UK company earnings were in recession before coronavirus crisis

Margins for UK companies are also much lower than they were before the previous recession.

8th April 2020 11:30

by Tom Bailey from interactive investor

Margins for UK companies are also much lower than they were before the previous recession.

UK companies are going into the coming coronavirus lockdown recession in an already weak position, according to Link’s latest Profit Watch report.

According to the report, UK corporate profits have fallen in the first three months of 2020. Three out of five companies reported lower profits over the period, the highest proportion since the third quarter of 2009. Overall, just 42% of companies reported their profits rising the first quarter of the year, the lowest proportion since 2009.

However, while the coronavirus and the shutdown of economic activity in March has played a large role in the decline in UK profits in the past quarter, it was a continuation of a trend of already weakening UK profitability. Profit declines in the two previous quarters mean that UK companies were already in the midst of an earnings recession.

As Link notes: “Even before the Covid-19 crisis their revenues and profits were in a prolonged earnings recession. Fewer companies have reported rising profits than any time since 2009. Their profit margins are far below historic highs.”

- Why investment funds fail, and how they can turn from zero to hero

When UK earnings are looked at over a 12-month period, UK companies have made profits of £166.9 billion. That’s 5.7% less than the £176.9 billion generated in 2007, on the eve of the 2008 recession. That means profits in 2019 were one third less than they were in 2008, once inflation is taken in account.

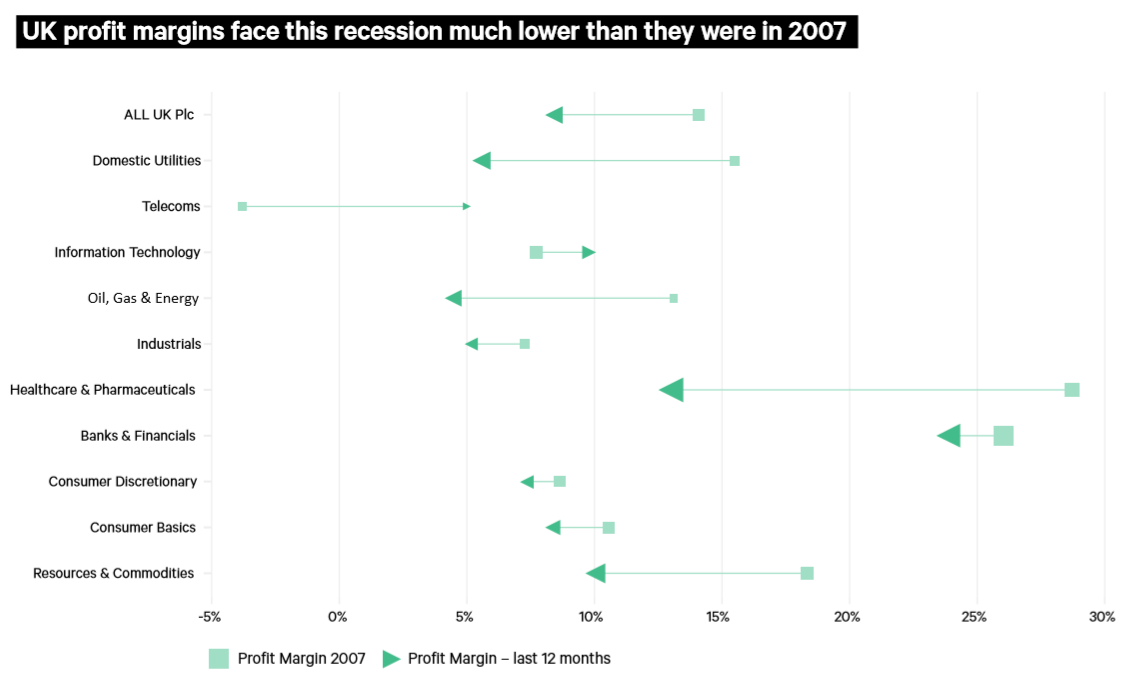

Margins for UK companies are also much lower than they were before the previous recession. For example, Link points out that prior to the financial crisis, companies made £14 for every £100 of sales. In contrast, over the last year they have made only £8.30.

As the chart below shows, the UK companies are facing the coronavirus recession with much thinner margins than when it entered the financial crisis. According to Link “this means profits are very vulnerable.”

Susan Ring, chief executive of Global Corporate Markets, notes that the decline in profitability justifies the current volatility in the stock market.

However, she argues: “Most of the value of a share derives from its ability to deliver profits over the next 15-20 years, not just from the next year or so. If the damage from the crisis is short-term, and if profits start to rebound later this year, then the elimination of almost £800 billion of value from UK stocks during the crash is a clear overreaction to the loss of perhaps £170 billion of profits.

“The gap is the value of uncertainty. Covid-19 will cause a huge amount of economic damage, but does it justify value destruction on this scale?

- Why you should resist dipping into your pension pot following sharp market falls

“All this does not mean the market cannot continue to fall for now. Moreover, if we are set to endure a protracted slump, then our estimates for profits are likely too sanguine. But the recovery will come.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.