from the previous month was far weaker than City expectations of 5%, and means the UK economy is still 24.5% smaller than it was in February.

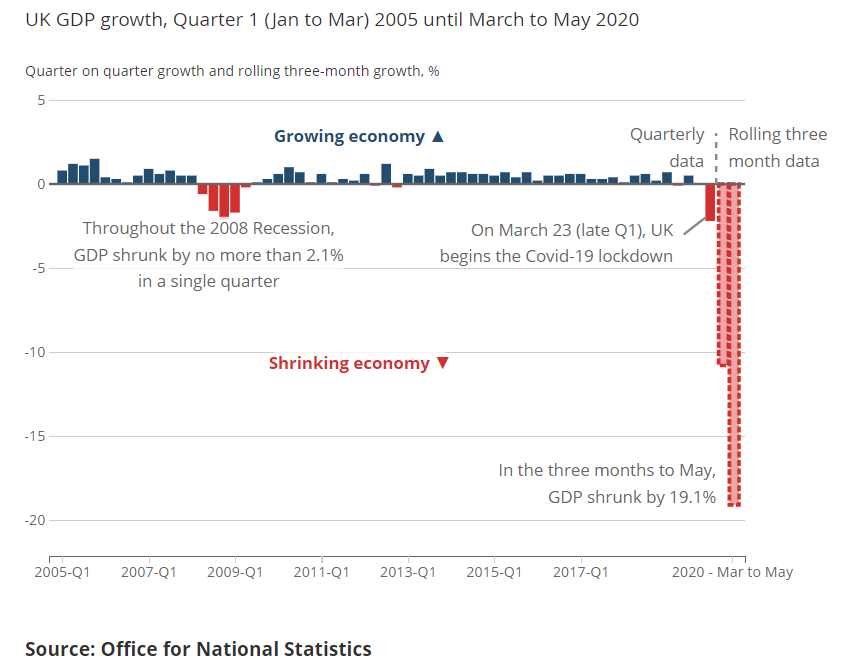

“GDP fell by 19.1% in the three months to May, as government restrictions on movement dramatically reduced economic activity,” explained the Office for National Statistics.

While the figure for June should be far stronger thanks to the easing of lockdown restrictions, today's update serves to heighten jitters about whether the economy will see the V-shaped recovery signalled recently by the Bank of England's own chief economist.

Pent-up demand amongst consumers should provide some respite as shops and restaurants re-open, although many fear a rollercoaster performance before any sustainable recovery.

Concerns about how easily consumers will slip back into their old spending habits were recognised across the FTSE 350 index today, with pub chains Mitchells & Butlers (LSE:MAB) and JD Wetherspoon (LSE:JDW) among a number of stocks 4% or more lower. The mood wasn’t helped by warnings from experts that the UK faces a potentially more deadly second wave of the coronavirus this winter.

The prospect of shoppers being forced to wear masks from 24 July also did little for sentiment towards retail stocks, with JD Sports Fashion (LSE:JD.) down 3% and Dixons Carphone (LSE:DC.) 4% lower.

Chancellor Rishi Sunak will be hoping that we've already reached rock bottom and that today's figures are the first positive step in the rebound. There was some optimism on this front from UK manufacturing, which rallied at a much stronger rate than expected during May.

But this sector only accounts for around 10% of the UK economy, which is why so much is riding on Sunak's £30 billion plan to get the public spending again. In his mini-Budget last week, he unveiled a voucher scheme so households can “Eat out to help out”, alongside a deeper-than-expected temporary cut to VAT on food, accommodation and attractions to 5%.

- interactive investor comments on the latest UK GDP data

- Chancellor Rishi Sunak pledges extra £30bn to save the UK economy

- Ocado: does lockdown shopping boom mark turning point?

While these initiatives will create a short-term spike in demand, they won't solve the country's longer-term economic ills. This was reflected in the reaction of share prices last Wednesday, with most pubs and leisure companies quickly surrendering their early gains.

As interactive investor’s head of markets, Richard Hunter, said:

“Both the “Eat out to help out” measures and stamp duty relief will have limited impact on longer-term revenues.”

The stamp duty holiday on property sales up to £500,000 will prop up 750,000 housebuilding jobs and the many more positions that would be impacted by a collapse in the property market.

But there are worries that the Chancellor has been too hasty in his intention to withdraw the Jobs Retention Scheme by October. A job retention bonus of £1,000 per employee will instead be paid to companies in order to encourage them to bring back furloughed workers.

Robert Alster at Close Brothers Asset Management said today:

“Jobs, both on the high street and in industry, are disappearing at an alarming rate and there are no signs yet of any real improvement in the UK labour market. There’s no question that this decision risks more economic contraction.”

What's clear is that the pandemic will have a long-lasting impact on the way we work and our patterns of spending behaviour. This was highlighted by the founders of Ocado (LSE:OCDO) and online electricals retailer AO World (LSE:AO.) when they posted their respective results today.

- The Ian Cowie portfolio: a contrarian approach to the quest for yield

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Ocado's Tim Steiner said the grocery landscape had changed forever after the Covid-19 lockdown condensed years of online growth into a matter of months. AO World's John Roberts called the shift in retail as “seismic”, adding that he was confident that consumers wouldn't want to go back to their old ways.

That's more bad news for the future of high streets, as well as the coffee shops, sandwich bars and other service industries dependent on robust levels of footfall.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.